Ethereum‘s (ETH) highly discussed Dencun upgrade is nearing its expected completion date of March 13. The upgrade will introduce various changes to the blockchain, particularly beneficial for L2s. Additionally, Ethereum‘s Dencun upgrade is highlighted as a significant update aiming to support Layer 2’s growth through fee reduction goals.

Upgrade Excitement in Ethereum

Following the retracted Shapella upgrade in 2023, the Dencun upgrade is set to be the next major update for Ethereum. The Dencun upgrade will simultaneously execute two upgrades from Ethereum’s consensus and execution layers. The main focus of the upgrade is to significantly reduce fees to aid the growth of Layer 2. This could be made possible through the activation of a new Ethereum Improvement Proposal (EIP) known as proto-danksharding. As developers prepare to push the new upgrade, Ethereum’s network fees have increased.

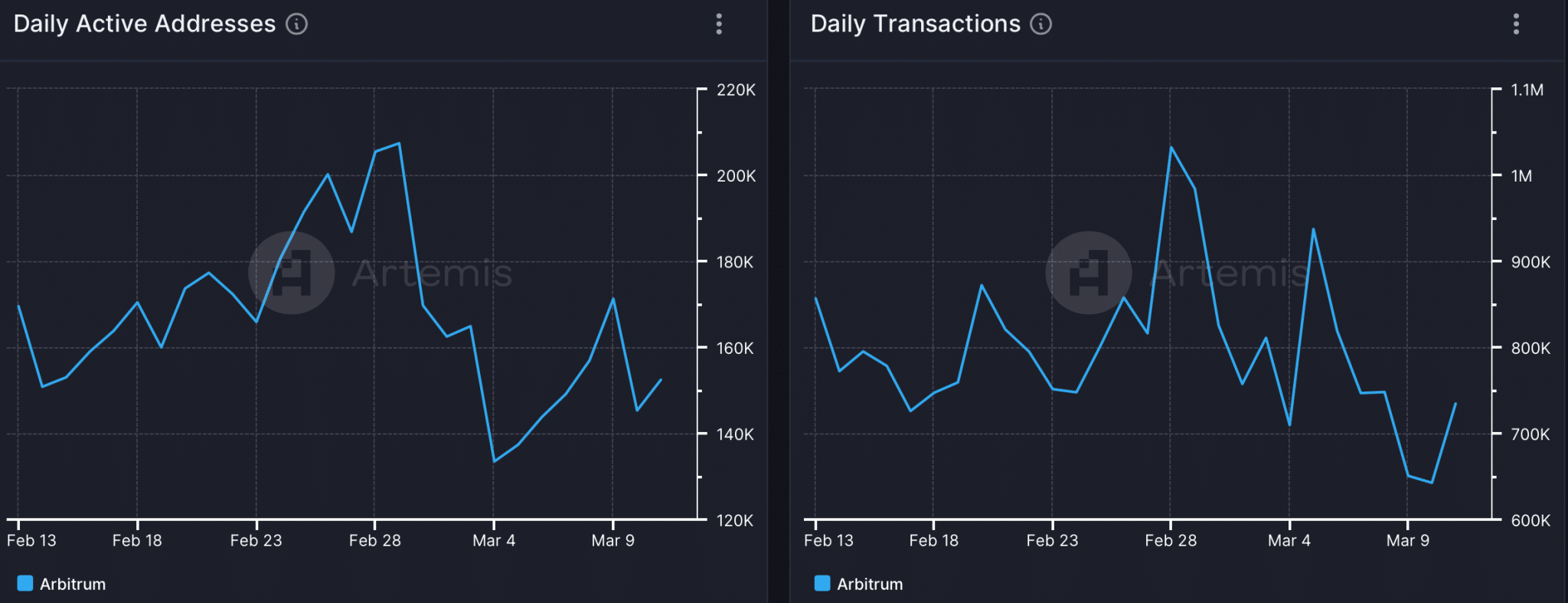

According to Artemis data, ETH fees have gained momentum and spiked on March 5. Consequently, ETH’s revenue also increased on the same day. This surge might be attributed to the rise in gas prices to 64.39 Gwei per Ycharts. While the captured value looks optimistic, Ethereum’s network activity has seen a decline. This is evident from the drop in daily active addresses charts since February 29.

ETH On-Chain Metrics

Due to the decrease in addresses, ETH’s daily transactions have also declined. However, Ethereum’s price movement has been favorable for the bulls, showing an increase of more than 9% over the last seven days. At the time of writing, ETH is trading at $4,034.42, with a market value of over $484 billion.

Ethereum’s social volume remained high, keeping it a hot topic of discussion in the market. Additionally, the weighted sentiment surged rapidly, indicating a dominant bullish trend around the token at the time of writing. The technical indicator MACD also displayed a bullish trend in the market. The Chaikin Money Flow (CMF) also recorded an increase, signaling the potential for further rises. However, ETH’s price had reached the upper limit of the Bollinger Bands at the time of writing, which could indicate a price correction.