Crypto investors were celebrating their gains from the new token on the Base network on Sunday. However, things quickly took a turn for the worse the next day. The BALD Token circulating on the Base network experienced a 90% drop. It was claimed that the issuer, who withdrew liquidity after our announcement yesterday, was actually a familiar name.

Who is the BALD Token Scammer?

Many on-chain experts are accusing the founder of FTX, a Ethereum layer2 solution on the BASE network, of being responsible for the issuance of the BALD Token. Adam Cochran, partner at Cinneamhain Ventures, wrote that it is 90% likely that SBF or someone else from Alameda is responsible for the rug-pull, referring to Bankman-Fried’s former company and co-CEO Sam Trabucco.

Cochran also argues that Bankman-Fried’s court and bail dates align with wallet movements. Reports suggest that FTX and Alameda have been depositing funds into the BALD developer wallet for over two years. The wallet currently holds a balance of 12,331 ETH.

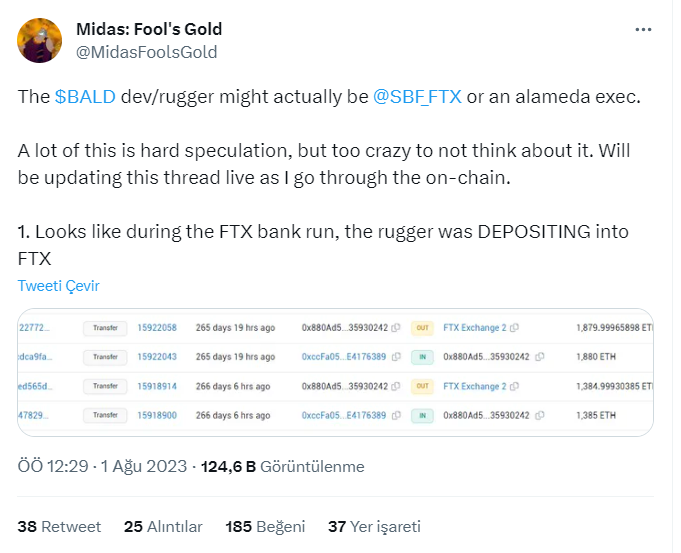

Another on-chain expert blaming FTX for the scammers is a user named MidasFoolsGold. He has a few pieces of evidence to support this claim.

- The scammer deposited funds into the exchange while people were fleeing during the FTX crash.

- The wallet is associated with Alameda.

- There was no movement in the wallets while SBF was in prison.

- Interestingly, the wallet revived when SBF landed in the US. The wallet receives Circle deposits and can make transactions 2 days after his arrest.

- The wallet was very active when LUNA crashed. This incident led many to assume that SBF was involved. They were probably using customer UST.

MidasFoolsGold assumes that if the BALD Token scammer is not SBF, it must be someone from his family, Alameda, or FTX executives.

Crypto Investors Should Be Cautious

Amidst all these discussions on Sunday, we saw that everyone knew the end result would be bad, even though BALD Token was trending on social media. This was interesting, and the investors who remained inside had lost money knowingly. This shows that crypto has normalized taking abnormal risks in certain investor groups. Like gambling addiction, there is a group of investors who take high risks in the hope of making high profits at the cost of losing their money.

Given the general expectation of a rug-pull or crash, the 90% drop on Monday did not surprise most people. In fact, some investors raised the price from $0.01 to $0.04 in anticipation of another surge.

So what was the main motivation behind this gambling table? The allegations that BALD Token, issued on BASE, was directly linked to Coinbase. There were only allegations, no official statements or tangible evidence. Most investors were aware that this was not the case, but since their only motivation was to make money, they didn’t care about the truth.

Therefore, the real thieves were the victims who bought into a story they didn’t believe in, just to be left behind in a game where the last ones to come out would lose. And the BALD Token scammer preyed on them, many of whom were still in the early stages, within less than 24 hours. This situation is similar to people who knowingly participate in pyramid schemes, thinking that the first ones to enter will win. So, the thieves are clearly the victims, sitting in the victim’s seat today just because they didn’t get the opportunity they wanted.