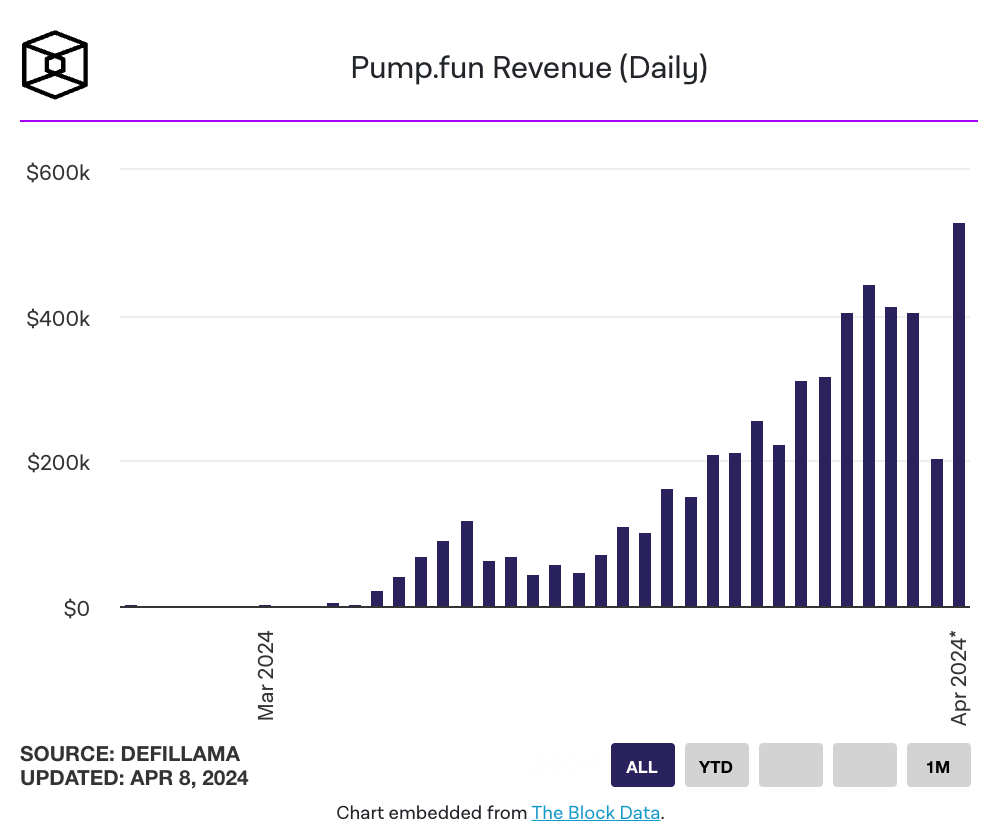

According to data from the blockchain data analysis platform The Block Data Dashboard, a new memecoin launch and trade platform called Pump fun has generated revenue of $5.2 million in the last 38 days, including $528,000 from transactions processed just yesterday. The platform was initially launched for memecoin projects within the Solana ecosystem.

A New Platform in the Memecoin Market

In January, support for memecoin projects on the Solana network was added, followed by support in February for the Ethereum Layer-2 network Blast. The platform has attracted significant interest from the crypto community by allowing investors to create and launch a new token that can be bought and sold instantly with less than $2 of liquidity in under a minute. Pump claims to prevent rugpull scams by ensuring the security of crypto assets created on the platform. The project emphasizes that each token on the platform goes through a fair launch process without any presale or team allocation.

Project teams simply select a name, ticker, and JPG image, and can immediately start trading on a bonding curve. Users can choose a token and buy assets through the bonding curve, selling them whenever they wish. The bonding curve is a mathematical curve that determines the price of a token based on its supply, and the price typically increases as more tokens are purchased.

When a sufficient number of users purchase the token and its market value reaches $69,000, $12,000 in liquidity is invested and burned at the Solana decentralized exchange Raydium. In the Blast ecosystem, the market value requirement is $420,000, and above that, $30,000 in liquidity is invested in the Thruster DEX.

Noteworthy Details of the Process

BaoBaoSol became the first token to transition from the bonding curve to a liquidity pool on Raydium, and users created tokens with any name in the hope of gaining traction. A user named Sato commented on the matter:

“So far, I have launched 182 pumpdotfun tokens. About 37 of them managed to enter Raydium. I’ve only made $642,000. It’s not as easy as people think.”

Pump, says it offers an alternative to the current token launches, which typically follow one of two paths: either directly distribute a token and create liquidity on a DEX like Raydium, then renounce token minting rights and lock or burn the liquidity provider tokens, or conduct a presale where participants send money to an address without any immediate return.

This process can lead to high costs, including expensive setup fees and the need for significant liquidity seeding. It also introduces complexity and risk due to the susceptibility of presales to fraud and the need for advanced tools to track actions like renouncing token minting rights.