Investors are still nervous and Bitcoin‘s price does not seem eager to maintain its new peaks. At the time of writing, BTC is trading at $64,150, and altcoins are generally in the red. Ether is finding buyers at $3,100. So, what are the current market predictions?

Latest Predictions for Cryptocurrencies

The cryptocurrency markets are going through an interesting period as recent US data fuels concerns about stagflation. We talked about the economy possibly continuing to contract while inflation remains strong at the beginning of last week. GDP and data from last week strengthen this view. On the other hand, the Fed needs to see more convincing data that inflation is continuing to fall before it can cut interest rates.

Market analyst platform DecenTrader mentioned yesterday in its market assessment that BTC’s recovery was triggered by Bitcoin funding rates turning to a more neutral stance after falling negative last weekend.

“Dropping below $60,000 scared many investors before the price recovery.”

Data from Coinglass confirms this and shows funding rates on exchanges in the neutral zone. When negative, this is considered a signal of decline, and the current situation indicates uncertainty with a neutral funding rate of 0.025 or about 0.5% weekly. Although the downturn seems over, if bulls cannot gain momentum, things might reverse again.

Bitcoin Commentary

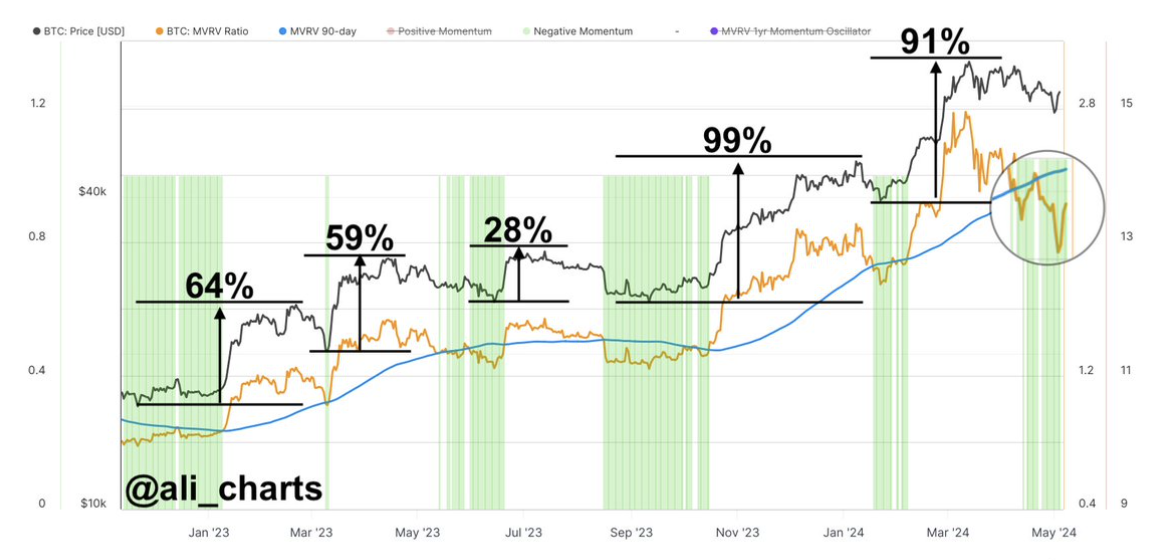

According to renowned cryptocurrency commentator Ali Martinez, there is a strong demand zone between $57,000 and $64,000, and the price could linger in this range for a long time. Martinez pointed out that the recent price drop has brought the MVRV ratio below the 90-day moving average.

“When the MVRV falls below the 90-day average, it signals a buying opportunity. Despite Bitcoin’s recent rise from $57,000 to $64,000, the 90-Day MVRV Rate shows BTC remains in a prime buying zone!”

According to IntoTheBlock, whales have been accumulating strongly with each dip. However, each accumulation period was followed by a price increase shortly thereafter, and whale accumulation is gradually decreasing. This could be interpreted as large investors becoming less eager to buy at the bottom levels.