Addresses in Layer 1 networks have exhibited a different model over the last 30 days. Considering the overall number of addresses in the networks, what is the trend of active addresses?

Strong Performance from Ethereum

IntoTheBlock recently highlighted the number of addresses in six leading Layer 1 (L1) networks. The data showed that Ethereum led the pack with approximately 103 million addresses in the last 30 days. Ethereum was followed by Bitcoin with about 51 million addresses.

Litecoin and Avalanche took the third and fourth places with 7.7 million and 6.3 million addresses, respectively. Dogecoin and Cardano completed the top six with approximately 5.3 million and 4.4 million addresses, respectively. According to the IntoTheBlock chart, Ethereum was at the top with the highest number of addresses in the last 30 days, while Bitcoin took the second spot. The analysis of active addresses in both networks on Santiment showed different patterns.

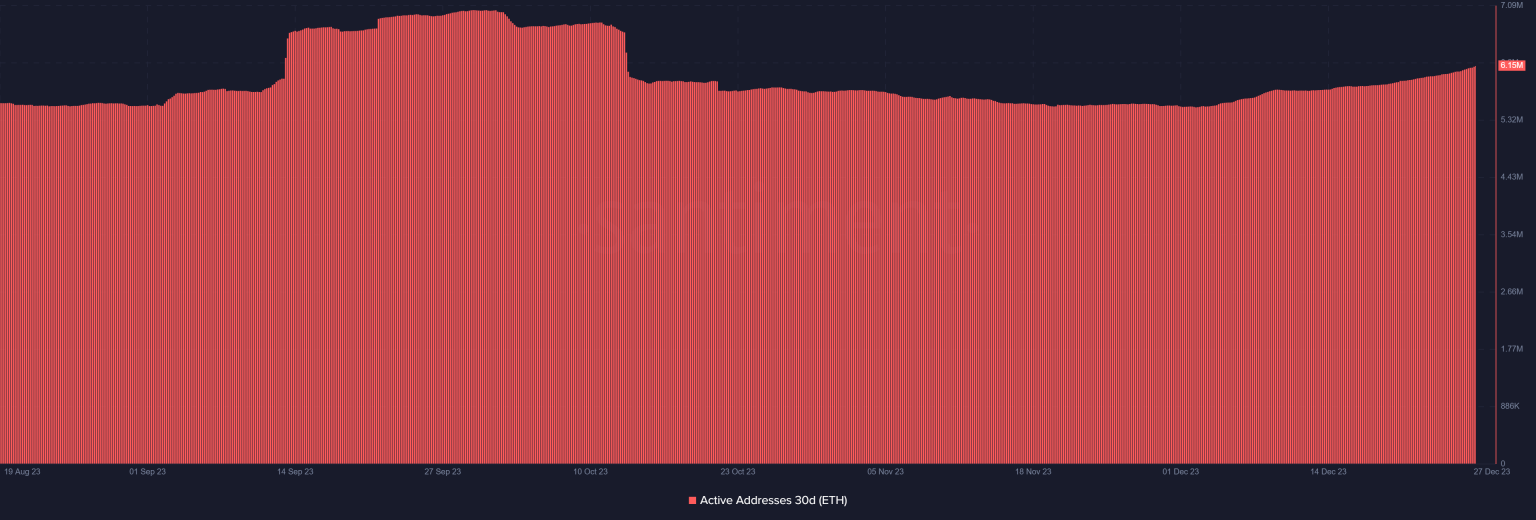

In the case of Ethereum, the analysis indicated a consistent increase in active addresses over the last 30 days. As of November 28, the number of active addresses was around 5.6 million. There was a notable increase at least twice a week, resulting in an addition of 10,000 active addresses. At the time of writing, the network’s active addresses had risen to approximately 6.1 million.

In contrast, Bitcoin displayed a different trend with more daily active addresses but a downward trend. The chart showed a clear downward movement indicating a decrease in active addresses.

Change in Bitcoin Address Numbers

On November 28, the number of addresses in the Bitcoin network was around 20 million. However, the latest data revealed that active addresses had dropped to approximately 17 million. An examination of the recent price trends of Bitcoin and Ethereum showed similar patterns in the last 48 hours. Ethereum observed a drop of over 1.7% in the daily time frame chart on December 26, trading around $2,231. At the time of writing, it had experienced another slight drop of less than 1%, falling to approximately $2,221.

Similarly, Bitcoin experienced a 2.67% drop on December 26, reaching a trading value of around $42,583. As of this writing, the downward trend continued, albeit less than 1%, trading at around $42,360.