Telegram met with its investors, and BANANA is observing a sentiment shift after the recent recovery, which may lead to accumulation among investors. However, investors are not very excited as they continue their bearish trends. BANANA’s price is in the green, indicating a slight change in market sentiment.

What’s Happening with BANANA?

During this period, the Market Value to Realized Value (MVRV) ratio is also showing bullish signals. The MVRV ratio evaluates investor profit and loss, and currently, BANANA’s 30-day MVRV data is at -13%, indicating potential selling pressure. Historically, the popular token‘s MVRV data between -15% and -30% has signaled the start of upward trends and marked it as an accumulation opportunity zone. BANANA is just above this line, which could trigger accumulation.

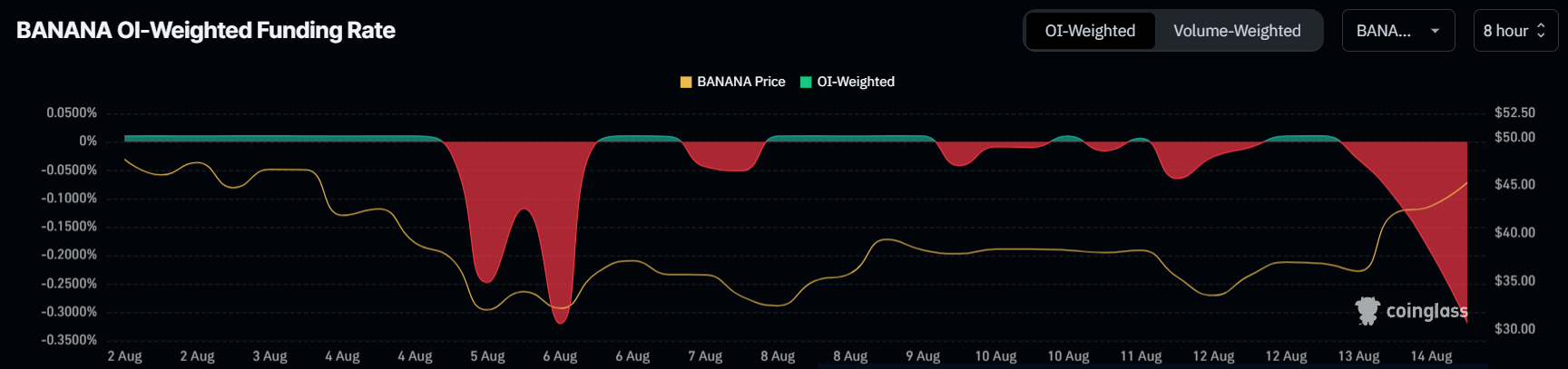

However, BANANA’s funding rate currently shows a strong downward trend, reflecting widespread skepticism among investors. This negative sentiment followed the recent selling pressure, leading to a cautious outlook and decreased confidence in the asset.

The ongoing downward trend in the funding rate indicates that investors are hesitant and actively placing short contracts in the market. Therefore, until there is a notable change in investor confidence, the asset may continue to face downward pressure.

BANANA Chart Analysis

Trading at $45, BANANA price nearly surpassed the $47 resistance intraday before slightly dropping. In the last three days, the Telegram token recorded a 35% increase, filling the market with more bullish optimism. If the $47 resistance is secured as a support base, BANANA price could rise to $55, as BANANA previously consolidated between $47 and $55, where the upward trend might halt.

However, if the breach completely fails, BANANA price will fall back to $40 and move sideways until stronger bullish signals emerge. Additionally, losing the $40 support will completely invalidate the bullish thesis.