The popularity of Polkadot (DOT) Coin has increased significantly in 2021, but its price performance in the past two years has not met expectations. What about the future? DOT Coin has failed to deliver the expected strong performance. When it rose amidst speculation that it had reached an agreement with the SEC at the beginning of this year, most investors were unaware that the story was actually written at the end of November. Since the truth emerged, the price has not experienced a significant recovery.

Polkadot (DOT) Coin

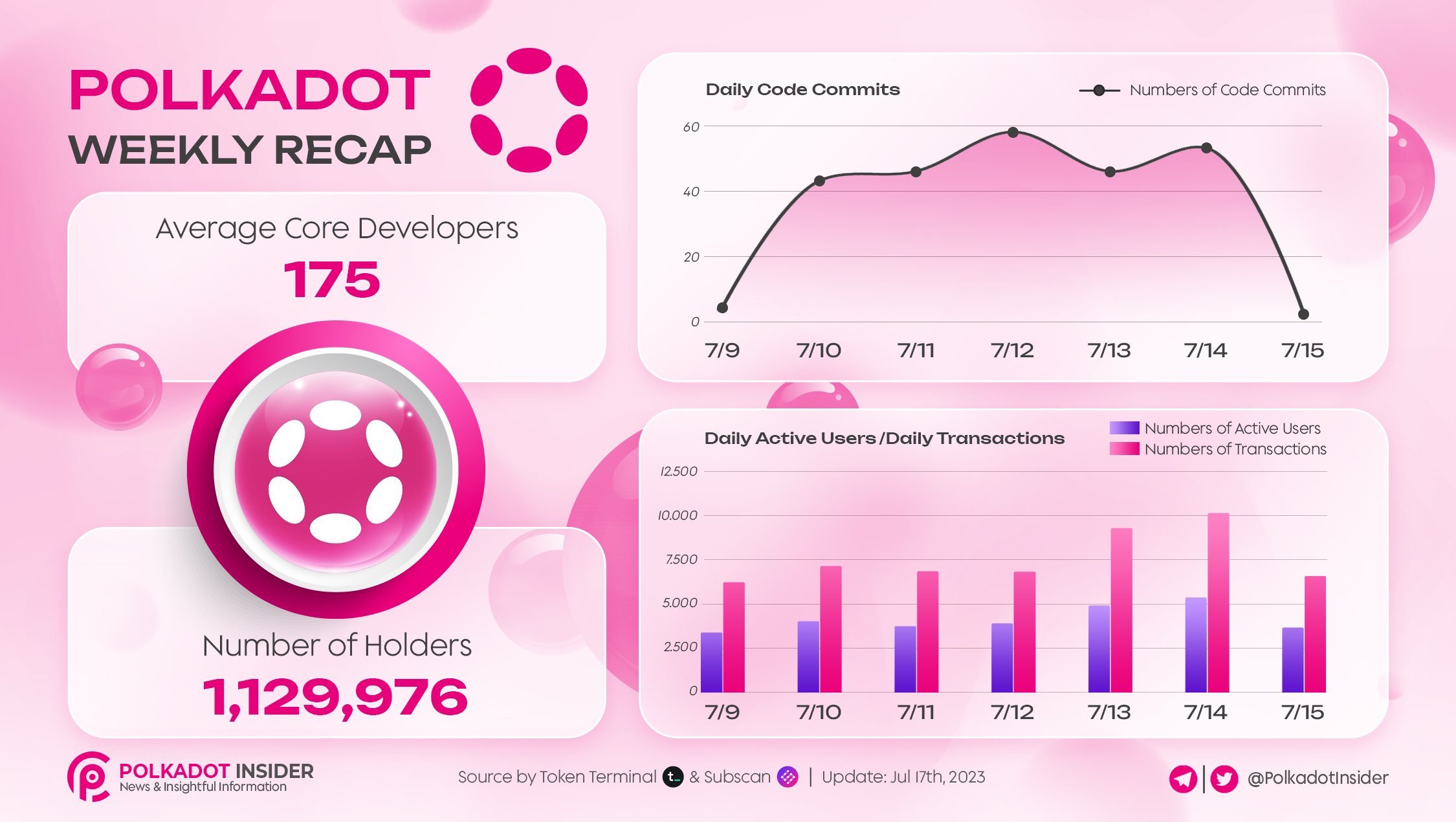

Polkadot continues to maintain its high developer activity. According to Polkadot Insider’s recent announcement, the increase in developer activity can be attributed to various factors. Increased developer activity is a factor that can potentially drive up the price of projects like Polkadot in the medium term. The announcement today included the following details:

So, how much will the increase in developer activity contribute to the price? Let’s take a look at the price predictions and details in the second part.

