Murray Roos, the capital markets chief of London Stock Exchange Group (LSEG), reiterated in an interview with the Financial Times that the LSEG has plans to develop a blockchain-supported trading center.

Improving the Trading Process of Traditional Assets

Murray Roos, the capital markets chief of LSEG, stated in an interview with a British media organization that he asked London Stock Exchange CEO Julia Hoggett to lead the project. Roos also mentioned that the company has been researching the potential of blockchain technology but explicitly stated that the exchange group has not built anything that supports cryptocurrencies.

Roos added, “The idea here is to create a more convenient, smoother, cheaper, and transparent process using digital technology and to regulate it,” emphasizing that the initiative aims to improve the trading process of traditional assets.

Tokenization of Assets

LSEG is far from being the only traditional financial market operator researching the potential uses of blockchain technology. Larry Fink, the CEO of the world’s largest asset management company, BlackRock, stated in a letter sent to shareholders in March that tokenizing asset classes could enhance efficiency in capital markets, shorten value chains, and improve cost and access for investors.

In a report published in July, the Bank for International Settlements (BIS) stated that tokenizing demand for real-world assets could be a way for traditional finance and crypto to work together. BIS also added that this could result in the growth of cryptocurrencies themselves by channeling new money into such tokenized assets.

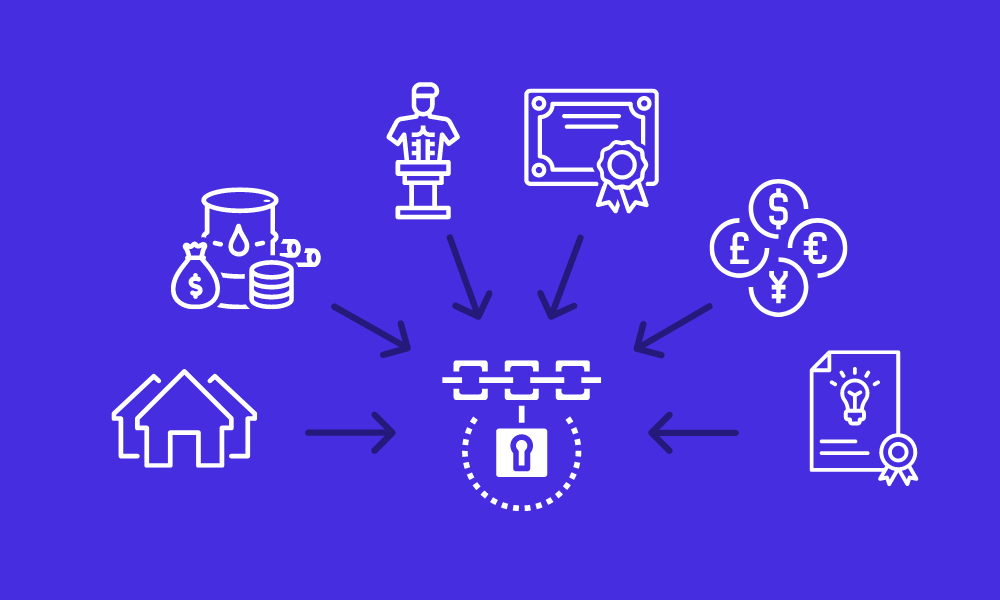

Asset tokenization is the process of converting physical or financial assets into digital tokens on blockchain or other distributed ledger technologies. This allows for a digital representation of traditional asset classes such as real estate, stocks, bonds, artworks, precious metals, making ownership and transfer of these assets easier and more efficient. Asset tokenization involves the following key steps:

- Asset Selection: A tokenization project selects the asset to be tokenized. This can be real estate, artwork, company shares, or anything else.

- Representation of Ownership Rights: The asset is represented by a digital token. This token represents ownership rights of the asset and can be transferred by its owners.

- Smart Contracts: Typically, these tokens are combined with smart contracts to manage ownership, rental income, or other conditions of the asset. This can enable automatic payments or changes in ownership.

- Regulations and Compliance: Asset tokenization projects must comply with existing financial regulations and legal requirements. This requires project owners to collaborate with authorities and act responsibly towards regulators.

Asset tokenization has several advantages. Tokenizing assets can provide greater access to these assets for more investors and individuals. Tokenizing an asset allows it to be divided into smaller fractions and enables smaller investments. Blockchain-based tokens can accelerate transactions and reduce costs. However, asset tokenization may also face legal and regulatory challenges, and tokenizing certain assets can be more complex.