Record levels of investment inflows have been observed in US-based spot Bitcoin  $91,967 and Ethereum

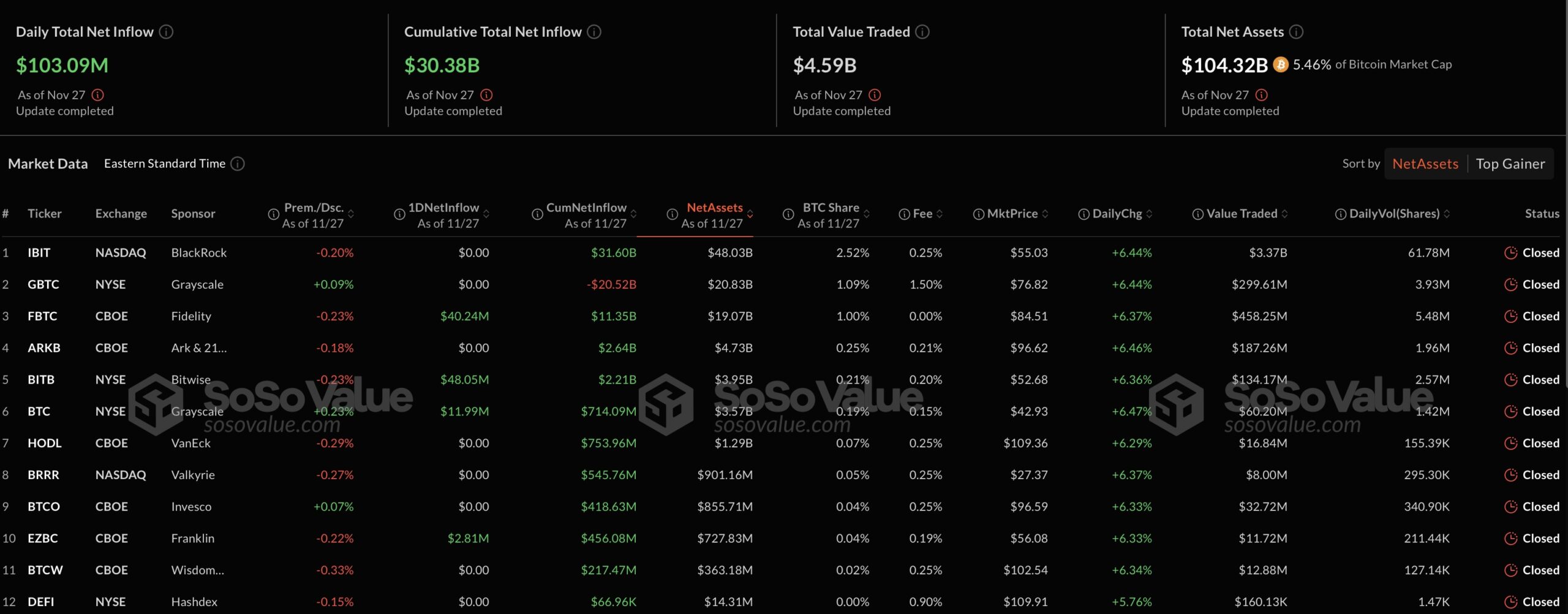

$91,967 and Ethereum  $3,139 ETFs. As of November 27, a total of 1,119 BTC, equivalent to approximately 103 million dollars, were recorded as net inflows into spot Bitcoin ETFs. Spot Ethereum ETFs also attracted significant attention on the same day with net inflows of 90.1 million dollars, which are believed to be driving the price increase of Ethereum’s main network asset, ETH.

$3,139 ETFs. As of November 27, a total of 1,119 BTC, equivalent to approximately 103 million dollars, were recorded as net inflows into spot Bitcoin ETFs. Spot Ethereum ETFs also attracted significant attention on the same day with net inflows of 90.1 million dollars, which are believed to be driving the price increase of Ethereum’s main network asset, ETH.

Confidence in Spot Bitcoin ETFs Remains High

On November 27, there were no outflows from spot Bitcoin ETFs, and a total of 103 million dollars’ worth of BTC inflows were reported. This indicates that investor confidence in spot Bitcoin ETFs is steadily increasing. The perception of Bitcoin as a long-term store of value is considered the main reason for this confidence.

Significant inflows also occurred in spot Ethereum ETFs during this period. Among the net inflows, Fidelity’s ETF led the way with 38 million dollars, followed closely by Grayscale’s ETF with 37.3 million dollars. VanEck’s ETF saw an inflow of 13.2 million dollars, while Bitwise’s ETF recorded an inflow of 1.6 million dollars.

Four Consecutive Days of Inflows into Spot Ethereum ETFs

Interest in spot Ethereum ETFs has continued uninterrupted for four days. During this period, total inflows have surpassed 220 million dollars. The intense interest in the king of altcoins’ ETFs supports Ethereum’s market value and contributes to price increases as well.

Experts suggest that this strong demand for spot Ethereum ETFs indicates a belief in the future potential of the king of altcoins. Increased inflows could further solidify Ethereum’s position in financial markets.

The substantial interest in both Bitcoin and Ethereum ETFs signals a deepening integration of the cryptocurrency market with traditional investment vehicles. This trend suggests that ETF products will play a broader role in the markets moving forward.