Crypto currency market analysts play a crucial role in decrypting signals and predicting potential trends. Michaël van de Poppe, a leading figure in the crypto world, shares his views on Ethereum, signaling a possible bottom and an impending reversal.

Ethereum’s Return Signals: An Analytical Perspective

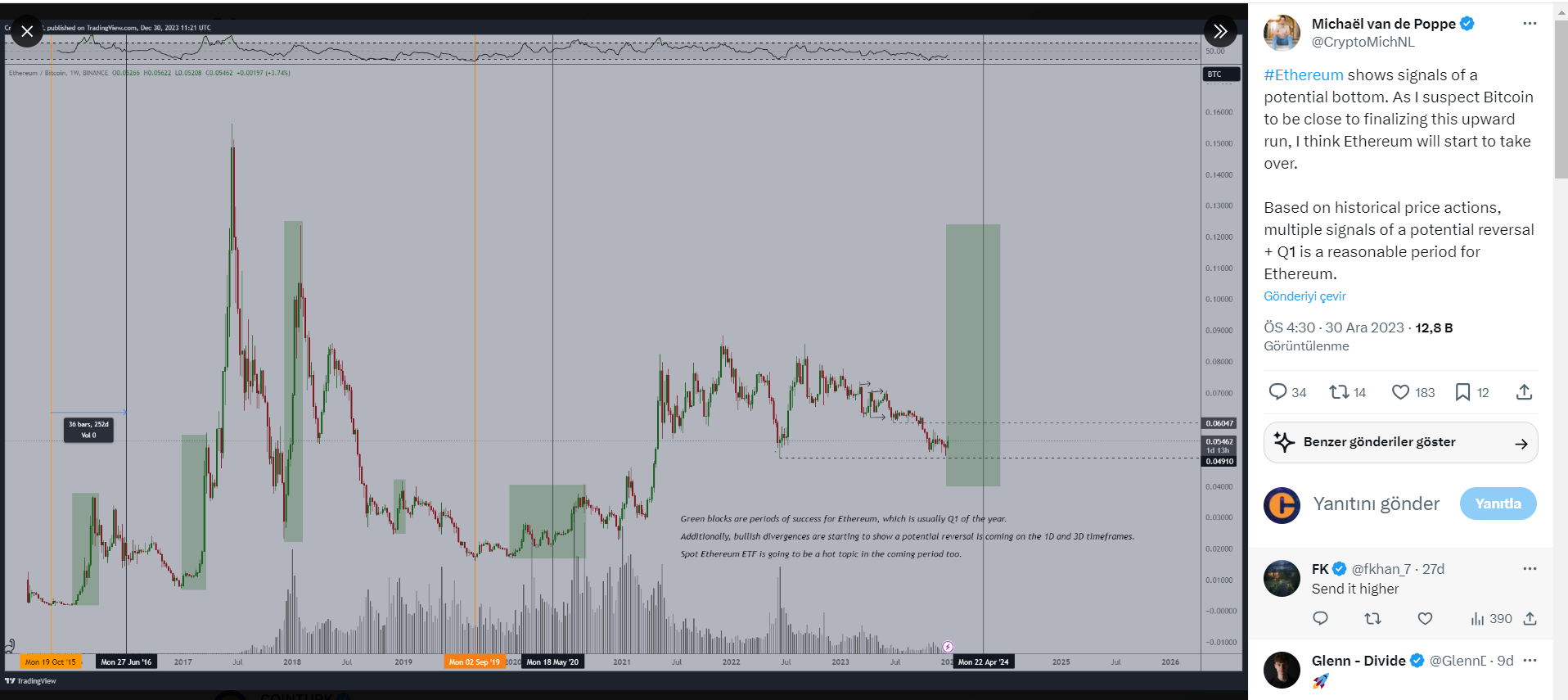

Van de Poppe initiates the discussion by highlighting Ethereum’s current signals and pointing to a potential bottom in its price trajectory. While expecting Bitcoin’s recent uptrend to complete, the analyst suggests Ethereum is ready to take on a more pronounced role in market dynamics. According to the analyst, Ethereum will experience a significant rise against Bitcoin.

Drawing from historical price movements, van de Poppe underscores the presence of multiple signals indicating a potential reversal for the altcoin Ethereum. This analytical approach adds depth to the evaluation, providing context for investors and enthusiasts looking to decrypt the market’s next moves.

Transition Period: Bitcoin’s Potential Peak and Ethereum’s Rise

The transition from Bitcoin to Ethereum is at the core of van de Poppe’s analysis. While speculating that Bitcoin’s rise is nearing its peak, the spotlight shifts to Ethereum as the potential successor. This transition is framed within the context of broader market cycles where different assets come to the forefront in turn.

Van de Poppe’s views indicate that the historically characterized first quarter is consistent with a reasonable timeframe for Ethereum’s potential resurgence. This temporal assessment adds a strategic dimension to the analysis, allowing stakeholders to position themselves in anticipation of Ethereum’s expected performance.

Navigating Market Dynamics: Historical Context Matters

The importance of historical context permeates van de Poppe’s assessment. Acknowledging that markets often exhibit cyclical patterns, the analyst utilizes past data to gain insights into potential future developments. In doing so, he provides a roadmap for understanding Ethereum’s position in the current market cycle.

A nuanced approach to market dynamics encourages a forward-looking perspective, calling on stakeholders to consider Ethereum’s past performance as a guide through the complexities of the crypto environment.

Predicting Ethereum’s Next Move

In conclusion, Michaël van de Poppe’s analysis serves as a valuable resource for those following Ethereum’s trajectory. By highlighting signals of a potential bottom and foreseeing a transition period from Bitcoin to Ethereum, he contributes nuanced insights to the ongoing crypto conversation.

As investors and enthusiasts navigate the intricacies of the market, van de Poppe’s perspective offers a roadmap for strategic decision-making. Whether Ethereum’s potential reversal will occur as expected remains to be seen, but the analytical foundation laid out by van de Poppe provides a thoughtful guide for those wanting to stay ahead in the dynamic world of cryptocurrency.