The applications made by BlackRock, the world’s largest asset management company, and other financial giants to the U.S. Securities and Exchange Commission (SEC) for a spot Bitcoin ETF in mid-June have led to strong optimism for the overall cryptocurrency market. It has now emerged that some financial giants have gone beyond Bitcoin and applied to the SEC for an Ethereum futures ETF.

Financial Giants Begin Applying for Ethereum Futures ETF

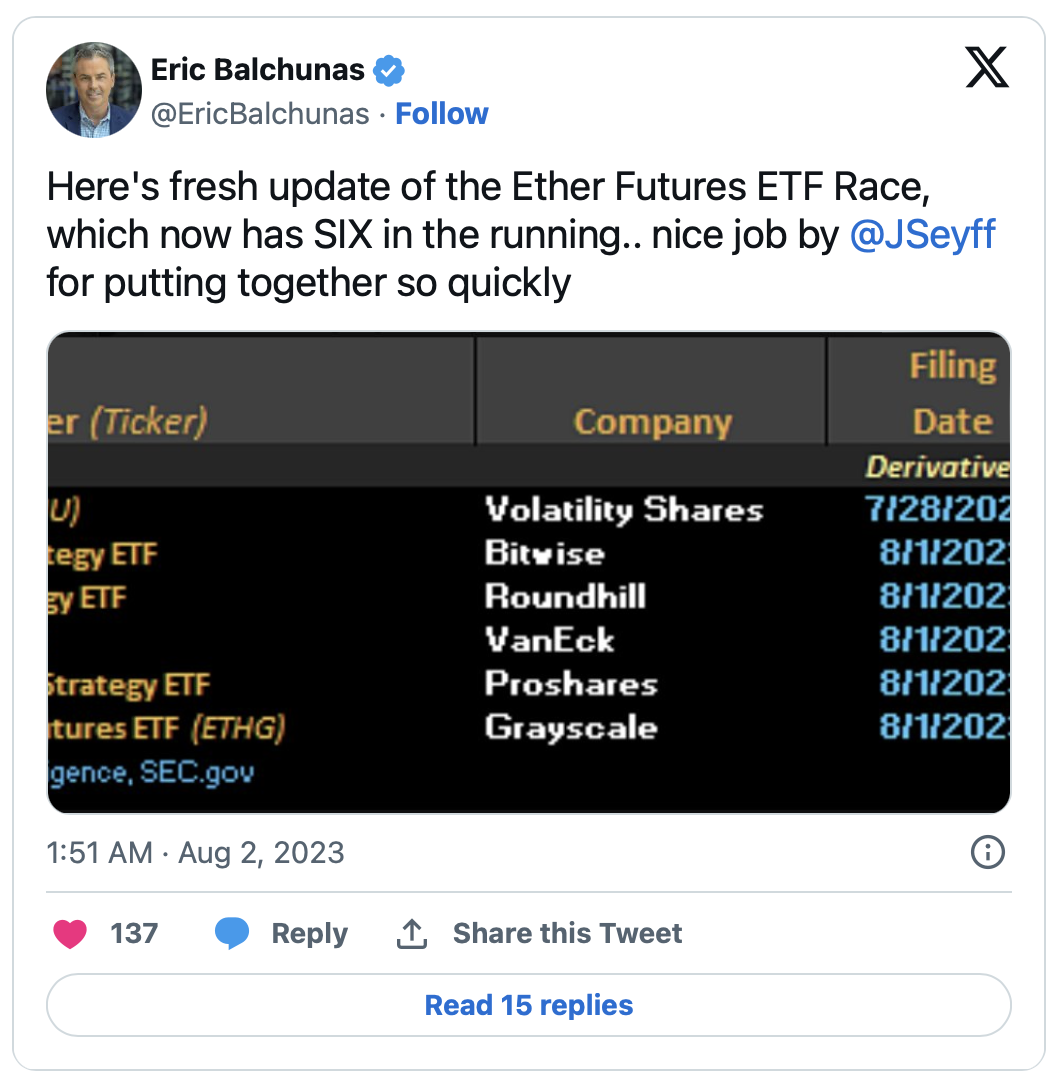

Eric Balchunas, Bloomberg’s authoritative ETF analyst, recently reported that six companies, including Volatility Shares, Bitwise, Roundhill, VanEck, Proshares, and Grayscale, have applied to the SEC for an Ethereum futures ETF.

Volatility Shares filed an application with the SEC for the Ether Strategy ETF on July 28. If approved by the SEC, investors will be able to invest in cash-settled ETH futures contracts traded on the Chicago Mercantile Exchange (CME) through the ETF instead of directly investing in ETH.

Following the SEC’s recent approval of the country’s first leveraged Bitcoin futures ETF, the 2x Bitcoin Strategy ETF (BITX), Volatility Shares has submitted a new application. The new application aims to move in proportion to the daily excess return of the S&P CME Bitcoin Futures Daily Roll Index. Balchunas tweeted earlier this week, “It’s interesting that the SEC has withdrawn some new ETH applicants, but VolShares has launched the 2x Bitcoin Futures ETF (still). So maybe they feel it’s the right time.”

