Ethereum, by market value, is not only the largest altcoin but also the most active smart contract platform. Most popular protocols operate on the Ethereum network, and even its competitors are striving to become EVM compatible for further growth. So, is it logical to buy ETH for the long term?

Short-Term Commentary on Ethereum (ETH)

ETH price has retreated to the $2,200 support level following the recent BTC decline. The negativity in BTC price created a multiplier effect in altcoins, which led to the loss of the hard-earned $2,700 level, wiping out $500 from the price. Still, some metrics are sending promising signals about the future of ETH price.

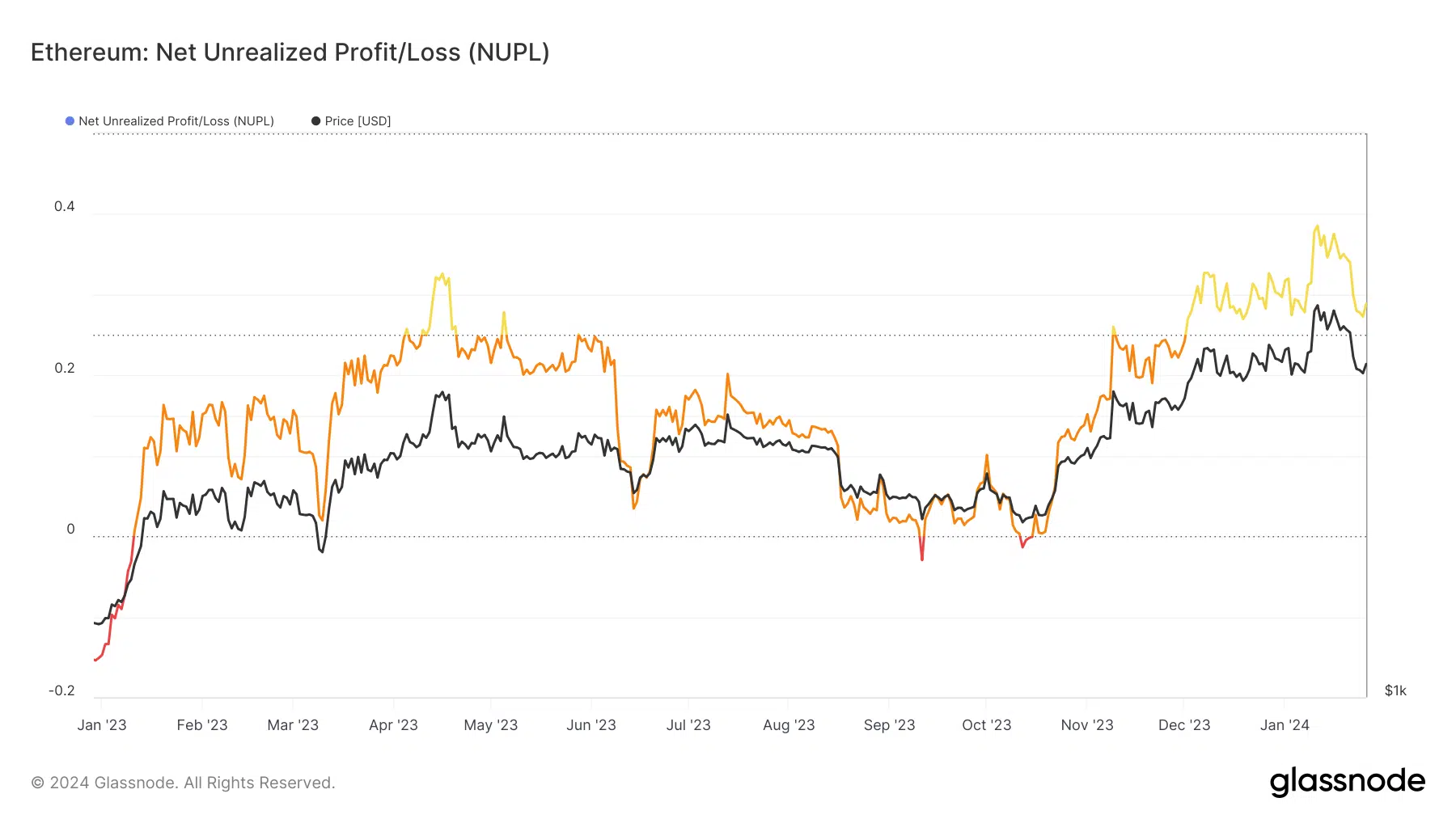

The NUPL metric has been slowly rising since October and reached 0.385 on January 11. According to Glassnode’s data, ETH’s NUPL was last at these levels in May. This figure indicates positive sentiment and reflects optimism.

Open interest in futures has relaxed, and leverage has increased over the past few weeks. Following ETF approval data, the expectation for ETH was a strong uptrend, and this data shows us that traders in futures were caught off guard by the sudden fluctuation. The decrease in open interest is supportive for the narrative of a mid-term futures-backed rise.

The Cumulative Liq Levels Delta is negative, meaning short positions dominate despite weak futures volume. This suggests that more people are expecting volatility during the Fed week, leaning towards the bears. Considering the accumulated short positions (and typically volatility during Fed weeks goes in both directions), we might see a jump to the $2,350 liquidation zone.

Ethereum Predictions

There are many reasons to be optimistic about ETH’s price increase in the mid-term. Instead of discussing them at length, it might be more sensible to summarize them in bullet points.

- Transaction fees will decrease with the Denison upgrade, increasing layer 2 activity.

- Negative inflation

- Spot ETH ETF applications are likely to be approved by the SEC, given the approvals of futures ETFs.

- Futures ETFs may see high demand due to staking rewards.

- General market sentiment expected to improve with the halving in April.

- Interest rate cuts expected before the second half of the year.

- Environmental concerns to be addressed with ETH’s transition to PoS.

- ETH not being considered a security by the CFTC and the SEC Chairman’s reluctance to clearly state it as such.

- Potential relief from regulatory uncertainty over altcoins due to ongoing Coinbase and Binance cases.

And much more. Of course, cryptocurrencies have high volatility, and even the strongest altcoin with solid fundamentals like ETH could one day go to zero.