Franklin Templeton, after the success of its Ethereum ETF, is now considering a Solana ETF. Spot Ethereum ETFs saw a net inflow of $107 million on their first trading day. Meanwhile, Donald Trump denied rumors of considering Jamie Dimon and Larry Fink for the role of U.S. Treasury Secretary. Here are three significant developments in the crypto market over the past 24 hours.

Is Solana Next?

In the United States, Franklin Templeton, one of the first firms to issue a spot Bitcoin ETF, is optimistic about more cryptocurrency ETFs, including a Solana product. Franklin Templeton shared the following statement on July 23:

“Bitcoin and Ethereum are not the only exciting developments in the crypto space. Solana has shown significant adoption and continues to mature, overcoming technological growth issues and highlighting the potential of high-performance, monolithic architectures.”

Franklin Templeton’s statement about potential Solana ETFs came on the same day the company launched its second spot cryptocurrency ETF, the Franklin Ethereum ETF (EZET).

Excitement on the First Day of Ethereum ETFs

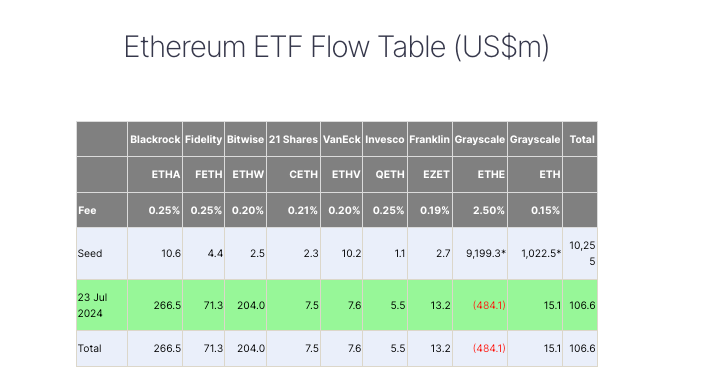

On the first trading day of spot Ethereum ETFs, despite outflows from Grayscale’s newly converted Ethereum Trust (ETHE), a list of eight new products saw a net inflow of $106.6 million. BlackRock and Bitwise led the list, with BlackRock’s iShares ETF (ETHA) gaining $266.5 million and Bitwise’s Ethereum ETF (ETHW) gaining $204 million in net inflows.

The inflows into new spot Ethereum funds were enough to overcome significant outflows from Grayscale Ethereum Trust (ETHE), which saw over $484.9 million in outflows in one day, equivalent to 5% of the once $9 billion fund. ETHE was launched by Grayscale in 2017, allowing institutional investors to purchase Ethereum but imposed a six-month lock-up period on all investments. The conversion to a spot ETF means investors can now sell their shares more easily, which may explain the high outflows on the first day.

What’s Happening in the U.S. Elections?

With less than four months to go until the United States presidential elections, reports circulated that Donald Trump was considering appointing JPMorgan CEO Jamie Dimon or BlackRock’s Larry Fink. In a post on Truth Social on July 23, Trump said neither Dimon nor Fink were part of his cabinet plans:

”I don’t know who said it or where it came from, but I have never discussed or considered Jamie Dimon or Larry Fink for Treasury Secretary.”

The connection with Jamie Dimon was first reported by Bloomberg. Shortly after, the New York Post reported that the Republican candidate was considering Larry Fink. While JPMorgan continues to experiment with blockchain technology, Dimon remains a staunch critic of crypto.