When it comes to cryptocurrencies, while Bitcoin is the first to come to mind, Ethereum (ETH) undoubtedly springs to mind when altcoins are mentioned. As the market’s largest altcoin, ETH continues to experience developments that could influence its price. A significant volume that has a major impact on the price saw an all-time high (ATH) level as of January.

Ethereum’s ATH in Options Trading

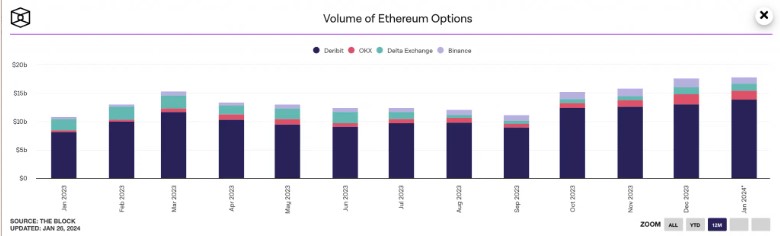

According to the Data dashboard provided by The Block, the Ethereum (ETH) options trading volume of $17.9 billion, despite the month not being over, indicates the highest level of all time.

Looking back at 2023, the options market trading volume was $17.7 billion. The value seen today indicates a 2% increase already.

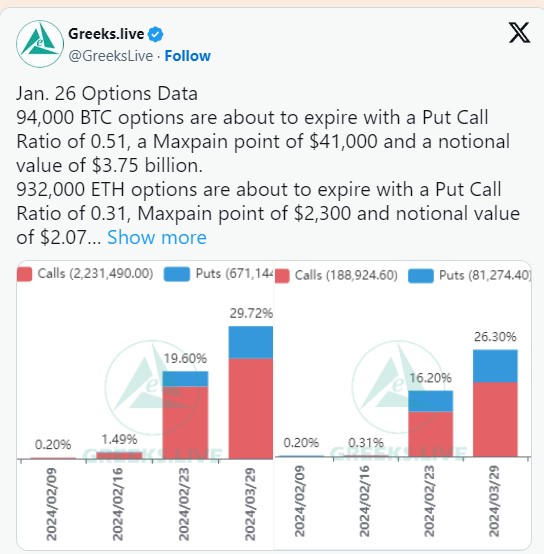

If we were to comment on ETH’s put-call ratio, it emerged that a large portion of the 932,000 Ethereum options contracts expiring on January 26 were considered to indicate a potential new rise.

According to a post shared by GreeksLive on X, the open interest in Ethereum options had a put-call ratio of 0.31 before the expiration of the option contracts.

For investors curious about what the put-call ratio is, it’s a measure of market sentiment regarding the asset in question. The ratio is calculated by dividing the number of outstanding put options (positions taken for a price drop) by the number of outstanding call options (positions taken for a price rise).

The mentioned ratio being 0.31 means that for every 100 ETH call options purchased, there are only 31 put options. This suggests that investors in ETH’s derivatives market expect the price to remain bullish until the expiration date.

ETH and Futures Trading

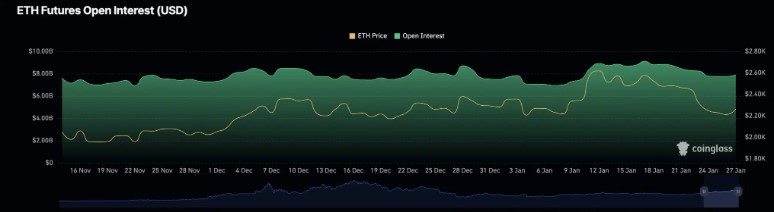

On the other hand, examining the futures side of ETH, traders may have adopted a different view. Looking at ETH’s futures open interest, it has decreased by 11% from January 17 to the present day. According to data provided by Coinglass, as of writing time, it had retreated from $8.7 billion to $7 billion.

A decline in open interest in an asset can bring about other situations. For example, decreased interest could lead to a drop in the number of transactions, which in turn could reduce price volatility. Reduced volatility could trigger a decline in interest among investors wanting to trade futures in the market and could drive them away from ETH.

On the other hand, taking a closer look at the ETH price, there has been a 0.13% decrease in the last 24 hours, which almost indicates a neutral appearance. Furthermore, the closely watched RSI value, as of writing time, is at 54.41, above neutral, which could be interpreted as buyers still maintaining a strong stance.