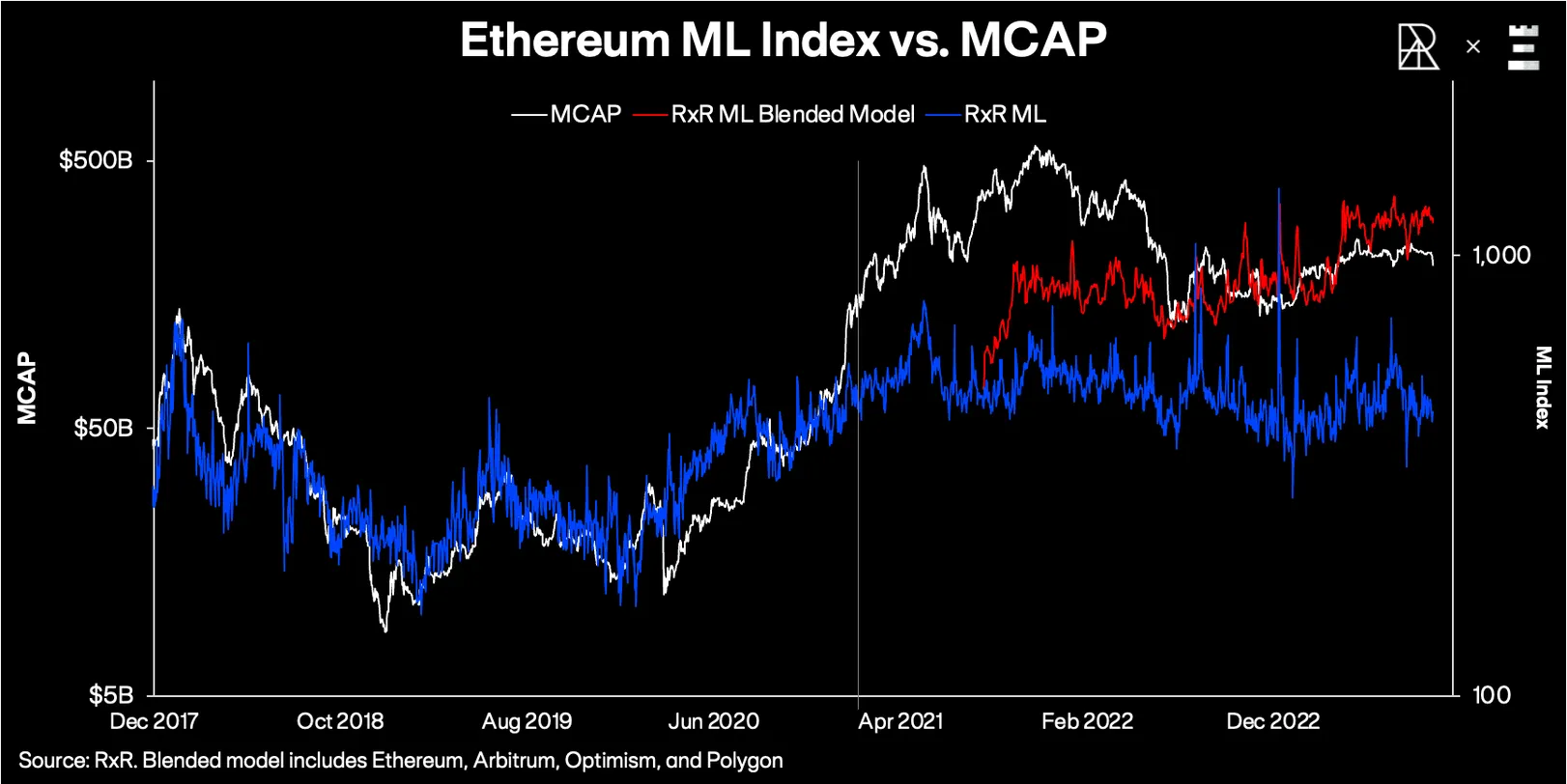

According to the blended Metcalfe law-based valuation model by research firm RxR, Ethereum (ETH) is trading 27% below its real value, which includes the adoption of Layer 2 scaling networks by active users.

Ethereum’s ETH Price Trades 27% Below Its Real Value

According to the latest analysis by RxR, a research-focused joint venture between Republic Crypto and Re7 Capital, Ether (ETH), the native asset of the Ethereum Blockchain, is trading 27% below its fair value. RxR’s fair value projection is based on a blended version of Metcalfe’s Law, which takes into account the active user base in the growing Ethereum scaling networks and active users on the Ethereum mainnet to measure the network’s fair value. Traditional Metcalfe’s Law models tend to focus only on the active user base on the mainnet.

According to Metcalfe’s Law (ML), the value of a network is directly proportional to the square of its user base. ETH allows users to transact, earn interest, stake, store NFTs, and participate in network security on the Ethereum Blockchain. Therefore, the value of ETH has long been directly linked to the usage of the Ethereum network.

To accurately assess the value of the network, it is more reliable to consider the increasing activity in Layer 2 networks or the off-chain solutions built on top of the mainnet, rather than relying on the traditional ML model, which represents a bottleneck caused by scaling and data. In other words, ETH does not necessarily have to be overvalued, as suggested by the traditional ML model.

Impressive Growth in Layer 2 Protocols

Layer 2 has become one of the most exciting areas in the market, with significant protocols finding their place. According to IntoTheBlock, Coinbase’s Layer 2 network, Base, has the most unique wallet addresses and transactions, while Arbitrum dominates in terms of trading volume, and Optimism focuses on the vision of a superchain.

According to L2Beat, the total value locked in Layer 2 protocols has grown over threefold in the past two years, surpassing $9 billion. Harland, in his assessment, stated, “The most significant change in April 2021 was that scaling solutions started to contribute on a large scale to Ethereum’s block space. For example, Curve, Sushiswap, Decentraland, and Aave were launched on the Polygon Blockchain between April and May 2021. All of these contributed to a total value locked in the Polygon Blockchain of $10 billion.”

Harland also highlighted the importance of including Layer 2 activity in machine learning fair value models, stating, “As of today, the total value of over 250 applications on Ethereum has exceeded $1 million. Due to the emergence of aggregation-focused solutions, the total TVL of approximately 30 Layer 2 networks reached $10 billion.”