On April 30, a clearer downturn in the cryptocurrency market was observed, which became significantly sharper on the first day of May. This price movement resulted in investors who took long positions in leveraged trades losing approximately $400 million over the last 24 hours.

Current Status of Cryptocurrencies

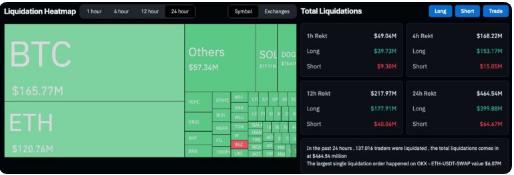

Specifically, due to the recent price movement, 137,016 cryptocurrency investors in long and short positions incurred losses of $464.54 million. Additionally, it was understood that only $64.67 million of these losses were related to short sales, while the remaining $399.88 million came from bullish traders who opened long positions.

Of the losses incurred, $168.22 million occurred in the last four hours, with $153.17 million resulting from the liquidations of bullish positions. These data were provided by Coinglass.

Bitcoin (BTC) and Ethereum (ETH) faced liquidations of $165.77 million and $120.76 million respectively, dominating the 24-hour period. Particularly, investors in these two cryptocurrencies saw losses of $145 million and $100 million in their long positions, representing 61% of the total.

Current Bitcoin Price Situation

Bitcoin and other cryptocurrencies also saw a decline from a market cap of $2.29 trillion on April 30 to $2.04 trillion on May 1, resulting in a total ecosystem loss of $250 billion (10.87%).

Bitcoin saw daily losses exceed 7.5% and created significant uncertainty on the first day of the month. At the time of writing, the BTC price stands at $57,200. The loss of the $60,000 support level has also increased investor anxiety.

Analysts’ price predictions cover potential movements to the $54,000 and $50,000 regions before reaching past price levels. Meanwhile, the $54,000 prediction is increasingly seen as a psychological support and target.

On the other hand, investors are already turning their attention to the Federal Reserve’s interest rate decision. According to recent statements and data, 99.5% of the market anticipates that interest rates will remain steady between 525 and 550 basis points.

The possibility of investors reducing their interest in risky assets could trigger more turmoil due to a hawkish approach. Last week, investors in Bitcoin ETFs were hit by the DTCC’s decision not to recognize the collateral value of these funds.