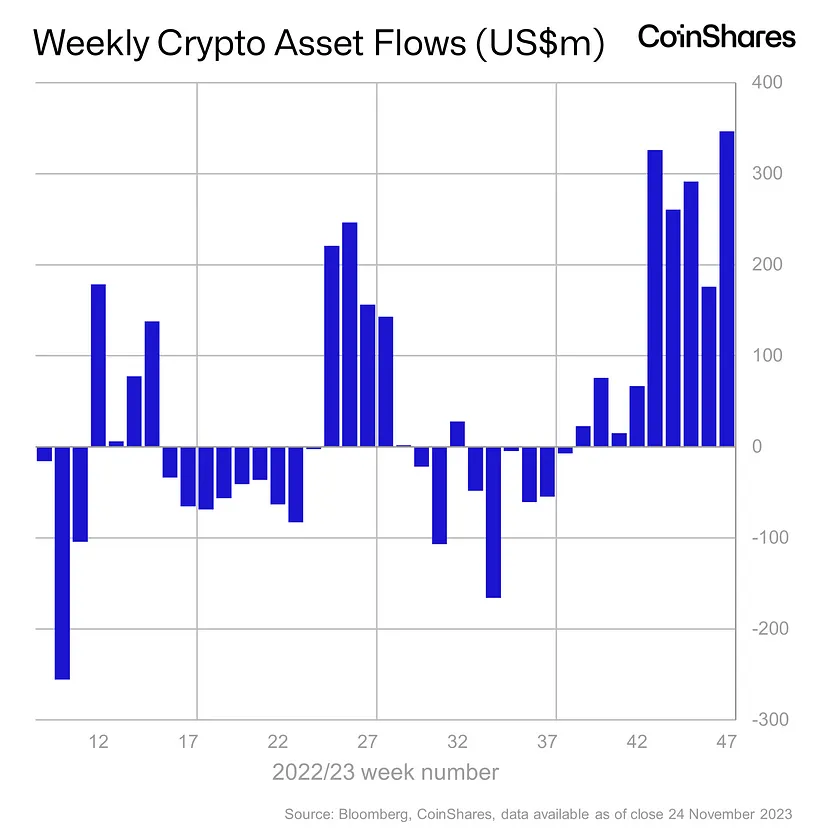

For investors, Mondays are quite significant as the report reflecting the current sentiment is always announced today. The CoinShares report, measuring institutional investors’ demand, tracks BTC and altcoin investment funds. It also provides significant signals to investors curious about the current state of the market.

Institutional Crypto Report

According to the report published a short while ago, there was an inflow of $346 million last week. Institutional crypto funds, which have seen continuous net inflows for 9 weeks, are trying to convince everyone that the recent rise could now be a trend reversal. Investors cannot be convinced that the movement we are in, following months of false rises, is the start of a bull season.

Bitcoin inflows were $312 million, and the total inflow for 2023 surpassed $1.5 billion. Ethereum saw an inflow of $34 million last week, with a 4-week total reaching $103 million. The report states:

“This inflow, encouraged by the anticipation of a spot-based ETF launch in the US, was the largest inflow since the bull market at the end of 2021. The combination of price increases and inflows has raised the total assets under management (AuM) to $45.3 billion, the highest level in the last 1.5 years. Regionally, Canada and Germany constituted 87% of the total inflows, while there was only a $30 million inflow from the US last week. Those waiting for ETF approval for entry might have fallen behind.”

Solana inflows slowed down and dropped to $3.5 million. DOT and LINK saw inflows under $1 million.