Crypto currency investors mostly conduct their transactions through applications downloaded on their mobile devices. However, some regions have started taking steps to force companies to ban due to legal disputes with global exchanges. India is at the forefront of this. The country, which hosts a large number of crypto investors, has also convinced Google to remove the applications.

Play Store Crypto Exchange Ban

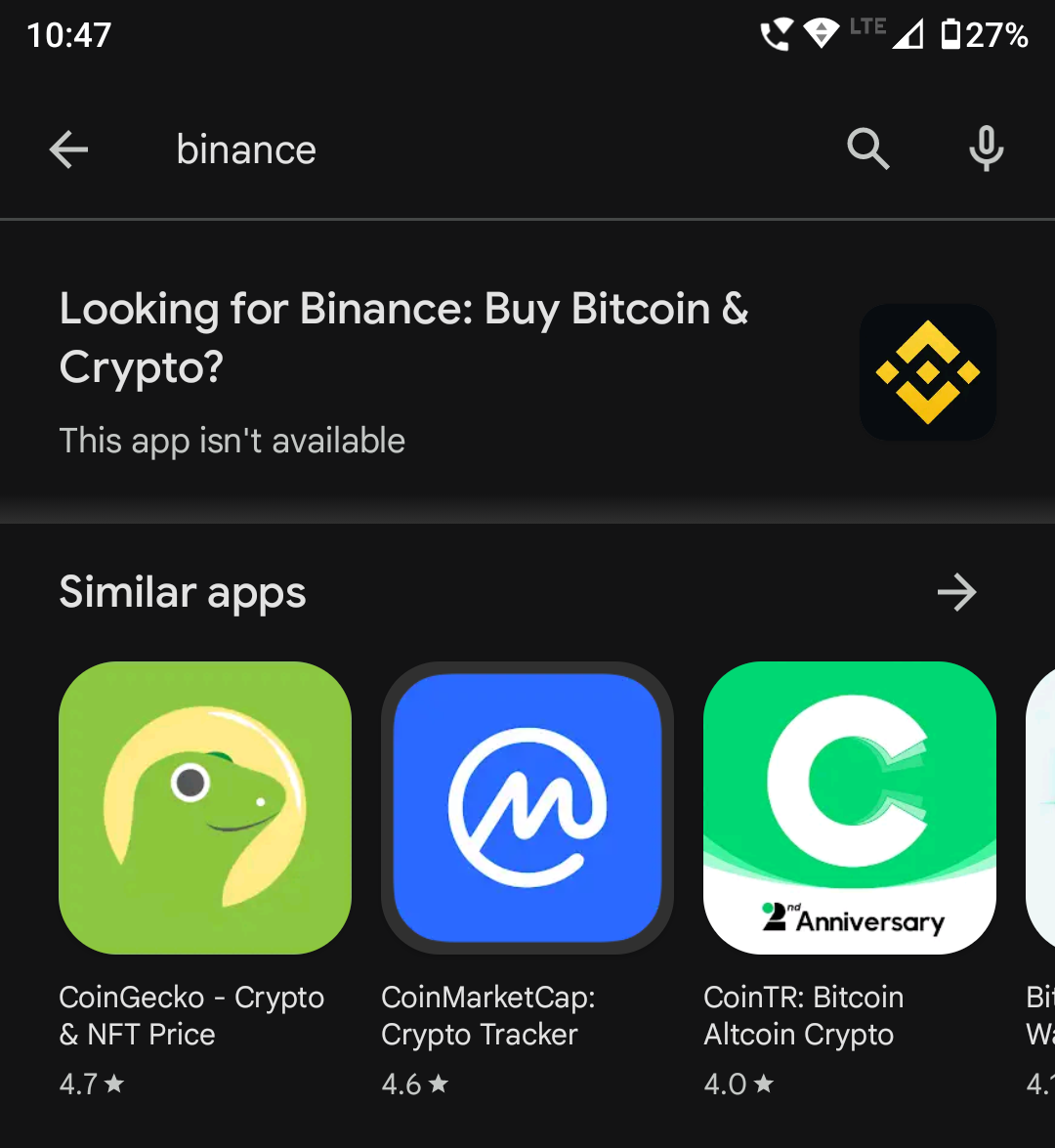

Google has removed applications of global exchanges such as Binance, KuCoin, Bitget, Huobi, OKX, Gate from the India Play Store. On January 10th, Apple took the same step, and within the following four days, Google also made its stance clear in the battle against crypto exchanges. India is excluding global exchanges from the country for not complying with its laws.

However, it is known that the real aim is to prevent capital outflow, as we remember from the WazirX raids. Years ago, the WazirX office was raided, and Indian authorities closely monitored the country’s largest crypto exchange for facilitating illegal money transfers abroad.

Yet, it is difficult to say that crypto tokens or stablecoins sent to centralized exchanges cause capital outflow from the country. Because these assets are stored in crypto exchange wallets, i.e., on the blockchain. Claiming that money moved to the blockchain has been transferred to any country requires ignorance of this technology, whether it stays in local exchanges or is moved to centralized ones.

India and Crypto Ban

India’s Ministry of Finance’s Financial Intelligence Unit (FIU) notified Binance, Huobi, Kraken, Gateio, KuCoin, Bitstamp, MEXC Global, Bittrex, and Bitfinex on December 28, 2023, that they were operating illegally in the country. The FIU notification states that any exchange serving Indian users must register as a “reporting entity” and declare to the income tax department.

Binance has announced that the assets of Indian users are safe and that they are working on resolving the issue. India has not announced a comprehensive ban on cryptocurrencies. However, with a vast population of low-income citizens, it is looking for ways to curb the growing interest in crypto.

To curb interest, Indian officials introduced a 30% crypto tax and a 1% cut on each crypto transaction, leading to reduced volumes and driving people in the region towards global exchanges. However, no matter how hard they try, investors have many options, including OTC transactions, and crypto has high resistance to such pressures.