Recent data from November 26, 2024, reveals significant trends in the flow of spot Bitcoin  $95,195 and Ethereum

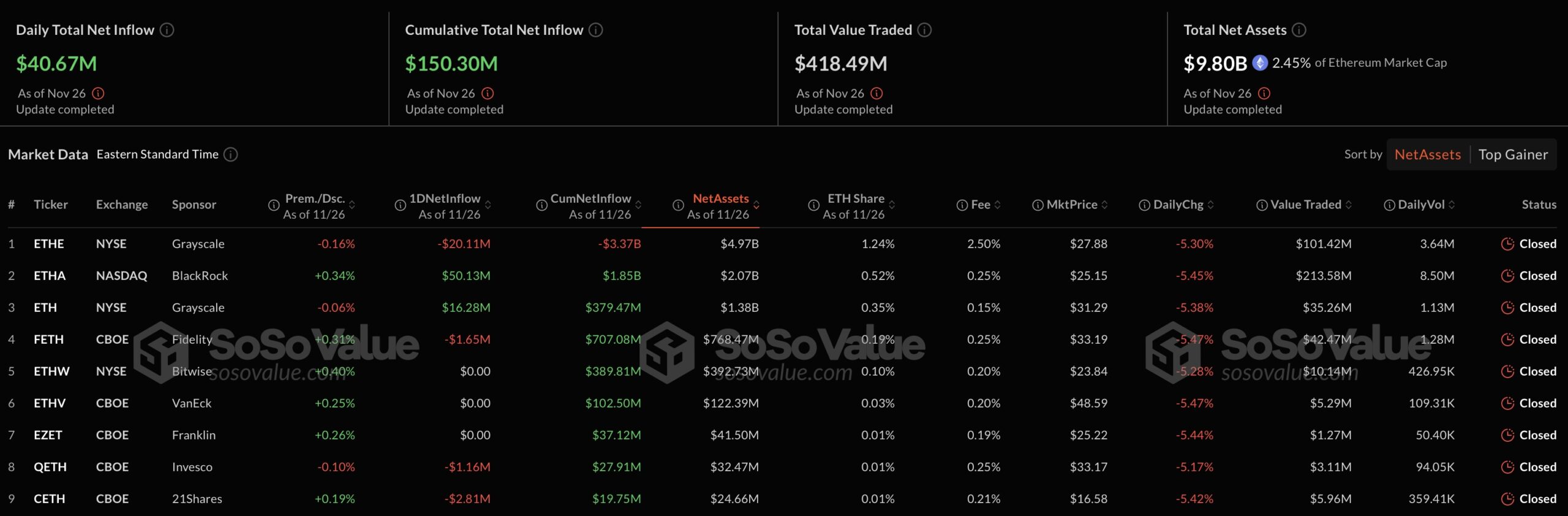

$95,195 and Ethereum  $3,334 ETFs in the United States. The data indicates a net outflow of 122 million dollars from spot Bitcoin ETFs, while spot Ethereum ETFs experienced a net inflow of 40 million dollars. Most of the outflows from Bitcoin are attributed to Fidelity, whereas BlackRock’s involvement was notable in the Ethereum inflows, suggesting a growing interest in Ethereum.

$3,334 ETFs in the United States. The data indicates a net outflow of 122 million dollars from spot Bitcoin ETFs, while spot Ethereum ETFs experienced a net inflow of 40 million dollars. Most of the outflows from Bitcoin are attributed to Fidelity, whereas BlackRock’s involvement was notable in the Ethereum inflows, suggesting a growing interest in Ethereum.

Fidelity’s Bitcoin ETF Outflow Continues

The total outflow of 122 million dollars from spot Bitcoin ETFs has led to sustained selling pressure in the market. Fidelity alone accounted for 95 million dollars of this outflow. In contrast, BlackRock reported a net zero flow in spot Bitcoin ETFs.

Overall, the data indicates that investors are largely risk-averse regarding spot Bitcoin ETFs. However, the latest figures suggest a slight easing of selling pressure compared to November 25. Investors are closely monitoring the impact of funds with significant outflows, though it is evident that other major funds have not balanced this situation.

BlackRock’s Strong Contribution to Spot Ethereum ETFs

In contrast, a more positive outlook characterizes the Ethereum side of ETFs. Spot Ethereum ETFs recorded a net inflow of 40 million dollars, with BlackRock contributing 50 million dollars to this figure. However, a 20 million dollar outflow from Grayscale’s Ethereum ETF slightly offset this total.

BlackRock’s interest in its Ethereum ETF is viewed as a development that boosts investor confidence. This trend may indicate a relatively stable situation in the Ethereum market. Experts suggest that inflows could create a somewhat positive perception in the markets.

Markets continue to closely monitor the effects of ETF movements. While there are ongoing significant outflows in Bitcoin, the inflows in Ethereum are regarded as a balancing factor in market sentiment. Whether Fidelity will persist with aggressive Bitcoin outflows and if investors will maintain their commitment to BlackRock’s Ethereum ETF may determine the market’s trajectory in the coming days.