Only a few days remain until the end of December, and a whole year is coming to a beautiful close. We’ve experienced intense days and weeks. More importantly, these sleepless nights of intensity continue in the recent days. In a short while, Elon Musk’s X Space broadcast will begin, and it is a matter of curiosity what he will say about Bitcoin and cryptocurrencies. Moreover, our SEC ETF approvals are just around the corner.

Crypto Currency Predictions

Bitcoin price performance dominates the cryptocurrency markets, and if we are to see rapid increases in crypto, BTC must remain strong. For now, the king of cryptocurrencies is finding buyers at $43,755. It is likely that this price will move away from its current position in the coming hours as we will see very big developments over a few weeks. Tomorrow the PCE data will be released, Musk’s statements are a subject of curiosity, and the SEC has met with all ETF applicants hours ago and is about to give the green light.

Bitcoin’s price surpassed $40,000 for the first time since April 2022, about two weeks ago on December 4th. It had only been 48 hours before it climbed to $44,000. It had done this at the $31,800 and $36,000 resistance levels as well. Now investors are expecting a rapid movement similar to the previous ones.

BTC, Crypto Currency Targets

Investors are questioning whether the approval of a spot Bitcoin ETF will trigger a price crash. Investors who have experienced many “sell the news” events in 2022 and 2023 were already expecting a decline since the price surpassed $30,000. They still have the expectation that the ETF approval will trigger a wave of selling.

A “sell the news” event could occur on the first trading day after the ETF approval if the volume is not as expected, just as we recently saw with the futures ETH ETF. However, there is a strong belief that institutional demand will increase exponentially, and if liquidity continues to be pumped into the market, why should the price fall?

According to a view shared by BritishHodl, the BTC price will rise sharply after the approval and then fall sharply. However, the expert adds that “the real valuation of the price should come 3 months later” and emphasizes a long-term bullish outlook. QCP analysts also shared a similar view yesterday, but they were talking about a few weeks, not 3 months.

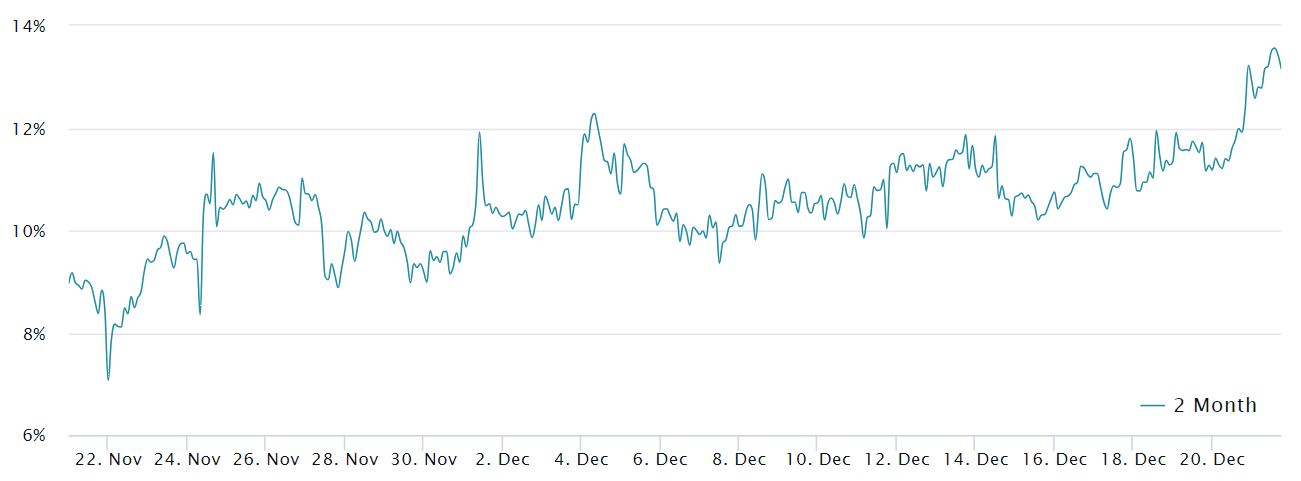

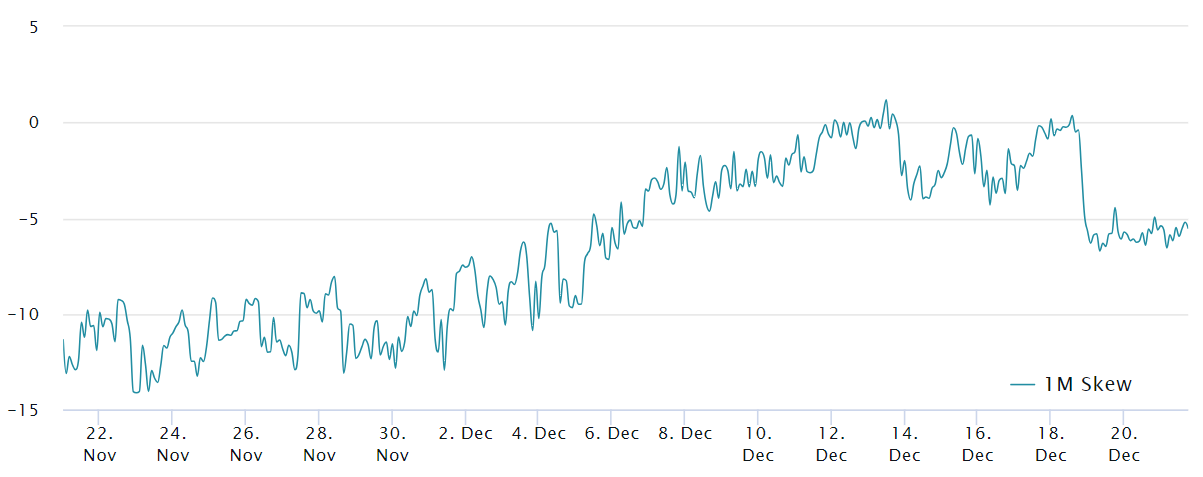

Moreover, the BTC futures premium has been above the 10% neutral-bull threshold since December 1st, and despite the recent correction, buyers continue to stay on stage. The Bitcoin options market also shows a 25% delta skew, meaning institutional and certain high-net-worth individual investors have turned bullish, maintaining their positions.

Therefore, BTC could initially surpass the $48,000 target and start a new ATH journey with closures above $55,000. In this case, we could see a value increase of more than 2-3 times across cryptocurrencies in general. Or what if the SEC unexpectedly rejects the ETFs (which seems like a low probability right now) and BTC returns to $30,000? Since we cannot see the future, it is not possible to be certain about anything.