Polkadot stands out as a Blockchain platform designed for interoperability among different Blockchains. However, the challenges of balancing user growth with network activity are an issue investors should consider when making long-term assessments. The DOT price has experienced a correction, retreating to the $8.42 level.

What Do the Latest Data Say About Polkadot?

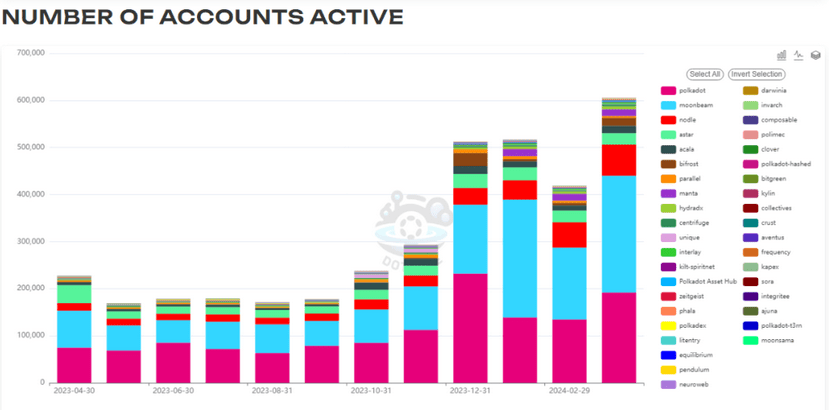

According to recent data, the DOT token reached an all-time high in March in terms of active wallets and unique accounts, surpassing 600,000 and 5.59 million, respectively. This indicates growing interest in the platform, along with the evolving developer ecosystem in parachains, which are specialized Blockchains connected to Polkadot’s main chain. Notably, a leading parachain called Moonbeam contributed to the highest number of active addresses, with approximately 250,000.

However, despite this increase, there is no significant rise in the number of transactions on the Polkadot network. Although there has been a slight increase in transactions compared to February, the current transaction volume is still well below the peak recorded in December.

This inconsistency causes concern among investors and experts about how actively they are participating in the network. The tendency of users to hold or stake DOT tokens instead of using them for transactions on the platform poses a significant question mark for the growth of the network and the increase in transaction volume.

Polkadot’s Price Seeks Stability After Recent Decline

Amid fluctuations in the cryptocurrency market, Polkadot’s native token DOT’s price has fallen below $9. It now appears to be stabilizing around $8.40.

This could indicate a period of consolidation following the drop from previous highs above $11. While price increases are often seen as a positive sign, they need to be evaluated alongside actual network usage. Polkadot’s current situation creates a paradox. The platform continues to attract new users, but these users need to become active network participants.

This could be due to various factors. Perhaps users are waiting for the creation of a specific application or service on Polkadot before actively participating. Technical limitations could also be hindering user activity. Whatever the reason, the level to which DOT has dropped may be seen as a buying opportunity for investors.