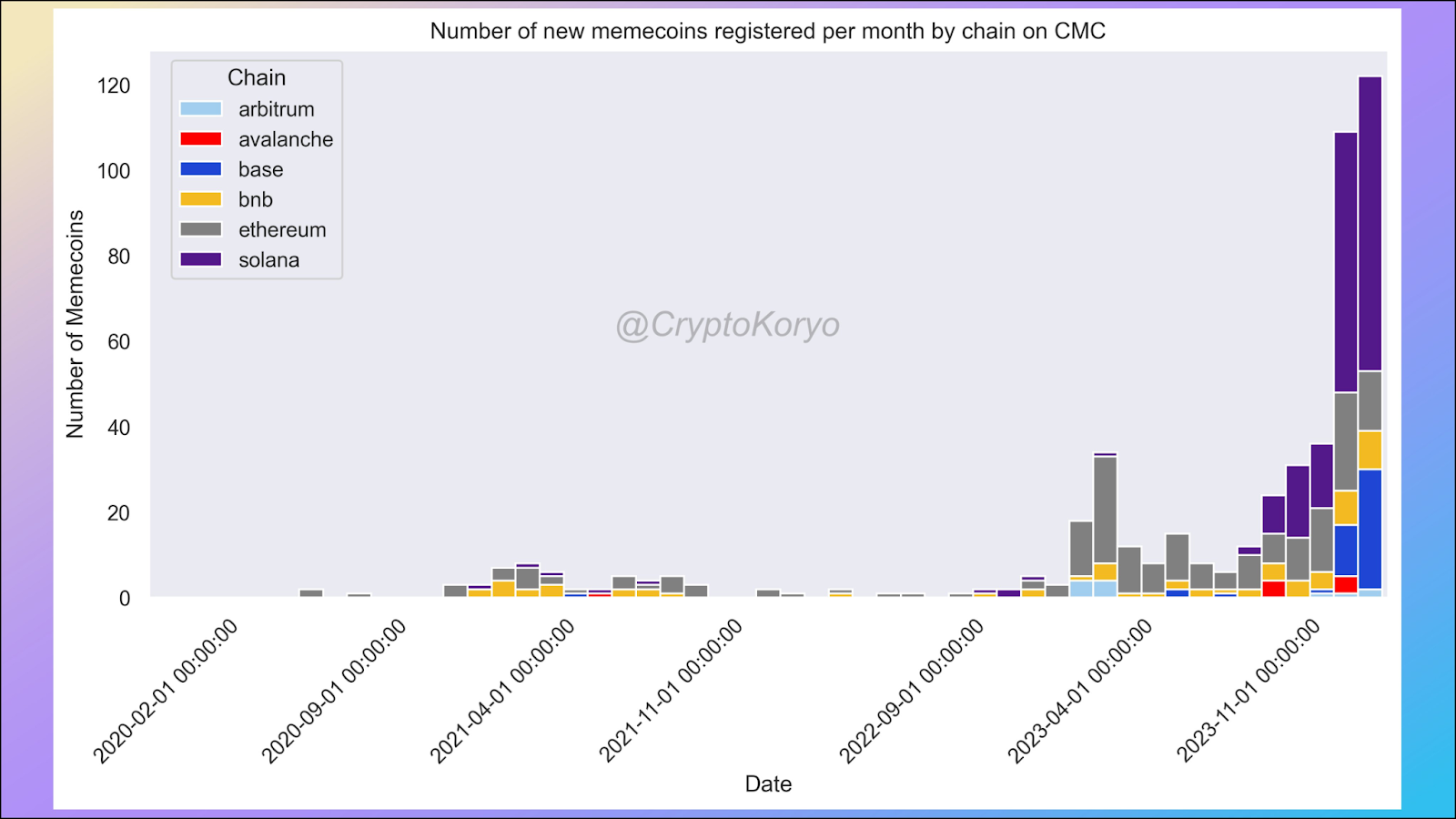

The cryptocurrency market has significantly changed since the 2020-2021 bull market, which saw significant gains for popular memecoin projects like Dogecoin, Shiba Inu, and FLOKI. Crypto Koryo, a data scientist with extensive experience in this field, explained how the memecoin market has developed and stated that investing in these assets now potentially involves high risks with low returns.

What’s Happening in the Memecoin Space?

In the past, memecoin projects benefited from a large influx of individual investments and limited competition. However, the barriers to creating new memecoin projects have decreased, leading to rapid market saturation. Crypto Koryo commented:

“Back then, distributing an ERC-20 token wasn’t something the average Joe could easily do, but today anyone can do it.”

Last month, 138 new memecoin projects were registered on CoinMarketCap; in April 2023, this number was only 18. This influx has reduced the individual potential returns of these altcoins and additionally spread the competition across various blockchain platforms; even the Bitcoin ecosystem now hosts memecoin projects.

A Warning to Investors from a Prominent Figure

Investing in these projects requires navigating a volatile market with many options. Crypto Koryo explained that an investor needs to seriously diversify their portfolio, otherwise, their assets could zero out:

“Considering that the majority of these new memecoin projects will go to zero, if you want to play this game, you need a lot of diversification. If there’s little diversification, your portfolio could drop to zero at any moment.”

Moreover, the shift from a developer-driven market to an investor-driven market means that the supply and demand dynamics have fundamentally changed. In 2021, demand significantly outpaced supply, but now the situation has reversed, creating a market where supply exceeds demand. In this process, although they can still offer significant returns, the chances of success are much lower and the risks are quite high. For most ordinary investors, the complexities and efforts required to remain profitable are daunting. Crypto Koryo concludes:

“Undoubtedly, among the thousands of memecoins launched every year, only a few will achieve good returns. The question is: How does this compare to holding Bitcoin or some kind of bluechip?”

Türkçe

Türkçe Español

Español