Ethereum (ETH) price dropped sharply by 22% in the last 24 hours. On a weekly basis, it experienced a 33% decline. Previously, we reported that Jump Crypto, one of the major crypto trading companies, has been selling its ETH for a few days. The community believes this move might be related to the investigation initiated by the CFTC in June in the US.

Hackers Seize the Opportunity to Accumulate ETH

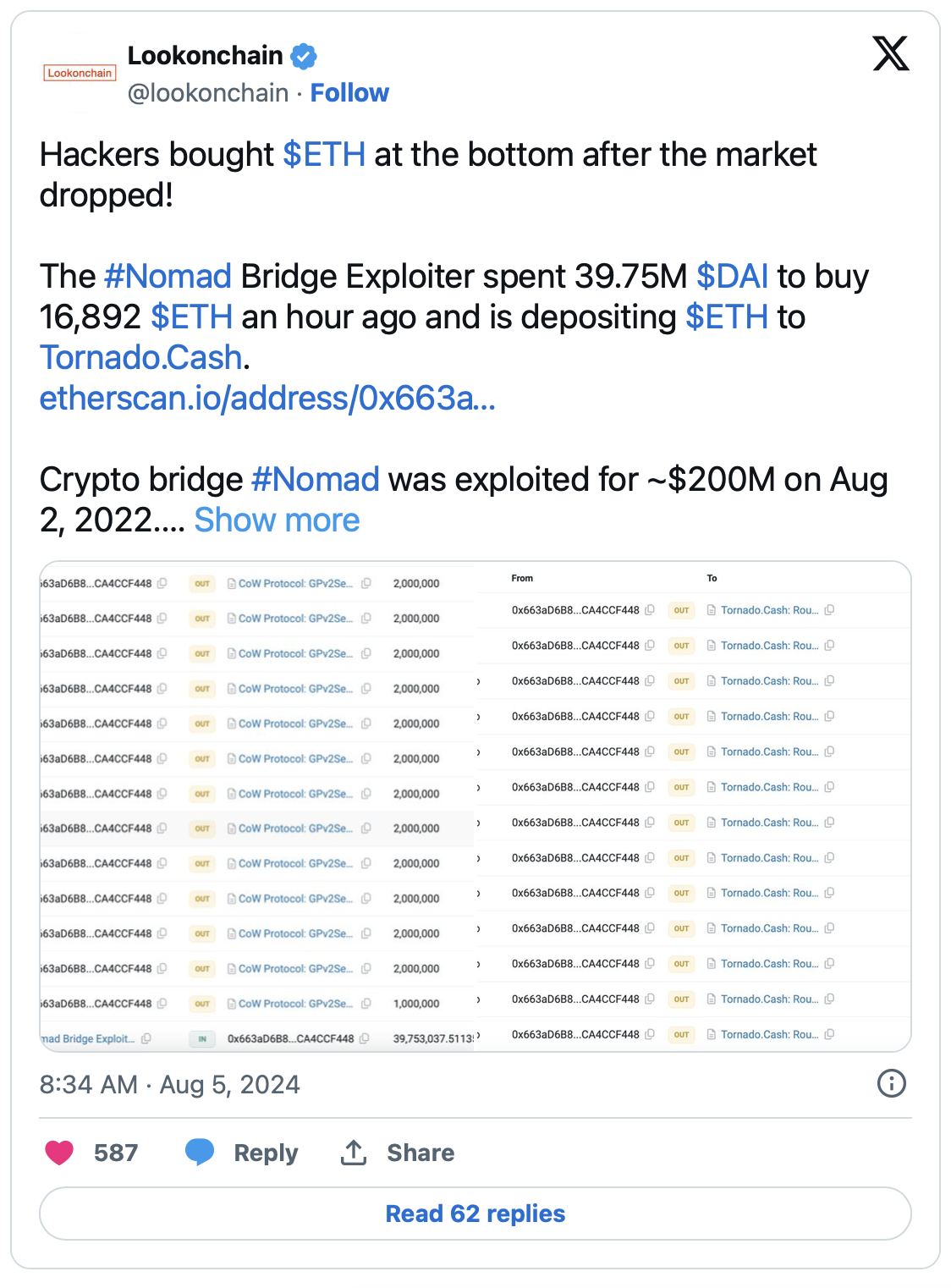

Just a few hours ago, an interesting development occurred with a significant buying movement. As known, large price drops are considered a buying opportunity for some investors. This seems to be true for Nomad Bridge hackers as well.

You might remember the attack on Nomad Bridge in 2022. Hackers managed to steal $190 million worth of various altcoins using a chaotic copy-paste attack method. Now, on-chain data shows that these hackers spent $39.75 million in DAI to purchase nearly 17,000 ETH a few hours ago.

Again, according to on-chain data, the hackers are trying to obfuscate the trail of the funds by depositing the purchased ETH into the crypto mixer platform Tornado Cash.

Buying Opportunity…

As ETH’s price fell due to the global market turmoil affecting the crypto market, and various speculations arose post-drop, the fact that Nomad Bridge hackers took advantage of this situation was noted as quite remarkable. Experts highlight that the sudden and significant drop in the price of Ethereum, the king of altcoins, presents a buying opportunity not only for ordinary investors but also for hackers, suggesting that the current situation might soon change. This could signal that the downtrend and selling pressure are nearing exhaustion.