After witnessing a price correction in a few days, the ETF approval has turned into a downtrend for Bitcoin (BTC). However, recent data suggests that the ongoing trend could change soon, which could be good news for investors.

Expert Opinion on BTC

At the time of writing, the leading cryptocurrency Bitcoin was trading at $42,989.21 with a market value of over $842 billion. In addition to ETF developments, another possible reason behind the downtrend could be BTC’s price movement within a parallel channel. A popular cryptocurrency analyst, Ali Martinez, recently highlighted this development in a tweet.

According to the expert’s analysis, BTC’s price could soon drop to $34,000 before gaining bullish momentum and rising to $57,000. Therefore, should investors wait for the BTC price to drop further, or could this be a good buying opportunity? An analysis related to the data of the cryptocurrency analytics company CryptoQuant revealed an increase in BTC’s exchange reserves. This could mean that there was high selling pressure at the time of writing.

Current Data on Bitcoin

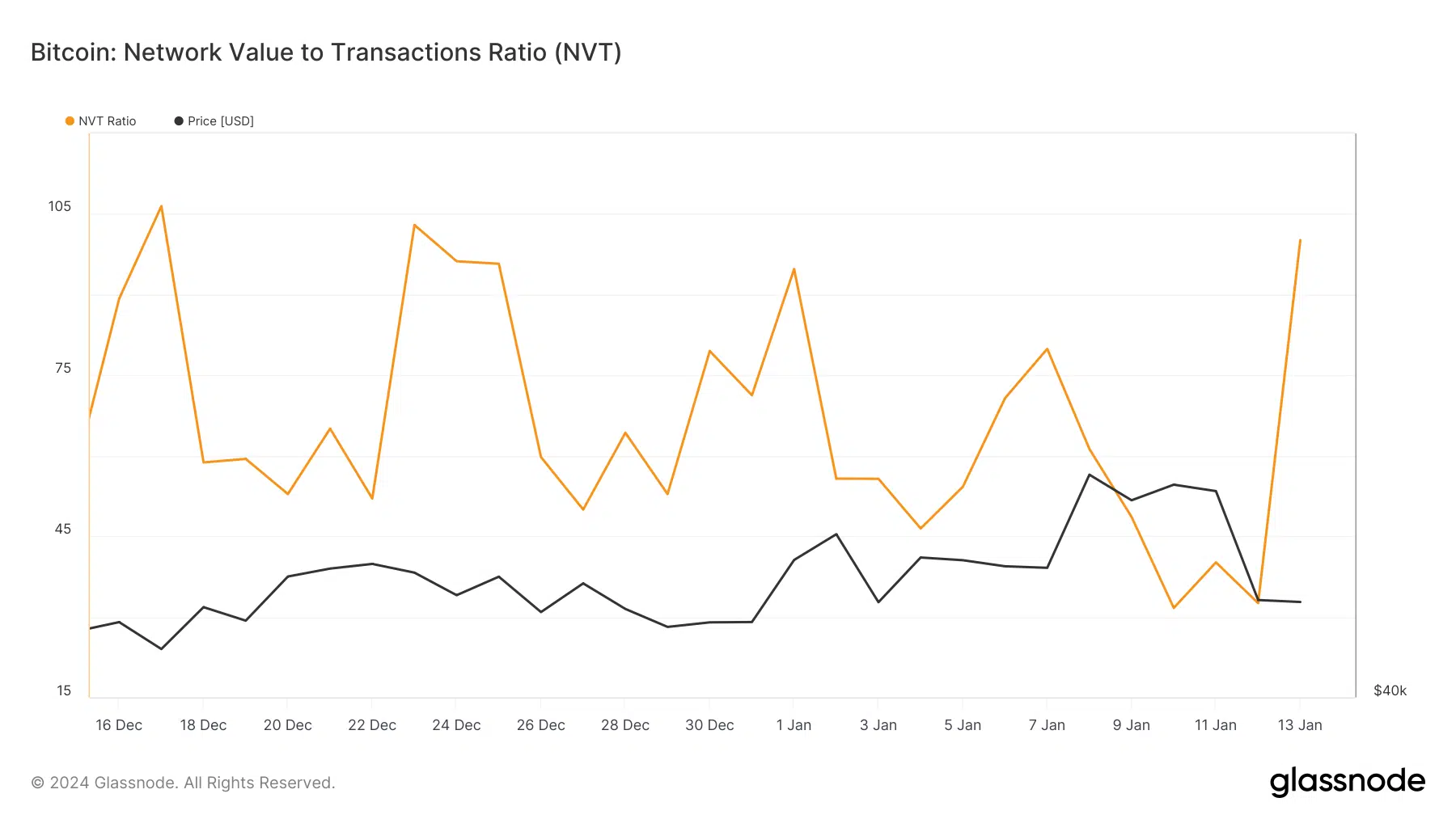

Bitcoin’s aSORP was also in a downtrend. This could mean that more investors were selling at a profit. However, in the midst of a bull market, this could indicate that the market has reached its peak. Additionally, BTC’s network value to transactions (NVT) ratio recorded a sharp increase after a decline. The metric’s rise, historically coinciding with market peaks and overvaluation periods, could generally be perceived as a bearish indicator.

Therefore, it might be a wiser option for investors to wait a bit longer to accumulate more BTC, as the above-mentioned metrics could indicate further price drops. A similar picture emerged when considering BTC’s daily chart. Its MACD showed a downtrend. The Relative Strength Index (RSI) was also below the neutral level, which could increase the probability of the downtrend continuing.

Türkçe

Türkçe Español

Español