Interest in the decentralized finance (DeFi) sector has been steadily increasing. As a result, many countries continue to release research reports on DeFi to the public. On October 17th, another report was added to this collection by the Bank of Canada. A staff note shared by the central bank evaluated the innovations and challenges in the DeFi space.

The Future of the Financial Sector

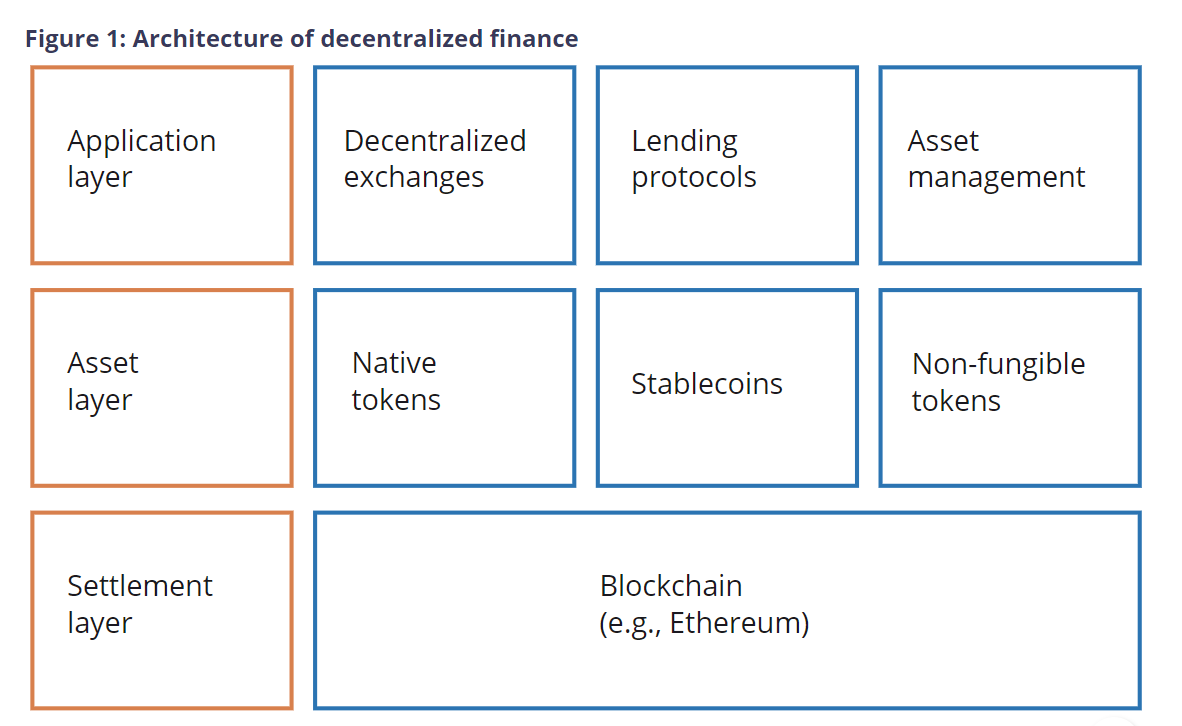

In the staff note, the DeFi space was defined as an emerging and multi-layered structure on the Ethereum blockchain network. It emphasized the various tools and services built on the main blockchain network, including tokenization, lending and borrowing services, and other innovations developed by developers.

The report highlighted the increase in popularity of the DeFi ecosystem since 2020 and how it has become an integral part of a sector that handles billions of dollars in volume within just a few years. However, the popularity of DeFi has started to decline, particularly with the collapse of the DeFi platform, Terra, from 2022 onwards.

Three Key Areas in the DeFi Sector

The staff note praised the bridging feature of the DeFi space, which allows the integration of applications and services within the crypto ecosystem. The report from the Bank of Canada emphasized three key areas in which the DeFi space can contribute to the financial system.

The first area discussed was the provision of financial services, highlighting how a decentralized ledger-based system eliminates the issues faced by traditional financial systems. This enables platforms to expand their service scope.

The second aspect addressed the competition among platforms and the open-source nature of DeFi. This allows anyone to build a platform, increasing competition and improving the quality of services offered by platforms.

Lastly, the report examined transparency. The use of programmable smart contracts eliminates intermediaries and increases transparency in the system, as every detail is accessible to data analysis platform analysts operating in the blockchain sector.