Polkadot recently introduced several new proposals with the potential to change the way blockchain operates. One of the most notable is Referendum 335. Despite the market’s downward trend, the token’s price charts have managed to stay on an upward trajectory.

Critical Developments in DOT

As of its current position, Polkadot is in the process of approving several new proposals that could have a greater impact on the future of blockchain. The first of these is Referendum 335. The proposal targets a new auction schedule for Polkadot for the year 2024 and is currently approved by 98.1%. The proposal also highlights the option to cancel the remaining auctions. Another proposal is Referendum 340, which suggests opening an HRMP channel between Asset Hub and Polimec. This proposal was also accepted with over 99% of the positive votes at the time of writing. The company made the following statements regarding the matter:

Opening a channel between Asset Hub and Polimec is very important because the projects that want to raise funds on Polimec will do so with stablecoins (USDT or USDC) or other tokens as determined by the fundraising project.

DOT On-Chain Data

Although these proposals may not have a direct impact on the price, they play a significant role in increasing market sentiment, which in turn affects the token’s price. According to analyses, despite many proposals being in the voting stage, DOT‘s overall popularity decreased last week, as evidenced by the decline in social volume. Following the sudden surge on December 9, 2023, the weighted sentiment recorded a sharp decline, along with a rise in negative sentiment about the token.

However, it was interesting to see that the weekly price chart remained on an upward trajectory despite the drop in the token’s popularity. According to CoinMarketCap, DOT showed an increase of more than 22% in the last seven days at the time of writing. It was trading at $6.89 and had a market value of over $8.6 billion.

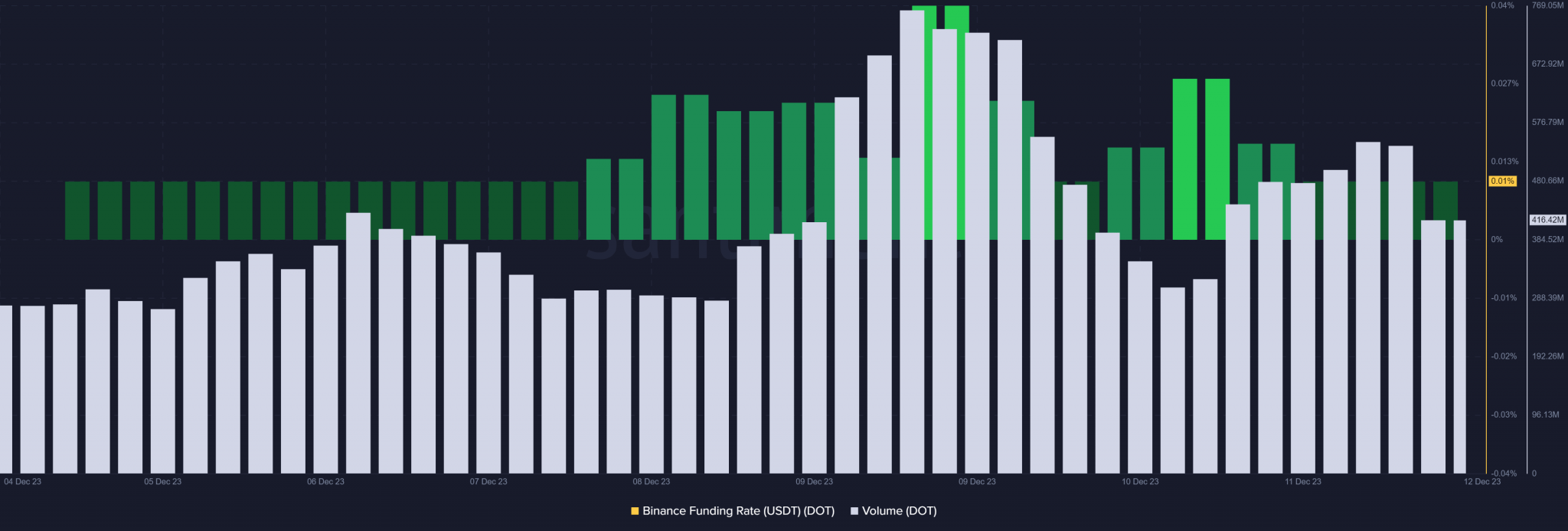

Additionally, investor interest in trading DOT was high last week due to the volume remaining high. Demand for DOT in the derivatives market was also high, which can be seen from the rising Binance funding rate.