Bitcoin (BTC), with expectations of $30,000, suddenly plunged below $28,000, actually taking the market in the opposite direction. This sharp drop in the BTC price has managed to affect all cryptocurrencies. But the real fall for BTC may not have started or ended yet!

The Risk for BTC Price Has Begun

Renowned cryptocurrency analyst DonAlt has actually recently released his own commentary on BTC price. DonAlt recalled that the symmetrical triangle pattern was broken to the downside and discussed the risks of breaking it again to the downside. The analyst admitted that he predicted a drop to $ 22,000 for BTC. Now, it is seen that another possible scenario has emerged that supports this prediction of the analyst.

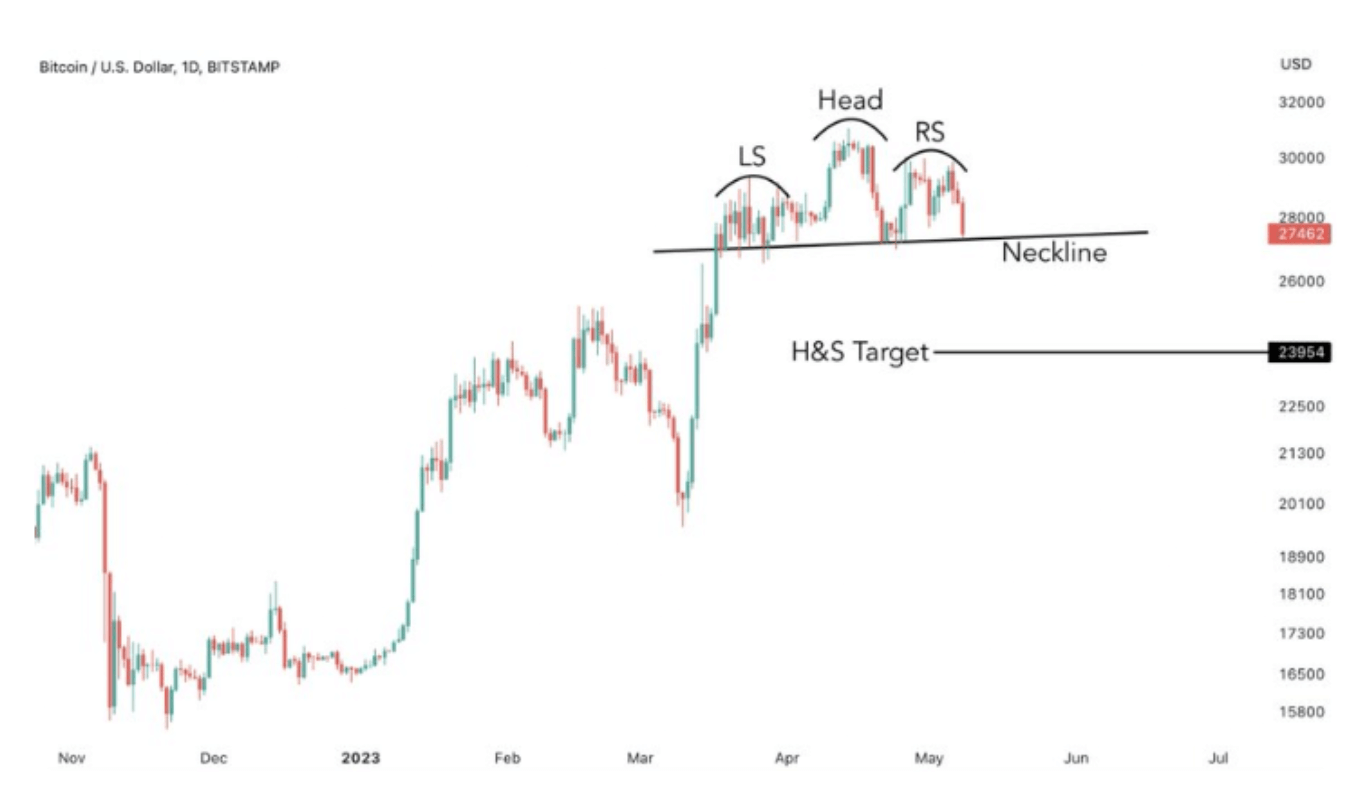

A look at the Bitcoin chart shows that in early April, the “left shoulder” pattern made itself known. Towards the end of April, it can be seen that the middle of the head and shoulders pattern, i.e. the “head” part, is reached, and in early May, the “right shoulder” pattern is in place. Popular analyst Game of Trades also warned investors in a tweet. After stating that BTC could move in favor of the bears by crushing the bulls, the analyst emphasized that the target is now $ 24,000.

Risk Zone in BTC Price

In addition to the above chart and pattern, the analyst stated that BTC could fall further from here. The MACD indicator, which was cited as a reason for this, caused the analyst to point to the $ 22,000 region below $ 24,000. The famous name also sees a decrease in social media searches and interest in general.

The technical aspect certainly doesn’t seem to be the only problem for BTC. Experienced analysts such as Mike McGlone have also stated that gold may be preferred over BTC against the threat of a looming recession. McGlone has made a name for himself with his successful macro and micro forecasts before. The risk of recession, which will start in the US and may even start, may affect the whole world and digital markets. Many analysts have stated that the critical point for BTC is $ 22,000 and the wait has begun.