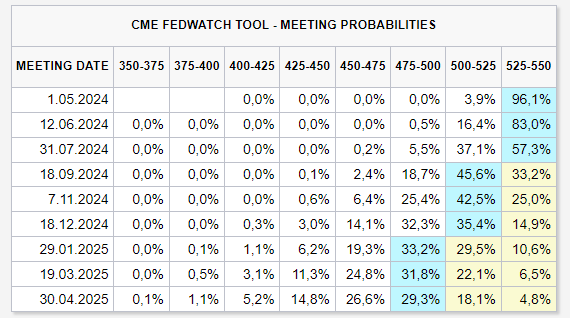

Risk markets have significantly fluctuated following the recent geopolitical tensions, and the risks are not yet mitigated. This week, aside from the intensified tremors, concerns about the Fed policy have also strengthened following the latest three-month inflation data. The expectation for an interest rate cut has been postponed until the meeting on September 18.

Fed Report and Markets

A few weeks ago, we shared analysts’ views that the Fed might not cut interest rates this year due to ten significant reasons. These views were shared before the March inflation data had arrived. Experts monitoring ten different leading indicators supporting inflation were talking about signals that the decrease in inflation had reversed.

Today’s Financial Stability Report also mentions that the uncertainty regarding Fed policy has now reached an even more concerning point. This situation could position the Fed to make an interest rate cut at the upcoming meeting, even if the annual inflation target is not met. In a negative scenario, however, the Fed might use this pressure as an opportunity to further stoke negativity and talk about raising interest rates by another 25 basis points. However, if a tightened monetary policy with credit tightening still fails to restrain inflation, the US economy could suffer serious damage, especially with such rapid borrowing continuing.

Key parts of the report are as follows;

“About two-thirds of the participants have mentioned policy uncertainty as a risk, and this rate is significantly higher than in the October report. Persistent inflation and tighter monetary policy continue to be the most cited potential risks to the financial system. Stress in commercial real estate and the banking sector is mentioned less frequently as a stability risk compared to the Fed’s fall 2023 survey. Increased geopolitical tensions and the upcoming US elections, including policy uncertainty, are mentioned by 60% of participants as a potential financial stability risk. Leverage in hedge funds has reached the highest level since data collection began. Of the over 9,000 eligible institutions, 1,804 benefited from the bank term funding program; 95% of them had assets under $10 billion.”

Türkçe

Türkçe Español

Español