As the 12th largest cryptocurrency by market cap and the 11th largest altcoin, Litecoin (LTC) has managed to increase its value by over 30% since the start of the year. However, one on-chain metric suggests that LTC is still trading at discounted prices.

Litecoin at a Discount According to Z-Score

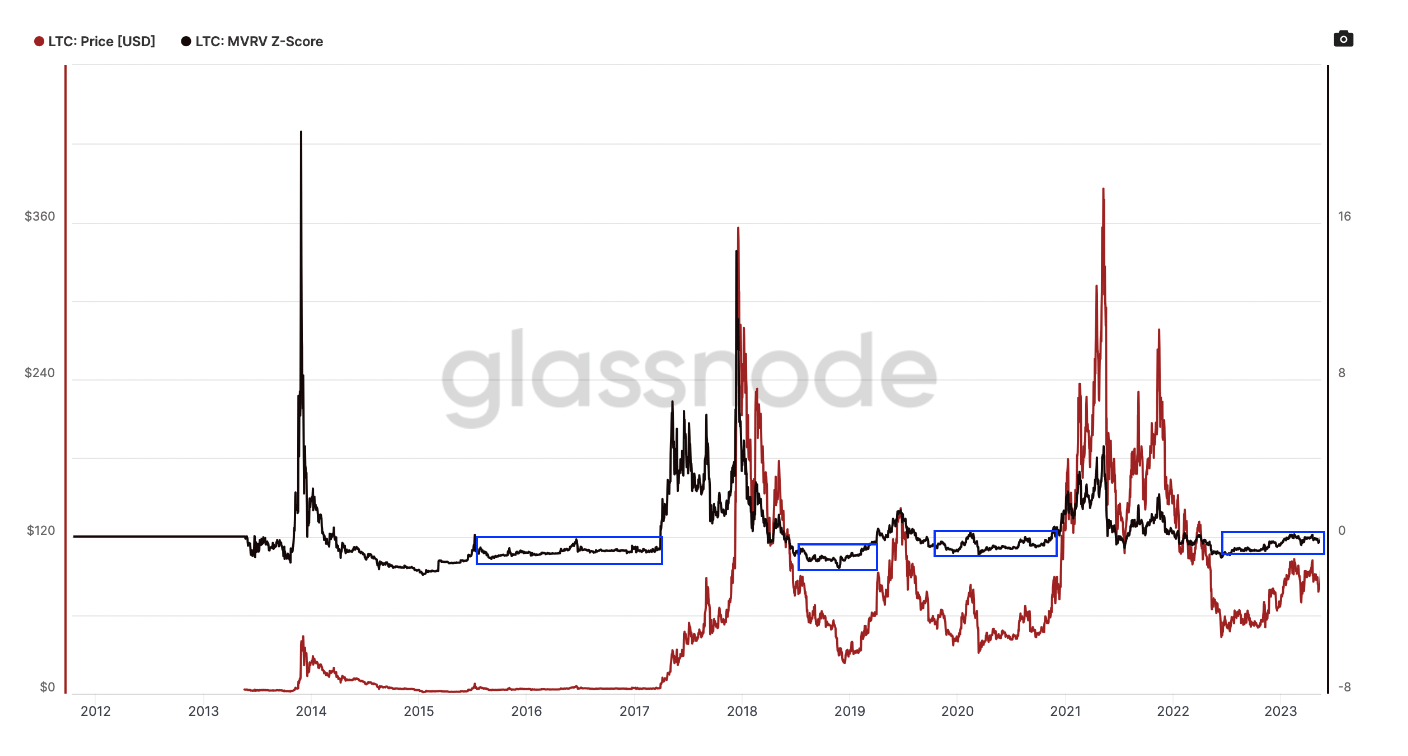

The Z-score, indicating the ratio of Litecoin‘s market value to realized value, has fallen into negative territory. According to crypto data platform Glassnode, this negative value suggests that the altcoin is trading below its expected price level.

Market value is calculated by multiplying the total number of coins in circulation by Litecoin’s market price. Realized value is a variant of market value, calculated by adding the market price at the last movement of coins on the Blockchain. It excludes all coins that have fallen out of circulation (more than 15%) and is said to reflect the network’s real or fair value. The Z-score shows how many standard deviations the market value is different from the realized value.

Historical data suggests that a Z-score above eight indicates overvaluation and peak price levels, while negative values suggest undervaluation and bottom price levels.

In the past, the Z-score indicator has several times dropped below zero, accumulated, and subsequently followed by strong bull runs. Considering historical data as a guide, the path of least resistance for the price seems to be upwards. However, Litecoin and the rest of the crypto market continue to be vulnerable to negative macroeconomic developments, such as central banks tightening liquidity and the condition of the global economy.

At the time of writing this article, LTC is trading at $91.44, with a 1.95% drop in the last 24 hours and reaching a high of $95 during the week. The data shows that the 11th largest altcoin has increased its value by 31% since the start of the year.

Towards Litecoin’s Block Reward Halving

The Litecoin network is expected to undergo its third block reward halving in early August. After the third block reward halving, the amount of LTC given as a reward to Litecoin miners for each block mined will be reduced from 12.5 LTC to 6.25 LTC.

Block reward halvings positively impact the price as they reduce the supply, assuming the demand for the asset remains constant.