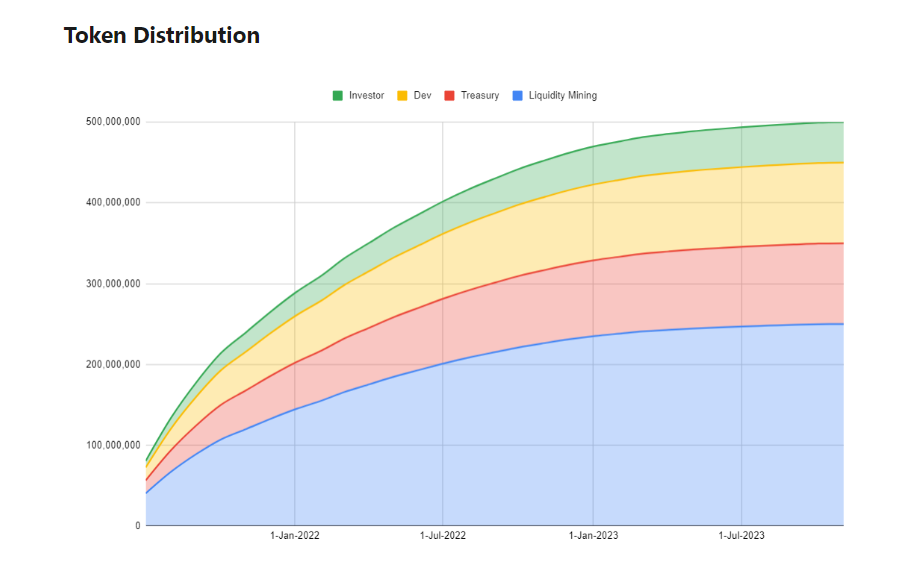

The popular DeFi protocol of the Avalanche ecosystem has made an important announcement a few minutes ago. According to the announcement, the maximum supply has been reached. While the ongoing trademark dispute with a famous US supermarket chain continues, the Trader JOE team announced that the token supply has reached 500 million and will remain at this level. So what does this mean?

JOE Coin News

The largest native DeFi platform of the Avalanche ecosystem is back in the spotlight. In their latest announcement, they stated that they have reached a maximum supply of 500 million tokens and will no longer mint new tokens. This is extremely good news for an altcoin because as demand increases, the price will not be suppressed by new supply. With increasing demand and a fixed supply, it is expected that the price will rise.

The JOE team emphasized that this is a strategic milestone and said the following:

“With Trader Joe reaching a total supply of 500 million tokens, an important milestone has been achieved. In line with our planned tokenomic strategy, no more JOE tokens will be minted. This new phase of Trader Joe is now being highlighted with solid stability and preparing the platform for its next evolution.

Due to an unforeseen error that occurred when JOE emission rate was set to zero, a contract containing approximately 10 million treasury allocated tokens was permanently locked in a contract and burned. Although this change was unplanned, it has not affected the operational capacity or financial health of the solid and well-capitalized treasury.”

JOE Coin Future

So what’s next? First of all, there won’t be any major changes. The team will continue to work on product development and protocol growth with the tokens allocated to them. If the promised developments are delivered, the JOE Coin price may increase further with the support of the limited supply.

The price ended its rally early as it couldn’t achieve daily closes above $0.43 in the middle of this month. Although it dropped to $0.33 during BTC fluctuations, it is currently continuing its rebound. If the $0.4 level is reclaimed, the rally can continue to $0.43 and $0.48. To see a long-term price increase, it is necessary for the $0.48 level to turn into support. In that case, the $0.71 peak can be targeted again.

On the other hand, daily closes below $0.33 have the potential to drop to $0.265.