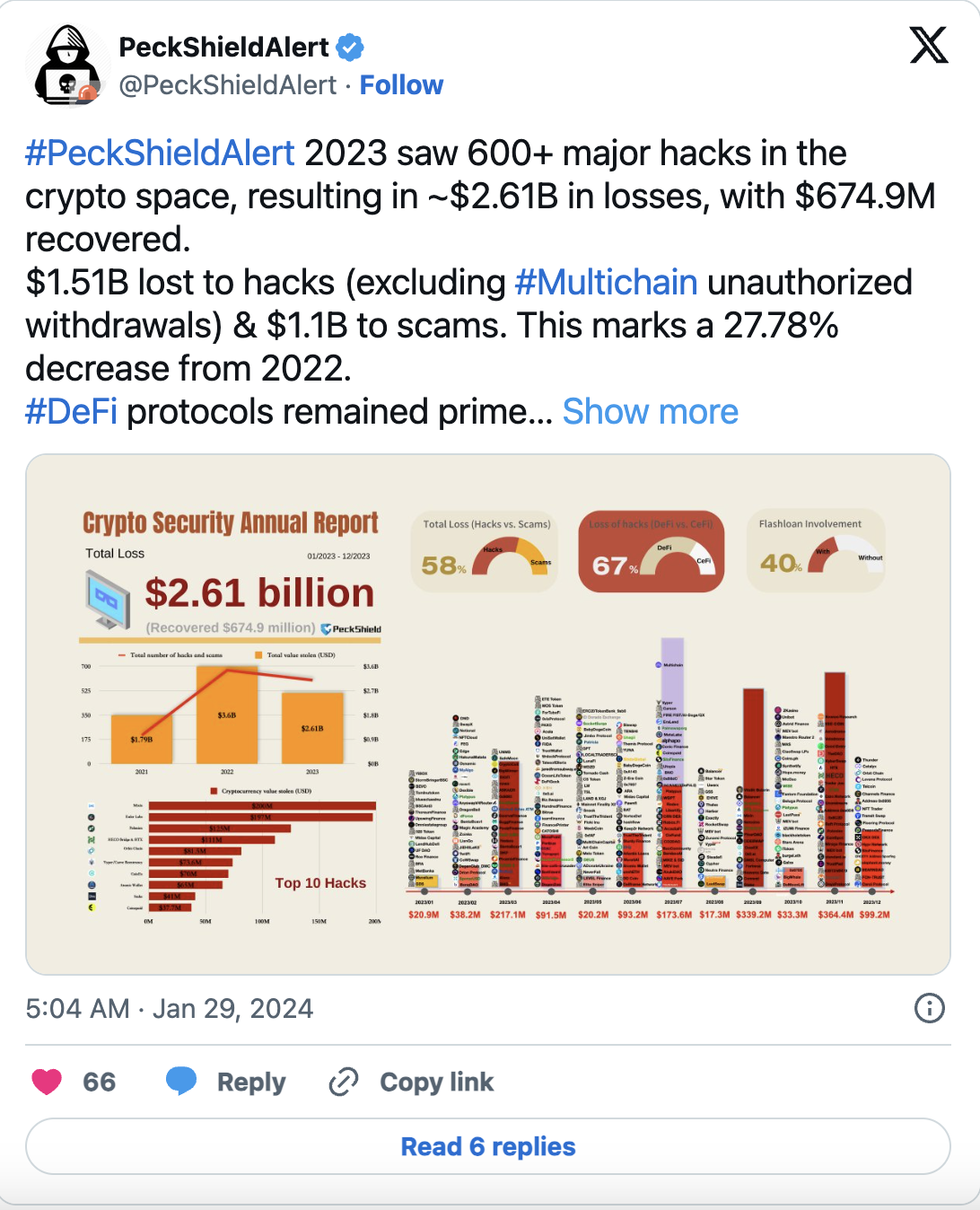

Blockchain security firm PeckShield released data summarizing losses due to hacks and scams in 2023. According to the company, excluding multi-chain loss attacks, $2.61 billion was lost throughout the year. PeckShield pointed out in its report dated January 29 that this amount represents a 27.78% decrease compared to the total global cyber attacks of approximately $3.6 billion in 2022.

PeckShield Team’s Report for the Year 2023

The blockchain security firm also emphasized that of the more than 600 large-scale attacks they monitored, over $674 million was recovered, which corresponds to 25% of the stolen cryptocurrency. The PeckShield team noted in their statement that the recovered amount represents a significant increase compared to only $133 million recovered from hacks in 2022. According to the security team, the recovery of funds resulted from more active negotiations with hackers and the rise of bug bounty programs:

“Engaging in active negotiations with hackers can facilitate the return of stolen funds. Implementing bug bounty programs to detect hackers and vulnerabilities in the system or conducting surveillance on the chain can enhance security.”

PeckShield also stated that collaborating with centralized exchanges, Tether, and law enforcement to freeze assets when they are detected can also aid in the recovery of funds. In addition to the amount recovered from hack attacks, PeckShield highlighted various data points including the volume difference between flash loan attacks, decentralized finance (DeFi), and hacks and scams. The data shows that flash loan attacks accounted for 40% of the hacks that occurred in 2023.

Noteworthy Developments in the Crypto Space

In addition to these developments, while some analysts claim that improvements in DeFi security have led to a decrease in the amount of crypto stolen in 2023, the PeckShield team emphasized that the DeFi space continues to be a primary target for attacks and scams. On January 4, CertiK co-founder Ronghui Gu stated in an interview that there was a positive development in blockchain security in 2023. The executive highlighted the growth of reward platforms and proactive security measures as a good sign for the year.

Nevertheless, PeckShield emphasized that 67% of the losses experienced in 2023 occurred in DeFi, while 33% occurred in the centralized finance space. It also underlined that 58% of the losses were due to hacks, while 42% were due to scams.

Malicious actors are also diversifying the crypto areas they target for their activities. From 2018 to 2021, Bitcoin dominated the trade volume for illegal transactions. However, things changed as stablecoin projects began to take a larger share of the illegal transaction volume in 2022 and 2023.