MakerDAO (MKR), popularly known as the decentralized central bank, has been making waves in the past few months with carefully orchestrated trading moves. The lending protocol, which effectively controls the supply and demand dynamics of the stablecoin offering DAI, has attracted users to its platform. As expected, the native utility token MKR has been one of the biggest beneficiaries.

Developer Activity in MKR!

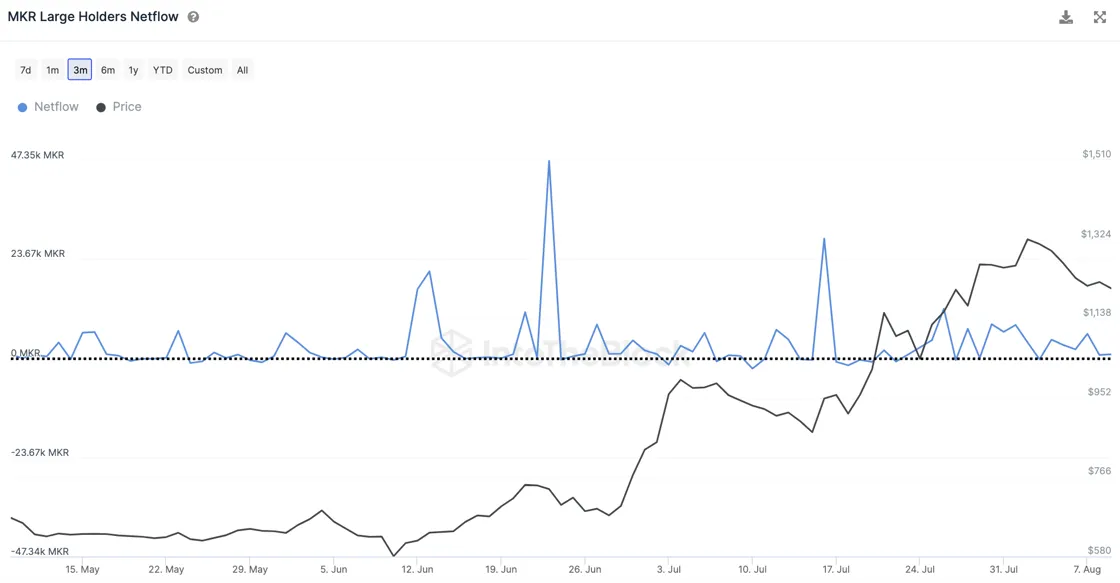

According to data from the on-chain research firm IntoTheBlock, MKR has nearly doubled its value in the past three months, making it one of the best-performing cryptocurrencies in the market recently. At the time of writing, MKR is trading at $1,228, surpassing a market cap of $1 billion. The data also revealed significant inflows into the wallets of large investors, indicating an increasing appetite for MKR.

This price increase has prompted investors to liquidate their holdings for profits. As a result, the supply of MKR sent to exchanges has steadily increased in the past two months, while the illiquid supply has decreased. MakerDAO’s efforts to increase the demand for DAI form the foundation of MKR’s growth. But then the question arises: what is the value MKR derives from the adoption of DAI?

The Current State of MKR!

MakerDAO offers lending services through the crypto collateralized stablecoin DAI. Users lock their crypto assets in smart contracts called Collateralized Debt Positions (CDPs) and receive new DAI tokens in return for the collateral. Similar to traditional banks, Maker also charges an interest called stability fee, which users have to repay when they withdraw their locked collateral. This is where the utility of MKR comes into play.

The stability fee can only be paid with MKR tokens, which are then destroyed and taken out of circulation. This effectively means that if DAI adoption and demand increase, the demand for MKR may also increase. Furthermore, this situation significantly contributes to the growth of MKR. Now that the connection between the two ecosystem tokens is clearly understood, it is important to analyze the main event that supported DAI last week.