Popular altcoin Shiba Inu (SHIB) saw a massive token burn as reported by the Shibburn platform, with several hundred million SHIB transferred to inaccessible wallets. This significant token burn activity was recorded as SHIB’s price continued to decline, showing only a slight recovery after an 8% drop earlier in the week.

Increase in Shiba Inu’s Token Burn Rate

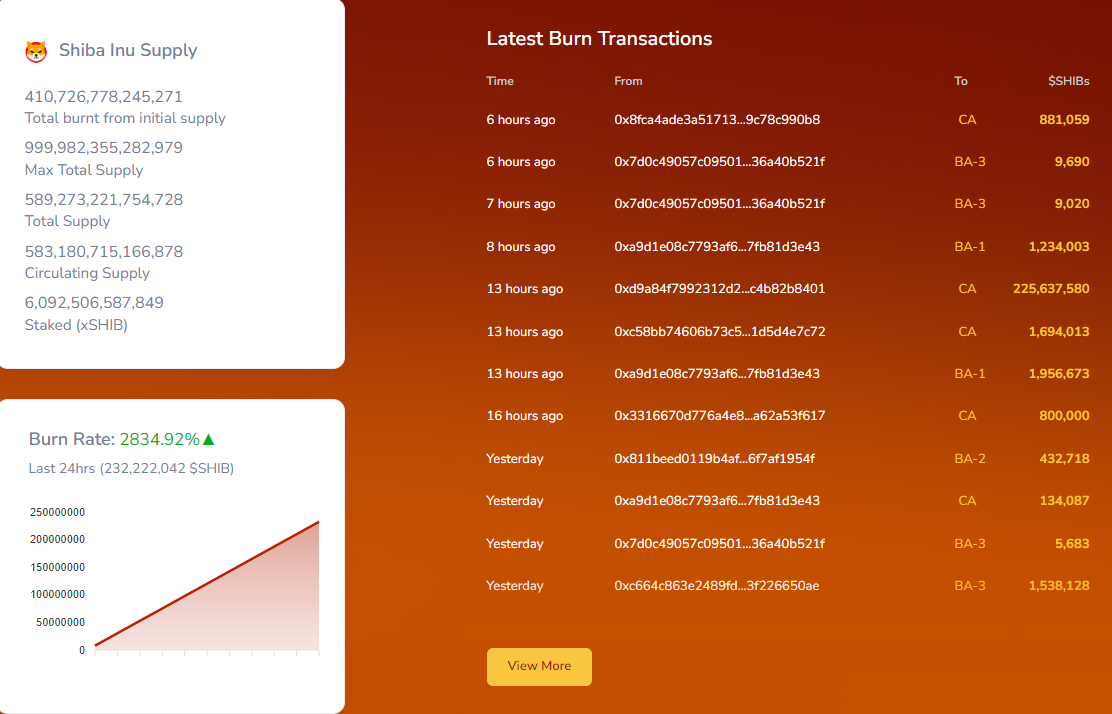

In the last 24 hours, SHIB‘s burn rate increased by an astonishing 2,834%. The token burn metric, which tracks the amount of SHIB removed from circulation, showed significant growth. Initially, the amount of SHIB burned was just over 7 million, but it has since surged to an astounding 232.22 million SHIB.

The four-digit token burn rate was achieved through eight burn transactions, with the largest single transfer moving 225.63 million SHIB to an inaccessible wallet. This transaction alone accounted for nearly all of the burned SHIB. Additionally, three other significant transfers each moved around 2 million SHIB coins to dead wallets, further reducing the circulating supply.

Current SHIB Price Status

In the last 24 hours, SHIB’s price dropped by 8.8%, falling from $0.00002350 to $0.00002207. The price attempted to break out from this support level twice, each time reaching $0.00002206. Despite the increase in token burn activity, SHIB pulled back after the first attempt but has since risen again and is currently trading at $0.00002206, a 3% increase.

The recent price drop coincided with increased activity from large investors, often referred to as “whales.” A notable transaction involved the transfer of 4.3 trillion SHIB, mostly purchased in 2021, to the Coinbase exchange for sale. Additionally, another significant transaction saw 600 billion SHIB purchased on Robinhood and subsequently moved to a cold wallet.

The high-volume SHIB burn and corresponding whale activity indicate significant market movements and investor strategies at play. The substantial reduction in circulating supply through token burns could positively impact SHIB’s price in the long term, provided demand remains constant or increases. Conversely, short-term price fluctuations reflect the complex dynamics of market sentiment, large-scale transactions, and investor behavior.