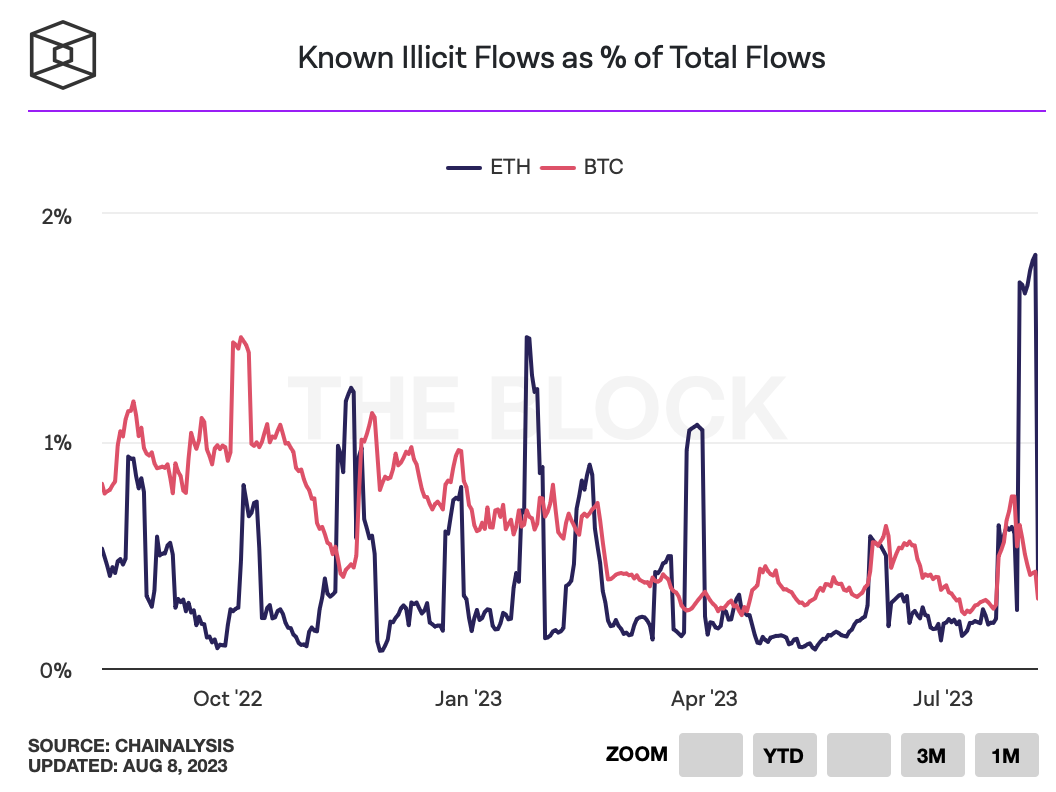

The king of altcoins, Ethereum (ETH), witnessed the highest level of illegal flows on its network last week. This increase coincided with the hack of Curve Finance, one of the leading DeFi protocols, and the withdrawal of $73 million.

Illegal Flows on Ethereum Network Increase to 2%

According to data provided by The Block, Ethereum, the leading Proof of Stake (PoS) blockchain, experienced its worst period in terms of illegal flows last week. Data tracked by blockchain research and analysis firm Chainalysis shows that illegal flows, known as a percentage of total flows on the Ethereum network, reached about 2% for several days last week.

This rate, ranging from 1.7% to 1.82% between July 30 and August 5, returned to normal levels on August 6. The highest level of illegal flows recorded before last week was in January when illegal flows accounted for 1.46% of total flows on the network, and there has been no significant increase since then.

Increase Coincides with Curve Finance Hack

It is not clear what exactly caused the increase in illegal flows on the Ethereum network, but the increase in flows coincided with the major hack attack on Curve Finance, a decentralized cryptocurrency exchange that rocked the DeFi market last week.

For those unaware, an attacker exploited vulnerable versions of the Vyper programming language to carry out so-called “reentrancy attacks” and withdrew over $73 million from Curve Finance pools on July 30. According to analysts at blockchain security company PeckShield, as of August 6, $52.3 million of the stolen funds have been returned.

Curve Finance is offering a $1.85 million reward to anyone who can help identify and convict the attacker for not returning all the stolen funds within the given time frame.