Blockchain data analytics platform Nansen has caught the attention of NFT investors with its latest announcement. According to the data provided by the platform, there has been a steady increase in Ethereum volume in NFT sales on a weekly basis. Nansen revealed in a post on X that NFT sales reached a level of 29,704 Ethereum in the week ending on October 9.

What’s Happening in the NFT Market?

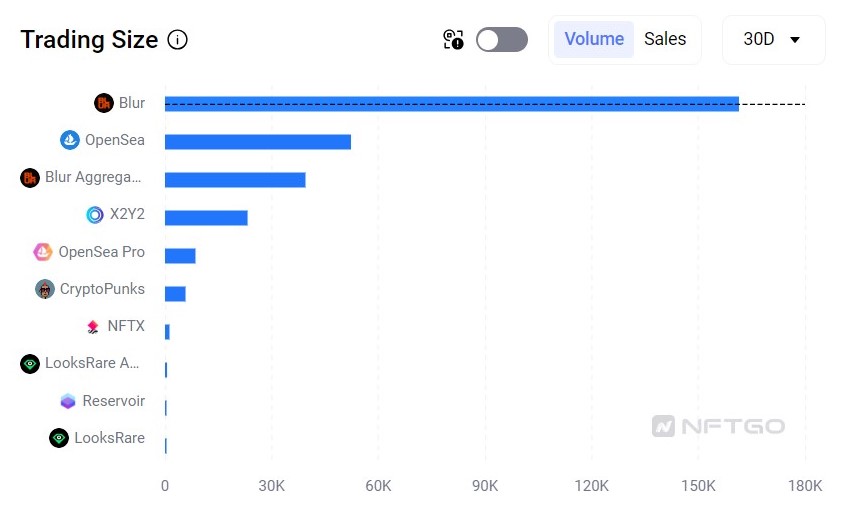

The volume value mentioned in the announcement by Nansen is approximately worth $56 million. The sales volume in the NFT market experienced a weekly increase and reached 68,342 Ethereum with a value of over $129 million. When looking at the market shares in NFT transaction volume, Blur, the leading NFT marketplace in terms of volume, ranked first in the past 30 days.

According to data analysis platform NFTGo, Blur had a transaction volume of approximately $305 million, equivalent to 161,433 Ethereum, in the past 30 days. Moreover, its competitor OpenSea, with a transaction volume of around $100 million, equivalent to 52,307 Ethereum, came in second place.

Increase in NFT Investor Numbers

Looking at the transaction volume from the perspective of NFT collections, Bored Ape Yacht Club (BAYC) had the highest transaction volume in the past 30 days. The BAYC collection obtained a volume of 35,226 Ethereum, worth $66.7 million. It was followed by Mutant Ape Yacht Club with 14,947 Ethereum and The Captainz with 9,948 Ethereum. CryptoPunks continues to be the top collection in terms of market value, but it only had a transaction volume of 5,773 Ethereum in the past 30 days.

In addition to these developments, data obtained by NFTGo showed a 12% increase in the number of NFT investors in the past seven days. The number of NFT buyer addresses was 22,804, while sellers remained at 27,308 during the same time period. Furthermore, the number of wallets holding NFTs is still around 6 million.

The increase in transaction volume for the NFT market occurred amidst ongoing decline news. On November 3, as OpenSea, the NFT marketplace, prepared to release its second update, the company laid off half of its staff.