Recent data for cryptocurrencies was quite significant, and we saw a continued decline in U.S. inflation. The U.S. markets started the day positively. The strong employment data that came on Friday was promising for investors as inflation weakened. So, what direction do the details of the latest report point to?

U.S. Inflation Data

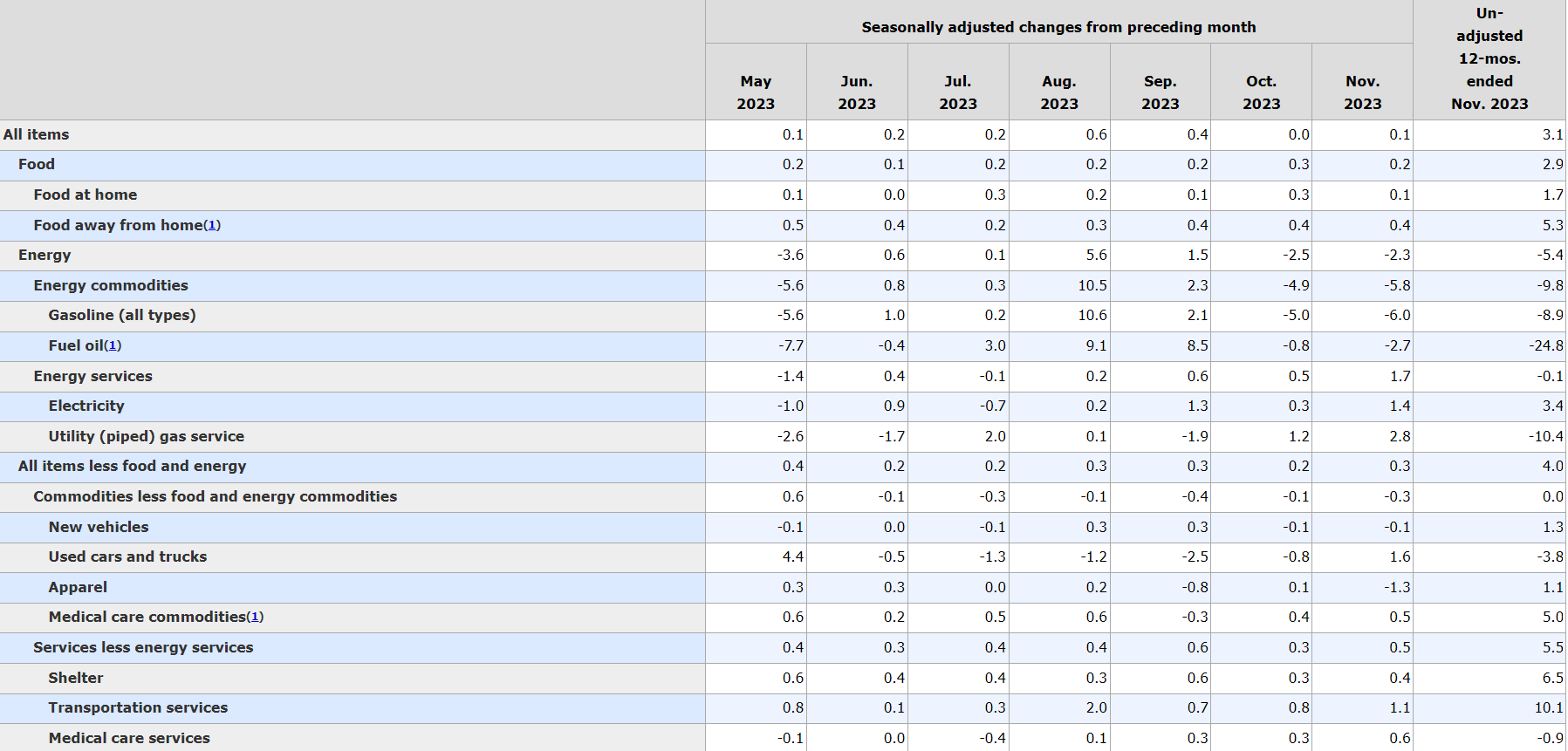

The housing index continued to rise in November, balancing out the decline in the gasoline index. The energy index overall fell by 2.3% over the month due to a 6% loss in gasoline. Considering the ongoing decline in oil prices this month, the current situation is promising for inflation. The food index, which had increased by 0.3% in October, rose by a slower rate of 0.2% in the past month.

The biggest increase last month was in the transportation index, at 1.1%. The largest increase in this category for the year was in August. The table above clearly shows how the decline in energy prices pulled down inflation. The near 25% drop in Fuel Oil eased the unbearable burden of inflation for U.S. citizens.

Treasury Secretary Yellen commented on the issue;

“I see no reason why inflation should not fall to the Fed’s target. There’s no reason to believe the final stretch will be particularly hard.”

December 13th Fed Meeting

Tomorrow’s statements by Fed Chairman Powell will be of critical importance. The strong employment data that came on Friday could balance the expectations met with inflation. Indeed, the Fed will evaluate its assessment as a whole since it has been following the positive data throughout the past month.

However, markets have entered an expectation of more than 100 basis points cut for the coming year. This extreme optimism is something that the Fed does not want and it breaks the effect of the policy. Therefore, Powell should make more cautious statements, closer to a hawkish stance, focusing on any negative data compared to the previous meeting.

In short, we can expect continued pressure on risk markets, including crypto, until the Fed meeting. We may see the Bitcoin price fluctuate with the 3-year interest rate expectation data coming at 22:00 local time. We will likely see downward spikes because it will be observed that the members once again focus on a more cautious rate cut path, undermining excessive optimism.

Fed evenings have been quite exciting for the past 1.5 years, and we are eagerly approaching another Fed evening. The expectation is that interest rates will remain steady and the first cut for the coming year is targeted at the May meeting. At least that’s how the market view is reflected in FedWatch. Goldman, on the other hand, is targeting meetings after June for the first rate cut.