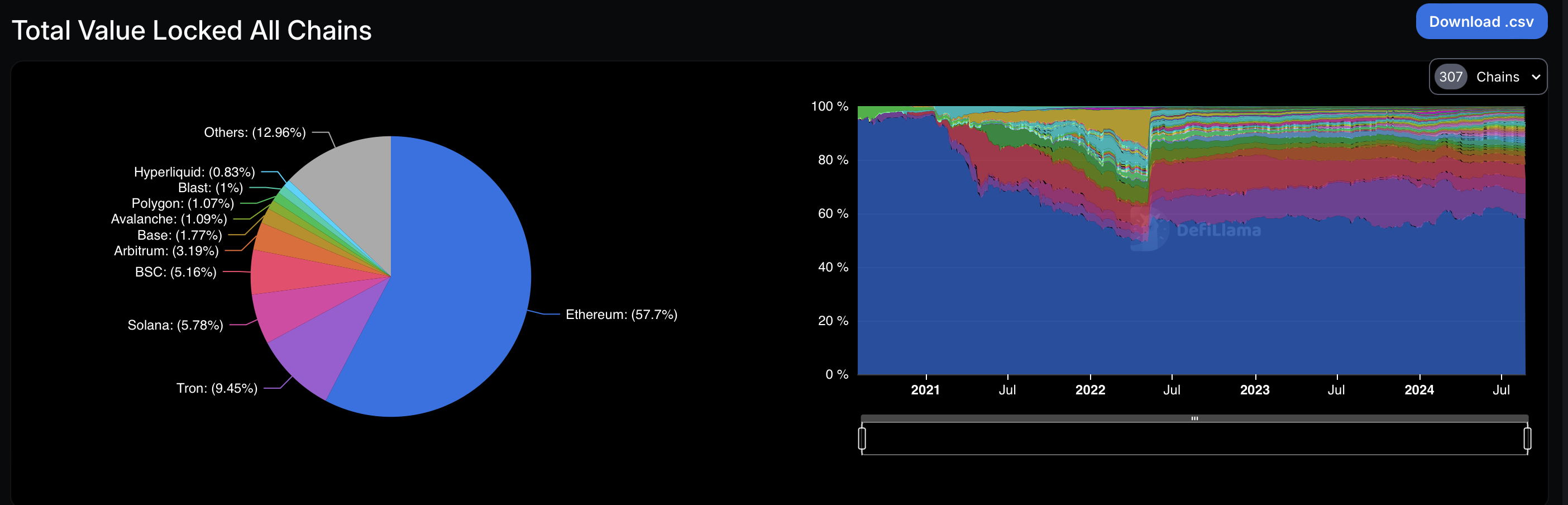

Decentralized Finance (DeFi) market may be gearing up for a strong comeback next year. According to a report published by Steno Research, the total value locked (TVL) in the DeFi market could surpass its 2021 peak and set a new record in the first half of 2025.

Interest Rate Cuts Expected to Boost Interest in DeFi

The report highlighted that the biggest factor for DeFi’s resurgence is the reduction of interest rates in the US. Since the DeFi market is largely pegged to the US dollar, interest rates directly affect interest in this market. According to analyst Mads Eberhardt, interest rates are the most critical factor affecting DeFi’s appeal, and investors may prefer higher-yielding risky opportunities in the DeFi market depending on interest rates.

Interest rates also played a significant role during DeFi’s initial surge. The “DeFi summer” of 2020 began immediately after the Fed lowered rates in response to the Covid-19 pandemic.

Other Factors Supporting the DeFi Market

On the other hand, interest rates alone do not explain DeFi’s comeback. Factors unique to cryptocurrencies also play a role in this rise. According to the report, the increase in stablecoin supply is vital for the DeFi market. Stablecoins form the backbone of DeFi protocols and have shown approximately $40 billion growth since the beginning of this year. With lower interest rates, the opportunity cost of holding stablecoins decreases, enhancing DeFi’s overall appeal.

Meanwhile, the growth of real-world assets (RWA) such as tokenized stocks, bonds, and commodities is increasing demand for the DeFi market. These assets have grown by 50% since the beginning of the year, indicating interest in on-chain financial products.

Finally, the low transaction fees on the Ethereum (ETH) network, the most widely used blockchain for DeFi, make DeFi more accessible to a broader audience.