Options Market Paints a Negative Picture for Ethereum (ETH)

Following the selling pressure seen earlier this week, the rise of over 2% in the Ethereum price in the past 24 hours indicates a positive sentiment. As of the time of writing, the king of altcoins is trading at $1,860 with a market capitalization of $223.44 billion. The drop of Bitcoin below the $29,000 support level also caused a decline in ETH, and the price of the largest altcoin dropped below $1,900. After remaining below $1,850 for a few days, the ETH price has now risen above this support level again.

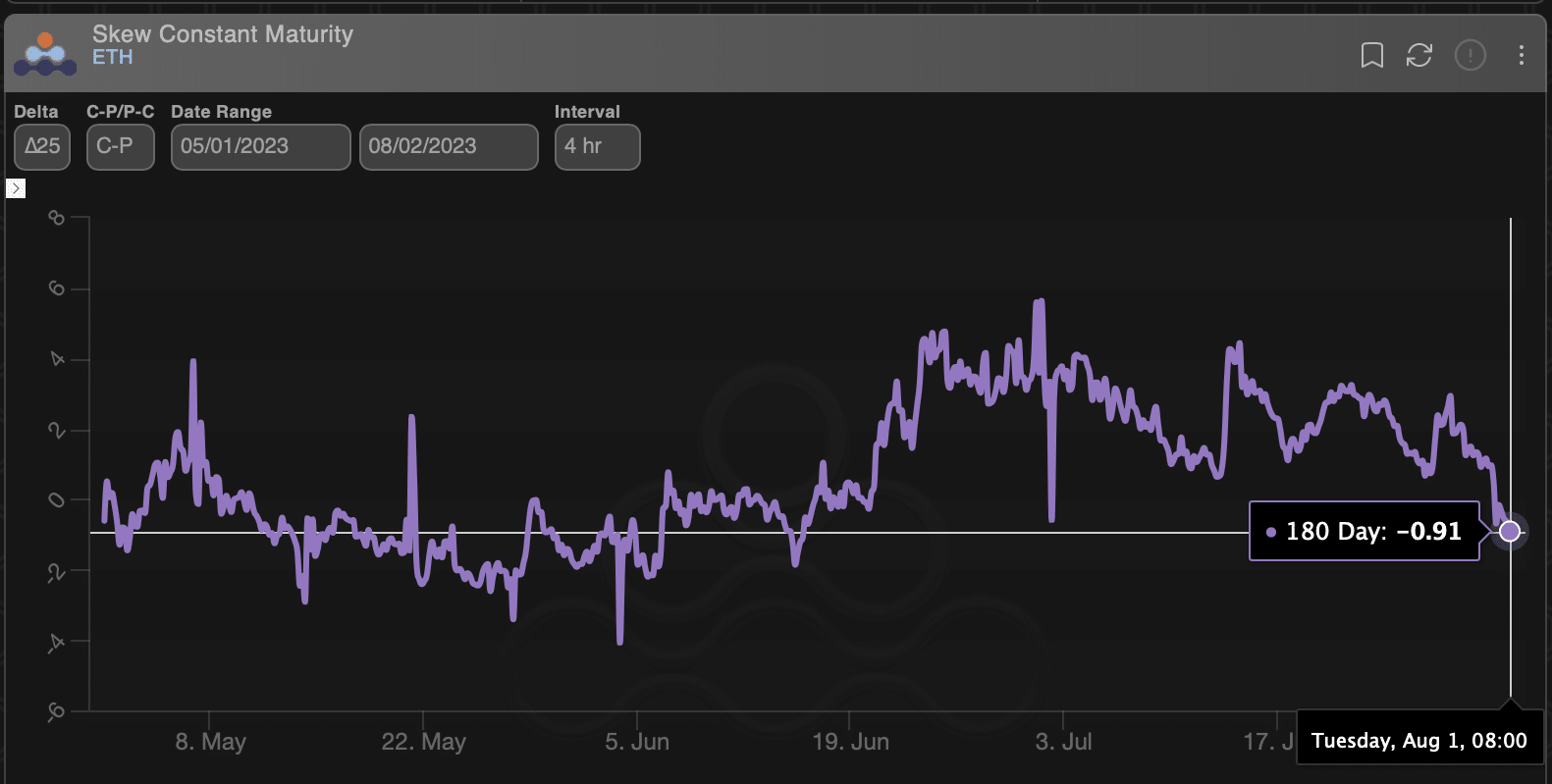

Meanwhile, Ethereum options market data indicates a negative trend for ETH price movement over the next six months. According to crypto data provider Amberdata, the 6-month put/call ratio, which is a measure of the difference between implied volatilities of options expiring in 180 days for ETH, has dropped to its lowest level since June 15, reaching -0.91.

This negative value indicates a preference for put options, which give the buyer the right (but not the obligation) to sell the underlying asset at a predetermined price on or before a specified date. While the purchase of put options suggests a bearish trend in the market, the purchase of call options indicates a bullish trend.