The number of exchange-traded funds (ETFs) providing secure access to cryptocurrencies for institutional investors is expected to increase over time. Currently, BTC and ETH ETFs issued by trillion-dollar asset managers are witnessing billions of dollars in inflows and hundreds of millions in volume. A key question arises: will there be ETFs for altcoins? While attempts for a SOL Coin ETF have faced setbacks, there is a new trend of applications emerging for XRP Coin ETFs.

XRP Coin ETF

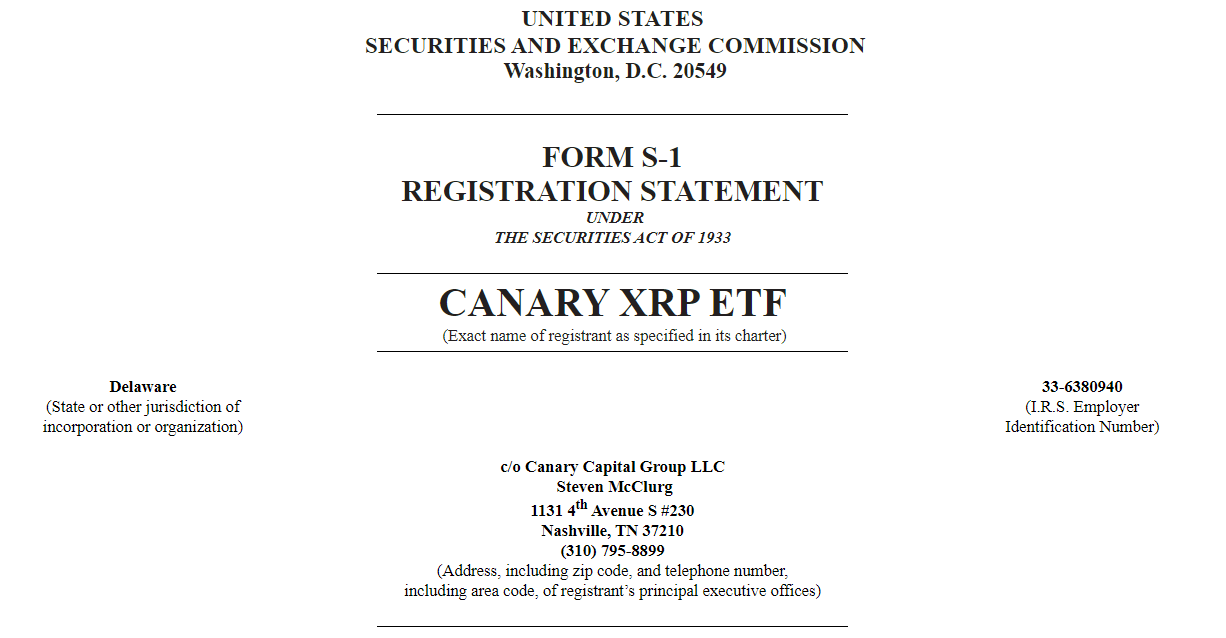

Following the withdrawal of SOL Coin ETF applications, we have recently seen XRP Coin ETF filings from both Bitwise and now Canary. These applications, made while the court proceedings are ongoing, are likely to receive decisions from the SEC before the case concludes, which could extend the appeals process until 2026. The SEC is expected to announce its decision on two XRP ETF applications within the next six months.

Canary Capital Group LLC recently submitted the latest S-1 filing. This ETF will hold XRP Coin in its reserves and, like others, will track the spot price. However, details regarding the ETF’s transfer agent, custodian, and cash management institution are still unclear. Given that Coinbase has previously provided custodial services for other ETFs, it could also play a role in this instance. Many giants, including JPMorgan, have been in line for cash management roles for quite some time.