On August 5th, the market faced a seasonal low, following price drops from the previous week. During this period, many cryptocurrencies, including Dogecoin (DOGE), experienced noticeable declines. DOGE’s price fell to as low as $0.083 during this drop. Although there was a subsequent price rise, investors still seem skeptical about the sustainability of the price recovery.

Dogecoin Current Status

According to data provided by Santiment, Dogecoin’s recent price decline caused its Market Value to Realized Value (MVRV) Z-Score to fall into the negative region. The MVRV Z-Score is used to determine whether a cryptocurrency is undervalued or overvalued compared to its fair price.

In a positive scenario, long-term investors tend to earn more profits compared to short-term investors. This is generally interpreted as a sign of a potential bull market. Conversely, a negative value indicates that short-term holders are taking advantage of the situation, suggesting a potential bear market.

It is worth remembering that this scenario was last seen in February before the incredible market rallies. Before this, it was observed in October 2023, when the current bull market began, and in June 2022, when the bear market was clearly felt.

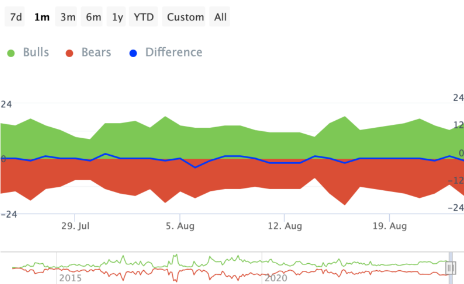

As of the time of writing, DOGE’s MVRV Z-Score has fallen into the negative region, indicating that Dogecoin meets one of the potential requirements for another rise. On the other hand, data provided by IntoTheBlock showed that the Bulls and Bears indicator was moving in line with the mentioned MVRV value.

On-chain data reveals that bulls are more dominant than bears. If this trend continues, a significant increase in Dogecoin’s price could be seen in the near future.

Will DOGE Rise?

Looking at the weekly price chart, Dogecoin is approaching a breakout in a descending triangle formation. Generally, if the asset falls below its support level, the trend is seen as bearish. However, for DOGE, this scenario also suggests the possibility of a move above the 78.6 Fibonacci retracement level.

The 78.6 Fib level is known for reflecting potential price values before reaching the main target. Looking at the above chart, DOGE’s price could reach $0.16 in the mid-term. If a successful upward breakout occurs, DOGE’s price could reach $0.22. However, if the trend reverses and the breakout is downward, DOGE could fall back to $0.049.

Türkçe

Türkçe Español

Español