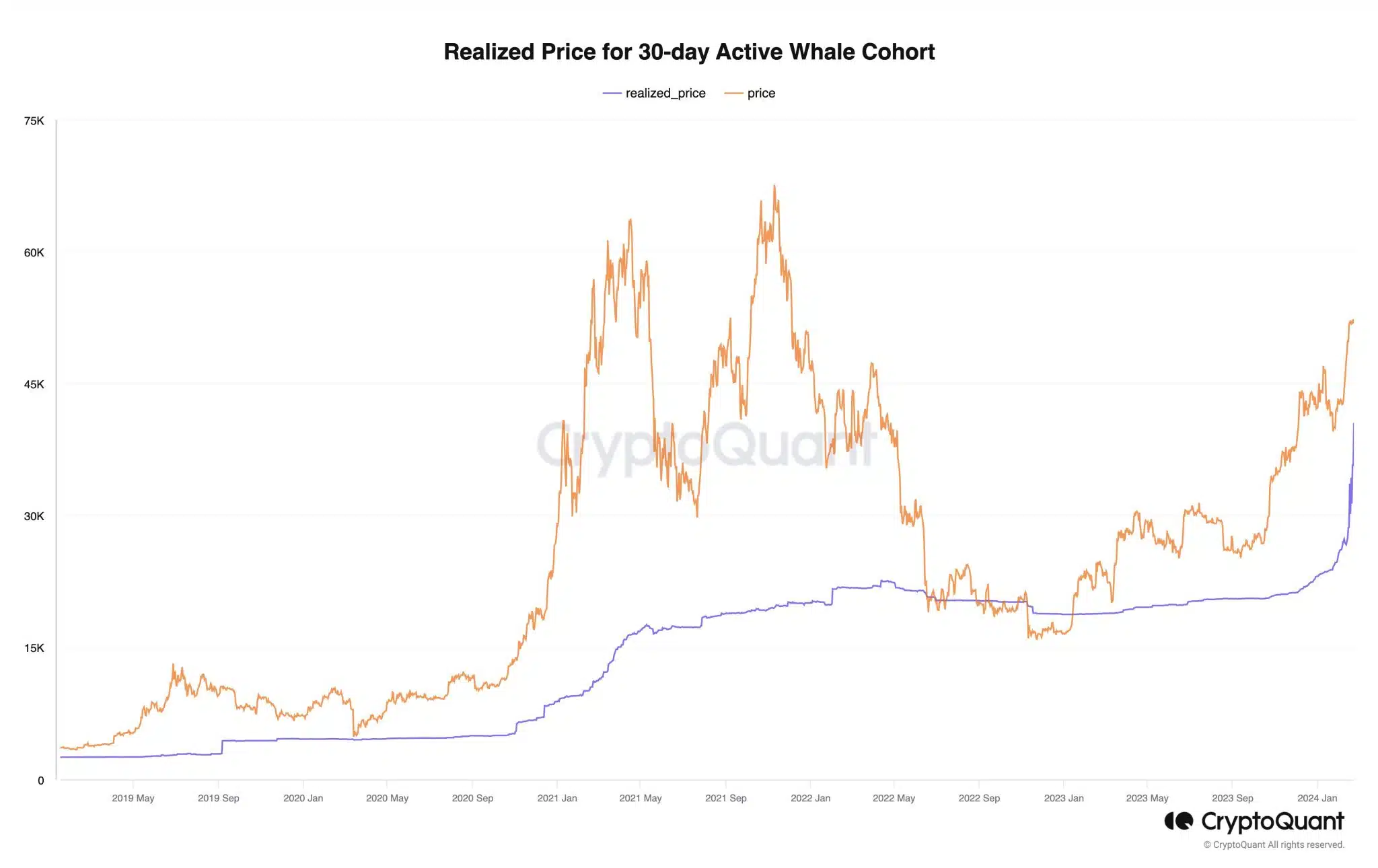

Bitcoin‘s (BTC) price may have risen to higher levels, but new data reveals that whales have not secured the best deals for their Bitcoins. According to the latest data, large Bitcoin whales actively trading last month sold their BTC at an average price of $40,500.

Signs of a Rise in Bitcoin

This group consists of whales holding over 100 BTC and having wallets not connected to centralized exchanges, with their last transaction occurring within the past 30 days. Their actions could contribute to short-term downward pressure. Understanding that active whales are not maximizing their profits could affect market sentiment. Investors might interpret this as a sign that even large investors are not confident in a sustainable upward trend. In the past three weeks, 700,000 Bitcoins have been transferred to Over-The-Counter (OTC) platforms favored by miners, coinciding with the anticipated approval of a spot Bitcoin Exchange-Traded Fund (ETF).

The Impact of Miners on Bitcoin

OTCs are venues where large Bitcoin transactions occur directly between parties, often used by miners and large investors for significant trades. The substantial transfer to OTCs in Bitcoin could be an indicator of miners’ strategic actions in response to the approval of a Bitcoin ETF. Miners’ cautious approach to using OTCs could also signal concerns about market conditions, potentially affecting broader investor sentiment and contributing to a more uncertain price trajectory.

Moreover, significant departures from traditional exchanges can limit the immediate visibility of such transactions in public markets, potentially leading to increased price volatility and unpredictability. Additionally, daily miner revenue has decreased. Miners may need to sell their BTC to keep up with mining costs, and reduced revenues could increase selling pressure on Bitcoin. Furthermore, as the halving date approaches, the potential for miners to earn fees diminishes, which could negatively impact the BTC price.