In a speech today at 18:00, Fed Chairman Powell stirred the cryptocurrency market, marking one of the most critical developments of the month. With inflation falling and following the recently received data, the Fed Chairman’s forthcoming announcements were of high importance. So, what happens next?

June’s Fed Interest Rate Decision

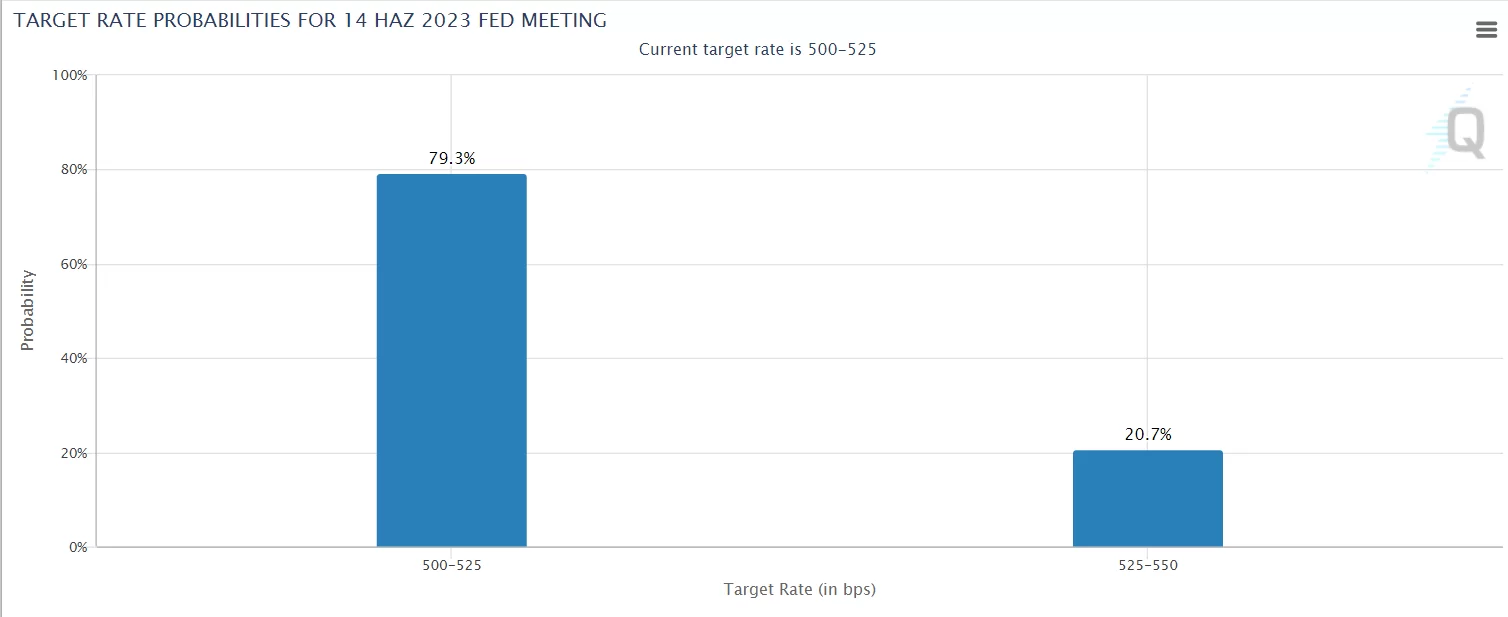

Upon evaluating the latest data and Powell’s statements, there is an 80% likelihood that there will be no interest rate increase in the June meeting. The Fed meeting on June 14th could be a turning point. The Fed has been successful in reducing inflation over the last year through aggressive interest rate increases and anticipatory rate hikes. Now, the goal is to maintain interest rates at a sufficiently tight level until reaching the 2% target.

Earlier statements suggested that once interest rate increases stopped, they could not resume. Consequently, Powell consistently mentioned that they were not rushing into making a final decision. Now, he speaks of potentially achieving a lower-than-predicted peak interest rate, given the impact of the banking crisis.

What About Cryptocurrencies?

If there is no interest rate increase in June, the only expectation for the subsequent meetings would be a signal for reduction. Historical data indicates that the Fed can keep the interest rate at its peak for 9-12 months. Considering the previous announcements of no reduction in 2023, interest rates will likely remain at the 5-5.25 range until the first quarter of 2024. Tightening credit conditions have pulled down the previously mentioned 5.75 peak.

We might see a more positive environment for cryptocurrencies in the next period. However, employment and inflation numbers will still likely cause market turbulence in the future. Investors are left with one issue. Today, we saw Bitcoin fall suddenly as Powell was speaking because debt ceiling negotiations were suspended. If the debt ceiling is raised for the 79th time next week, this issue will also be resolved.

In conclusion, as we approach June 1st, a more favorable environment is expected for the cryptocurrency markets. Today’s announcements and the latest data suggest we may be nearing the end of the exhausting bear markets. Of course, conditions can change rapidly, but today the climate is good for crypto.