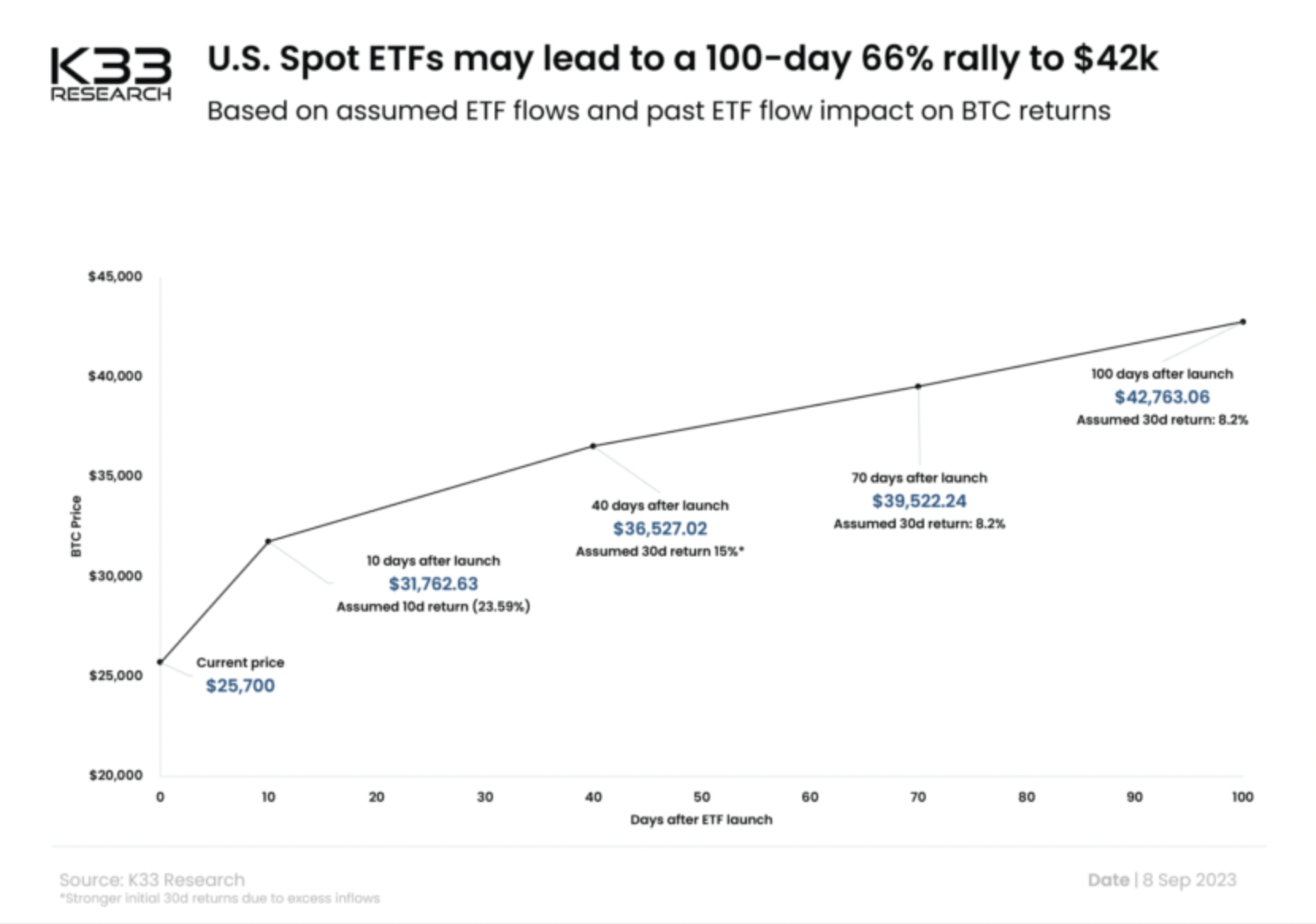

Crypto research firm K33 Research published a report yesterday on the possible effects of a potential approval of a Spot Bitcoin ETF on the market. The report suggests that if Spot Bitcoin ETF applications are approved, Bitcoin could gradually surpass the $42,000 price levels 100 days later.

Will Spot Bitcoin ETF Applications Get Approval from the SEC?

The Securities and Exchange Commission’s (SEC) rejection of previous Spot Bitcoin ETF applications and statements made by SEC Chairman Gensler regarding Spot Bitcoin ETFs have led to the expectation that the chances of the SEC giving the green light to Spot Bitcoin ETFs in the near future are quite low. However, recent developments have largely reversed this expectation.

Recent developments such as BlackRock’s application for a Spot Bitcoin ETF and Grayscale winning its SEC case have strengthened the expectation that the SEC may approve ETF applications. Bloomberg ETF analysts have raised their predictions of the likelihood of Spot Bitcoin ETFs getting approval from the SEC to 75% despite the SEC’s decision to postpone ETF decisions.

Meanwhile, as expectations of Spot Bitcoin ETFs receiving approval from the SEC continue to strengthen, the potential effects of a possible ETF approval on the market have also begun to be widely discussed. Crypto research firm K33 Research has published a report on the potential effects of a potential ETF approval.

Attention-Grabbing ETF Report from Crypto Research Firm

Crypto research firm K33 Research published a report yesterday on the possible effects of a potential Spot Bitcoin ETF approval on the market. The report highlights the price levels that Bitcoin could reach gradually after a possible ETF approval.

Vetle Lunde, an analyst at K33 Research who wrote the report, discussed the price levels that the leading cryptocurrency BTC could reach 10 days, 40 days, 70 days, and 100 days after the ETF approval. The report suggests that Bitcoin could surpass the $42,000 price levels 100 days after the approval of a possible Spot Bitcoin ETF.