NFT Investor Hanwe Chang allegedly deceived a bot, unaware of his ownership of Azuki NFT, and won 800 Ethereum (ETH). It is claimed that the NFT investor offered an inflated bid for several similar Azuki NFTs held in an anonymous wallet.

A bot associated with the Elizab.eth address copied the offer accepted by Chang’s secret wallet. This transaction earned Chang 800 ETH, which is approximately worth $1.5 million. Elizab.eth also offered a 10% reward if Chang returns the assets.

NFT Market and Legal Regulations

Lawyer Gabriel Shapiro argued that elizab.eth could legally reclaim the assets with the help of an authorized attorney. He emphasized that the case is more complex than it appears on Twitter.

Security firm PeckShield announced that NFT thefts decreased by 31% from the previous month, totaling $1.7 million in July.

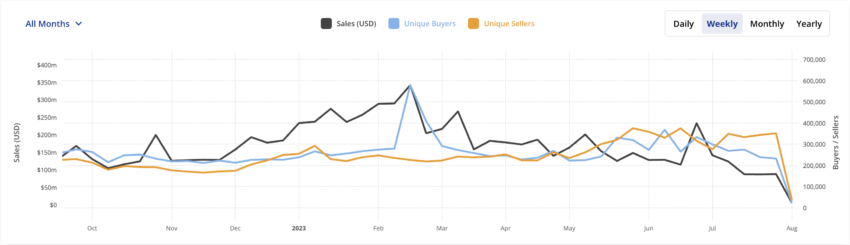

NFT is a digitally minted title deed on blockchain ecosystems used to determine ownership of digital or physical assets. Sales volumes in the booming NFT market declined by 38% between July 3rd and July 31st as investors evaluated long-term strategies.

Reshaping NFT Ownership Models

Most global regulators have yet to establish clear rules for NFTs, excluding income taxation.

The Crypto Asset Markets in Europe bill, considered one of the most advanced regimes in crypto regulation, has not created new laws specifically for NFTs. The UK Law Commission recently proposed recognizing crypto assets as personal property.

Typically, a developer codes an NFT according to a specific token standard and provides owners with a link to access the item on the server. Like cryptocurrencies, NFTs can be stored as tokens in a blockchain user’s crypto wallet. Therefore, legal regulations should also consider NFTs as personal property.

In an interview, Michael Sanders from Horizon Blockchain Games stated that blockchain ecosystems will soon enable complete ownership transfers of crypto assets among Web3 players. This way, anticipated regulatory measures can enter the crypto market more swiftly.