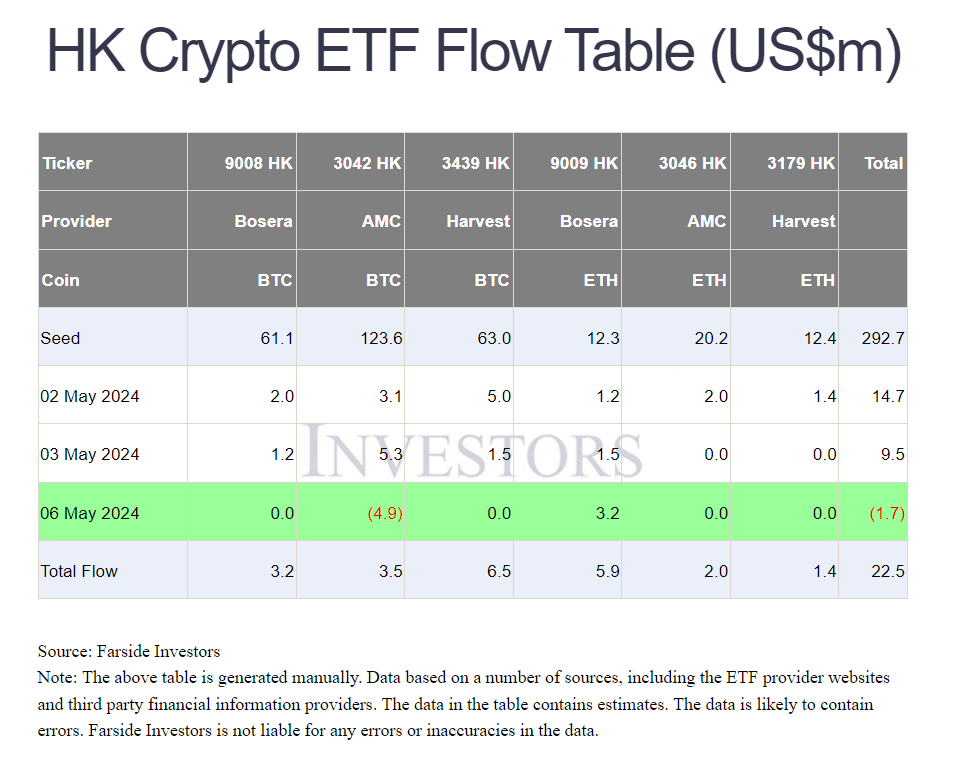

Hong Kong spot Bitcoin exchange-traded funds (ETFs) showed much lower performance in their launch week compared to their US-based counterparts. According to data compiled by Farside Investors, the three spot Bitcoin ETF funds launched in the East Asian City on April 30 attracted a total of $262 million in assets under management (AUM) subscribed before listing.

Hong Kong and the ETF Space

These asset inflows were less than $14 million in the launch’s first week, which is far below the billions of dollars that flowed into US-based spot Bitcoin ETF funds in January. Farside Investors shared the following statement:

“In our view, the launch of Bitcoin and Ethereum ETF funds in Hong Kong is a minor process compared to US ETF funds.”

Meanwhile, the world’s first Hong Kong spot Ethereum ETF funds also did not show impressive performance, with a cumulative $54.2 million AUM and $9.3 million in total inflows as of May 6. Senior Bloomberg ETF analyst Eric Balchunas commented on the results:

“As we advised, do not expect big numbers against Hong Kong and the US. The $310 million in Hong Kong ETF funds are equivalent to $50 billion in the US market. Therefore, in this context, these ETF funds are already big in terms of local market value compared to those in the US.”

Data Highlights Key Issues

Hong Kong stock sector, with a total market value of $4.5 trillion, is relatively small compared to the $50 trillion in stocks listed across all US exchanges. The Hong Kong stock sector is also less liquid due to China’s slowing economic growth since 2022.

Recent research by cryptocurrency exchange OSL found that about 80% of crypto-enthusiastic investors in Hong Kong plan to invest in the new spot Bitcoin and Ethereum ETF funds. However, the assets are not currently accessible to Chinese investors unless they reside in Hong Kong. Researchers at SoSoValue stated:

“China does not allow RMB investors to make purchases, and the increasing funds may be limited, which could lead to low trading volumes. Therefore, there are still strict restrictions on investor qualifications for Hong Kong-based crypto ETF funds, and mainland investors cannot participate in the transactions.”