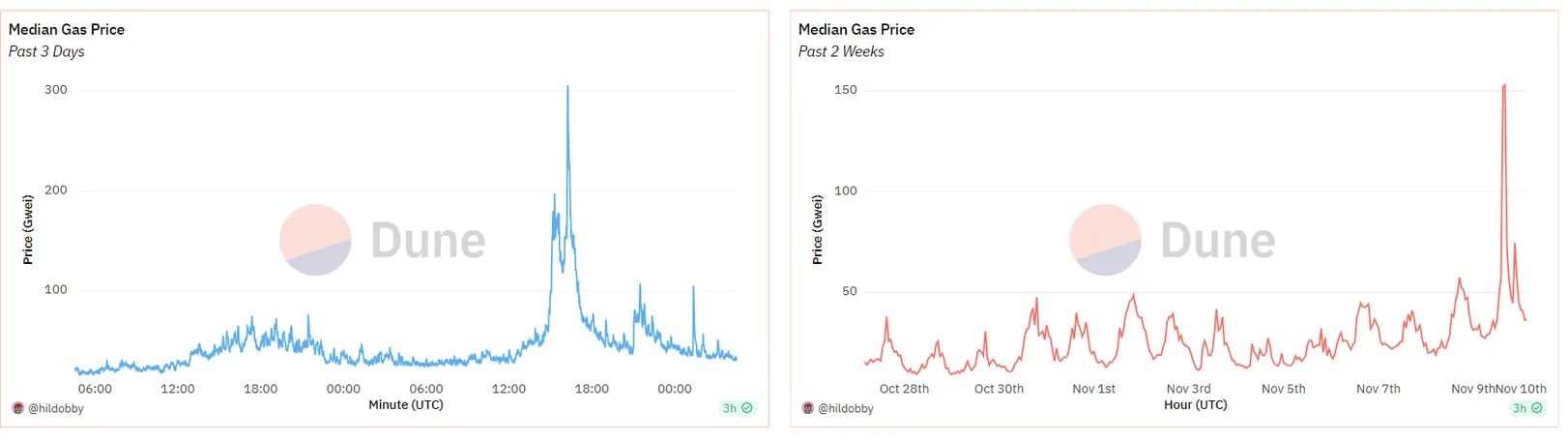

According to data from Dune Analytics, transaction fees on the largest smart contract platform, Ethereum (ETH), have significantly increased due to the growing demand for block space on the network. Performing a transaction on Ethereum has become much more expensive for users in the past 24 hours.

Measured by median gas prices, transaction fees reached up to 270 gwei late yesterday, temporarily reaching a level last seen in June 2022. This temporarily raised the cost of swap transactions to a range of $60 to $100 for a few hours. Gwei is a small unit of ETH equal to one billionth of an ETH and is used to express gas fees. Gas fees represent the fee paid by Ethereum users to ensure that their transactions are included in the earliest block by network validators.

The gas fee, which is used to pay for any activity on Ethereum, was at its highest level since May at 33 gwei at the time of writing. ETH transfers between wallet addresses have been costing an average of $30 since this morning. Ethereum validators prioritize transactions that pay the highest fees instead of a first-come-first-serve basis, which means transaction fees in popular altcoins built on the Ethereum blockchain can often reach thousands of dollars.

The increase in transaction fees on the Ethereum network came after investors’ heightened interest when financial giant BlackRock applied to the U.S. Securities and Exchange Commission (SEC) for a spot Ethereum ETF months after its spot Bitcoin ETF application. Following BlackRock’s application, ETH’s price increased by up to 10%, surpassing the $2,000 level.

Chain-Top Activity Still Low According to Nansen Data

Meanwhile, data from Nansen shows that chain-top activity is still relatively low compared to the higher period in 2022. This indicates that individual users are largely staying away from on-chain trading. Nansen analyst Jake Kennis stated in his message, “There doesn’t seem to be an increasing trend in on-chain activity in terms of DAUs and newly funded wallet addresses entering the Ethereum ecosystem.”

Kennis added, “This suggests that on-chain activity may be lagging behind the price movement here, or that we haven’t yet seen the on-chain tracking typically associated with increased market activity.”