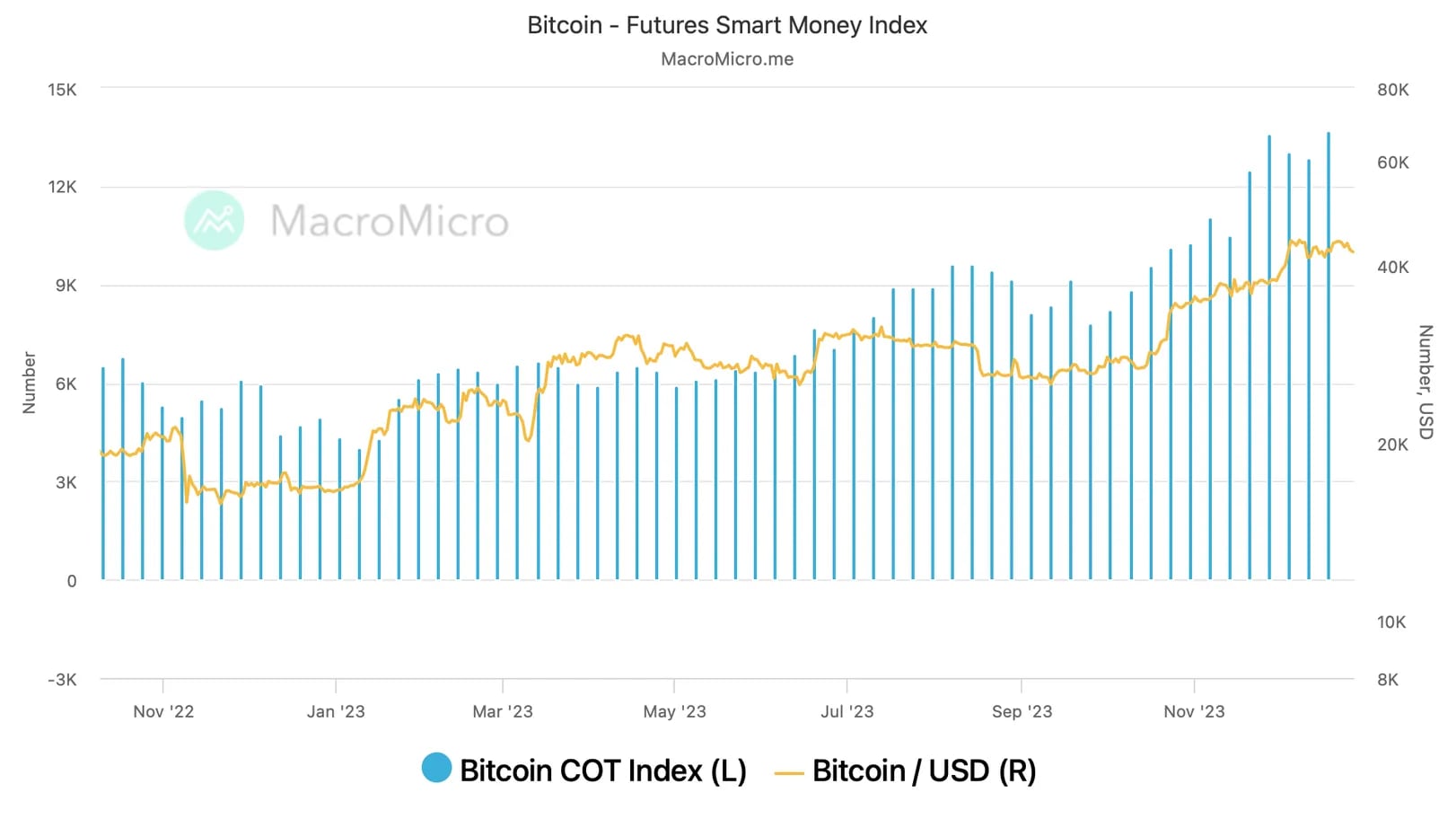

Data tracking site MacroMicro‘s smart money index for Bitcoin futures last week soared to a record level of 13,711. This surge in long positions came just days before the US Securities and Exchange Commission (SEC) is due to make a decision on applications for a spot exchange-traded fund (ETF). Despite the positive outlook, some market observers expect the “buy the rumor, sell the news” scenario to play out following the ETF approval.

Smart Money Is Currently Focused on Bitcoin (BTC)

The message from the smart money index for Bitcoin futures, which tracks the difference between large investors’ long and short positions at the Chicago Mercantile Exchange, suggests that smart money or institutional investors are heavily focusing on Bitcoin (BTC) as the deadline for the SEC to approve spot-based Bitcoin ETFs rapidly approaches. The indicator is based on the CFTC’s weekly Commitments of Traders report.

The smart money index last week reached a level of 13,711, surpassing the previous peak of 13,603, and indicated a record net long position by asset management companies and other reportables.

The CME’s standard Bitcoin futures contracts, which are 5 BTC in size and settled in cash, are widely regarded as a proxy for institutional activity, allowing market participants to invest in cryptocurrencies through a regulated platform without having to own the crypto asset itself. Futures are derivative contracts that obligate the buyer to purchase an asset and the seller to sell an asset at a predetermined price at a later date. A long position implies an obligation to buy the underlying asset and carries a bullish sentiment, while taking a short position indicates the opposite.

The smart money index has surged sharply this quarter with the narrative around the spot ETF and strengthening expectations of the Fed’s interest rate cuts in 2024. The SEC’s setting of January 10 as the deadline to approve/reject an ETF investing in Bitcoin instead of BTC-linked futures was a trigger for this rise. Observers are expecting record inflows into the asset class following the potential launch of one or more spot ETFs.

Warning for Bitcoin: “Buy the Rumor, Sell the News”

Expectations of a rise have boosted Bitcoin by about 60% this quarter, opening the door to a potential “buy the rumor, sell the news” investment strategy following the launch. The market analyst team at Singapore-based QCP Capital stated in their report last week, “As we approach the eventual launch of a spot ETF, we must note that the actual demand for the ETF is likely to fall below market expectations initially. This is leading to increased expectations of a classic ‘buy the rumor, sell the news’ scenario playing out in the second week of January.”

The analysts added, “Therefore, we expect a resistance zone for BTC between $45,000 and $48,500 and anticipate a pullback towards the $36,000 levels before the continuation of the uptrend.” QCP Capital analysts also mentioned that the bullish trend is likely to continue ahead of the block reward halving in April.