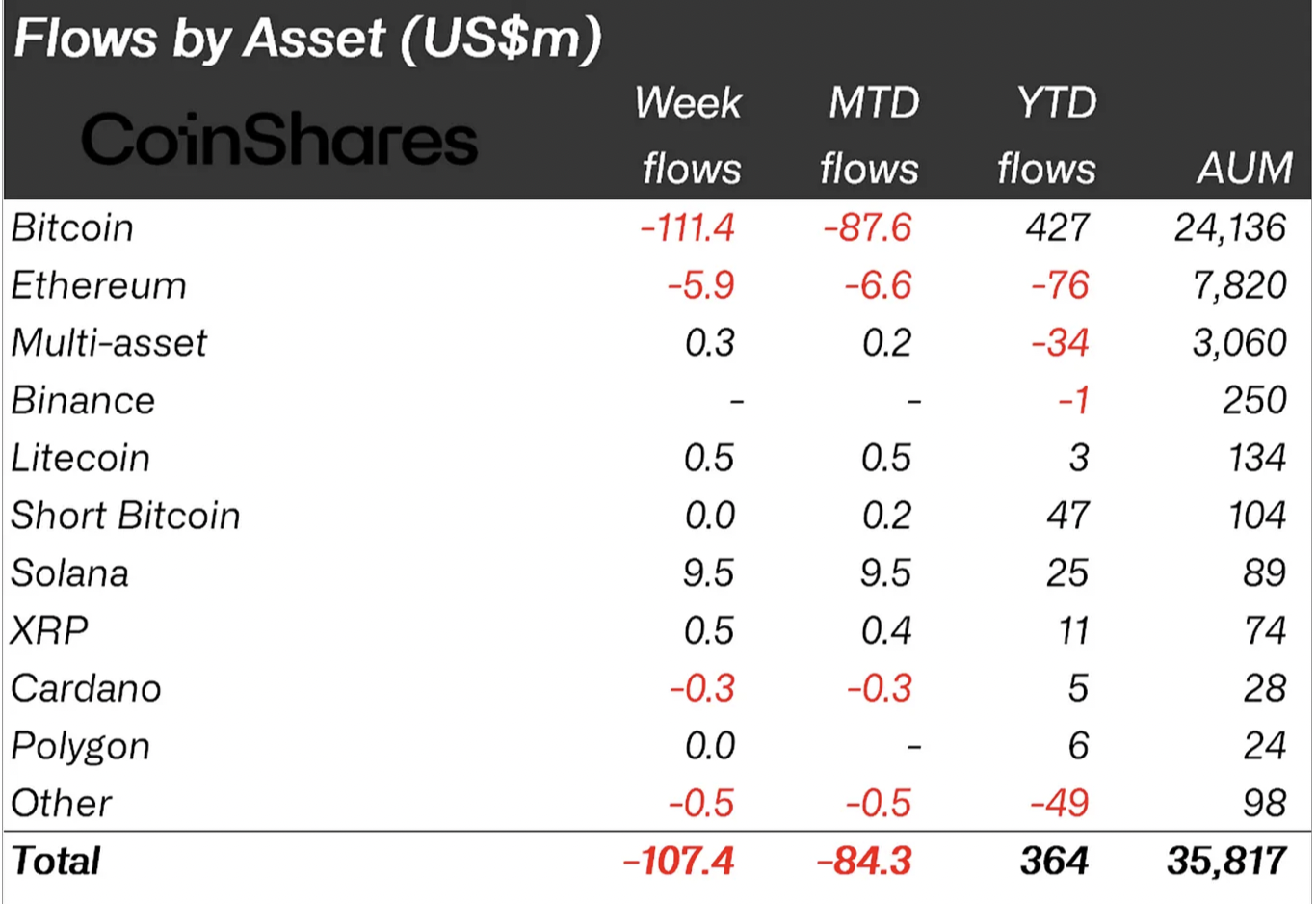

CoinShares, a digital asset manager, has published its weekly report sharing data on inflows and outflows of digital asset investment products. According to the CoinShares report, digital asset investment products recorded an outflow of $107.4 million last week. In Bitcoin-focused investment products, there was also a record-breaking weekly outflow of $111.4 million, the largest since March.

CoinShares Report

According to CoinShares’ weekly report, digital asset investment products saw an outflow of $107.4 million last week. The main focus of the total weekly outflow in digital asset investment products was Bitcoin-focused investment products. There was a record-breaking weekly outflow of $111.4 million in Bitcoin-focused investment products, the largest since March.

CoinShares also highlighted the decrease in trading volumes along with the outflows in digital asset investment products in their report, stating:

“This week, a total outflow of $107 million was observed in digital asset investment products, driven by profit-taking that has gained momentum in recent weeks. Bitcoin remained the main focus and saw a record-breaking weekly outflow of $111 million since March.”

Crypto Market Continues to Bleed

In addition to the $111 million outflow from Bitcoin-focused investment products, there was also an outflow of approximately $6 million from Ethereum-focused investment products. As a result, the total outflow recorded in Bitcoin and Ethereum-focused investment products last week exceeded $117 million.

However, despite the total net outflow of $107 million, there was also a record-breaking weekly inflow of $9.5 million in Solana-focused investment products, the largest since March 2022. There were also small inflows in XRP and LTC-focused investment products.