DOT Coin Analysis

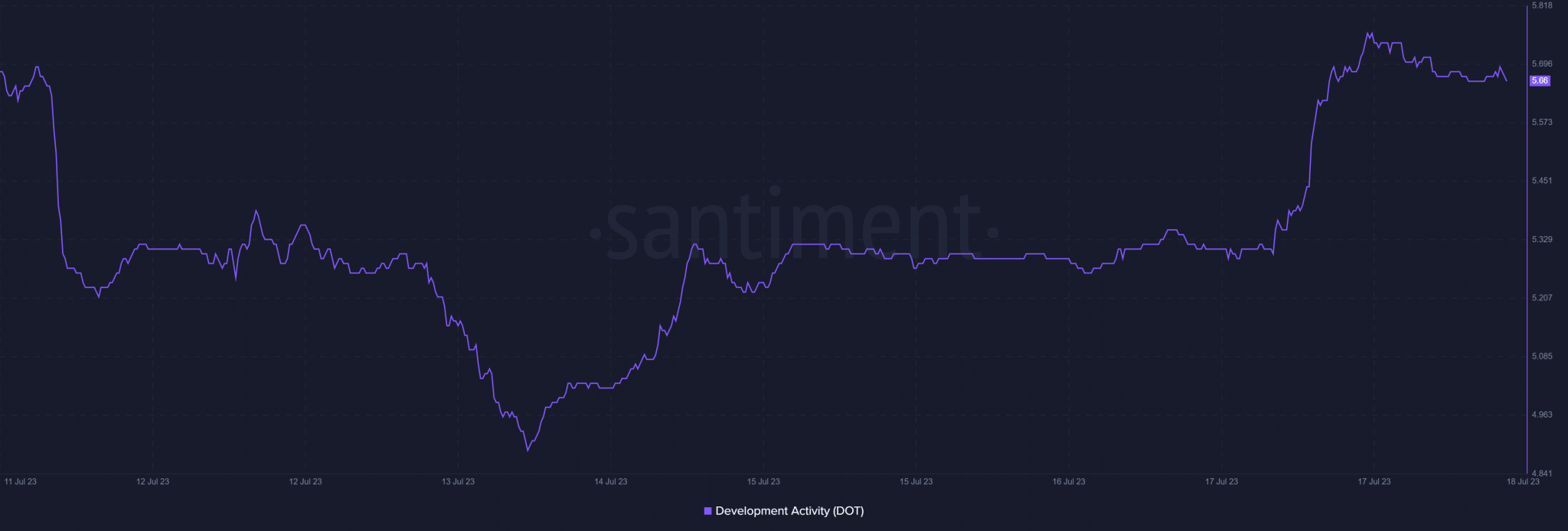

Not only the increase in developer activity, but also the value of the network has been on the rise for months. However, despite the active ecosystem, the token’s price has experienced a decline. Polkadot Insider’s weekly report highlighted the high number of code commitments made by DOT last week. This is also a point emphasized by Santiment. The increase in metrics indicates that developers are striving to improve the network.

In addition to the increase in developer activity, the value of Polkadot as an ecosystem has also increased, as evidenced by the increase in TVL in recent months. Polkadot has also laid the groundwork for this growth with several important integrations and launches. The relaunch of Unique Network’s NFT Marketplace has provided early access to some NFT tools for product/content creators in this field.

While the developments in Polkadot’s ecosystem are promising, the same cannot be said for the token’s price movement. According to CoinMarketCap, DOT’s price has fallen by over 3% in the last 24 hours. Looking at the daily chart of DOT, it appears that market indicators could remain in a downward trend. For example, the MACD indicates that the downward trend will continue. The RSI also highlights the possibility of further losses in the price of DOT Coin.

While increased developer activity may benefit DOT Coin investors in the long run, it does not seem to be generating short-term gains. Especially with the Federal Reserve meeting approaching in about a week, we may see larger losses in the altcoin group, including DOT Coin.