Grayscale, one of the largest digital asset investment firms globally, has published its market analysis report for the second quarter of 2025. The report highlights significant changes in the list of the top 20 cryptocurrencies. New entrants include altcoins Maple (SYRUP), Geodnet (GEOD), and Story Protocol (IP), while Akash (AKT), Arweave (AR), and Jupiter (JUP) have been removed from the list. Grayscale emphasizes that all coins in the ranking are high-risk and volatile.

Highlights from Grayscale’s Report

Grayscale reports that the total number of digital assets in the cryptocurrency market, excluding NFTs, has surpassed 40 million. The company’s industry framework encompasses 227 different cryptocurrencies, with a total market value of approximately $2.6 trillion. This figure accounts for about 85% to 90% of the total value of the cryptocurrency market.

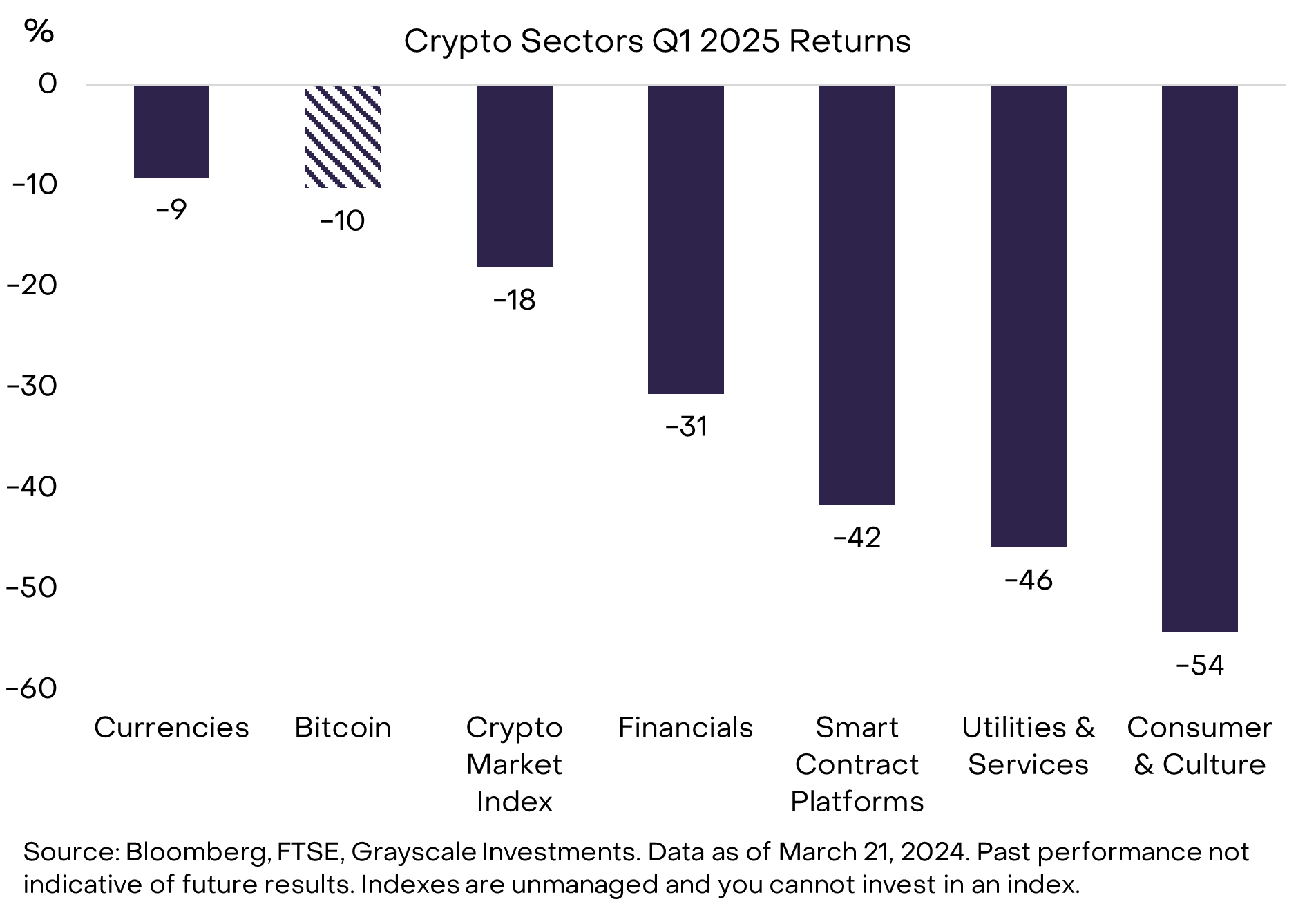

According to the report, the cryptocurrency market experienced a decline in value during the first quarter of the year. Grayscale’s Crypto Sectors price index fell by 18% as of March 21. While some cryptocurrencies, such as Bitcoin (BTC)  $91,967 and XRP, saw minor declines, a few coins experienced slight increases. The largest losses were observed among altcoins in the consumer and culture sectors, primarily led by Dogecoin

$91,967 and XRP, saw minor declines, a few coins experienced slight increases. The largest losses were observed among altcoins in the consumer and culture sectors, primarily led by Dogecoin  $0.139586 (DOGE) and other memecoins.

$0.139586 (DOGE) and other memecoins.

Grayscale notes that Bitcoin’s long-term fundamentals remain robust. The number of addresses holding at least $1 worth of Bitcoin assets reached a historic high of 48 million. This trend illustrates investors’ inclination towards long-term holding, or “hodling.” The number of active users on the Bitcoin network has stabilized around 11 million, reaffirming Bitcoin’s strong position as a store of value. Additionally, the Bitcoin network’s hashrate has risen to approximately 800 EH/s.

The report indicates a decline in key metrics for smart contract platforms. This decline is primarily attributed to reduced meme coin activities on the Solana  $143 (SOL) network. Nevertheless, Solana continues to attract approximately 90 million active users monthly while generating around $390 million in transaction fees, accounting for nearly half of the total fees produced by all smart contract platforms.

$143 (SOL) network. Nevertheless, Solana continues to attract approximately 90 million active users monthly while generating around $390 million in transaction fees, accounting for nearly half of the total fees produced by all smart contract platforms.

High Growth in Application-Focused Cryptocurrency Sectors

In application-focused cryptocurrency sectors, including finance, consumer culture, and services, total transaction fees reached approximately $2.6 billion in the first quarter of 2025. This represents a remarkable 99% increase compared to the previous year.

The report highlights the rapid growth of application-based cryptocurrency sectors.