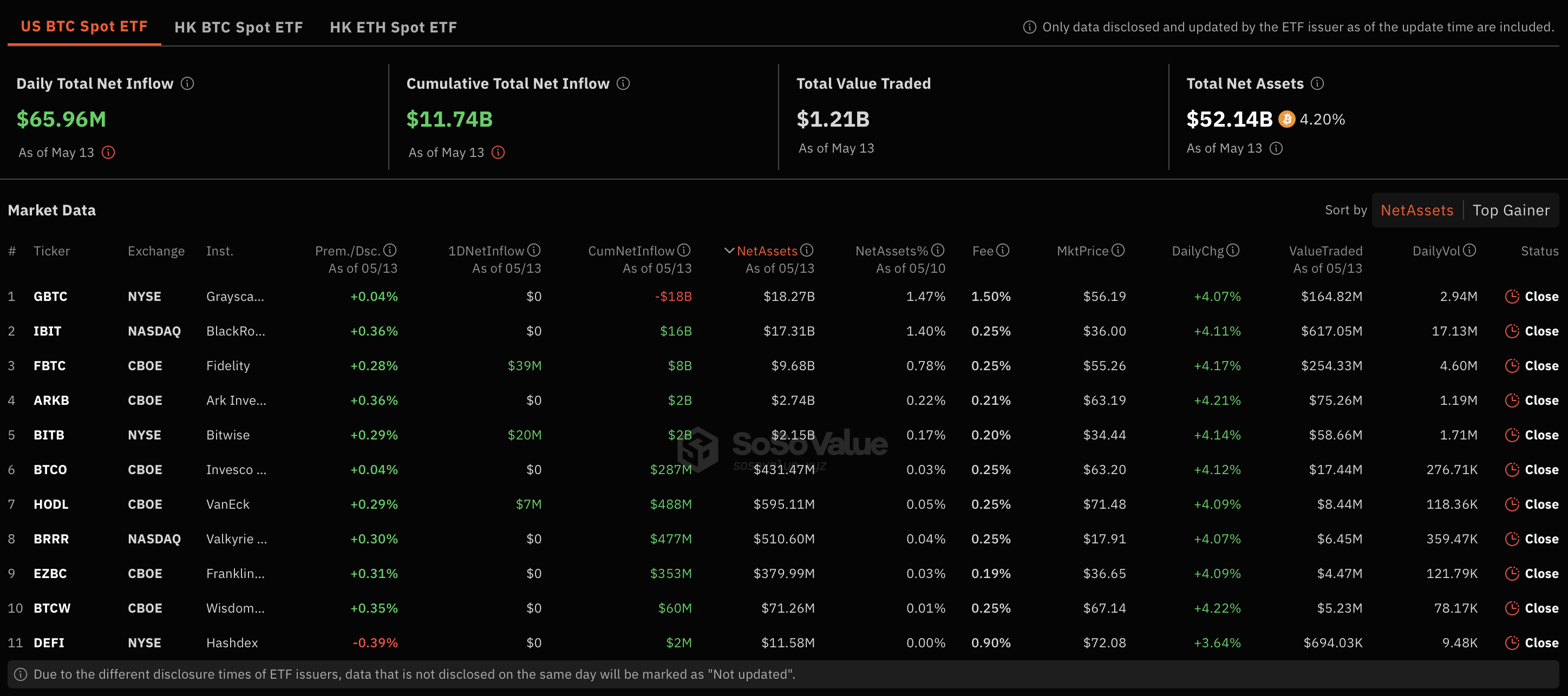

Spot Bitcoin exchange-traded funds (ETFs) in the US saw significant net inflows totaling approximately $66 million on May 13. The increase in inflows to spot Bitcoin ETFs brought the cumulative total net inflow for these investment products to approximately $11.75 billion since their listing.

Fidelity Alone Attracted $39 Million

According to SoSo Value’s data, the most significant contribution to the inflows on May 13 came from Fidelity’s Wise Origin Bitcoin Fund, which alone attracted $39 million in daily net inflows. This indicates that Fidelity holds a very strong position in the spot Bitcoin ETF market.

Other leading spot Bitcoin ETFs also saw significant inflows. The Bitwise Bitcoin ETF (BITB) attracted $20 million, and the VanEck Bitcoin Trust ETF (HODL) attracted $7 million. These inflows are significant as they demonstrate continued investor interest and confidence in these products despite overall market trends. However, no other spot Bitcoin ETF, including Grayscale’s spot ETF-converted Grayscale Bitcoin Trust (GBTC), which has seen cumulative net outflows of approximately $18 billion, recorded net flows in either direction during this period.

Despite the significant inflows observed on May 13, the overall trend for spot Bitcoin ETFs remains downward. Data shows that the daily managed assets for these ETFs have been slightly but steadily declining since the beginning of April. This decline reflects recent outflows and indicates a broader market sentiment that may be cautious or bearish regarding Bitcoin investments.

Spot Bitcoin ETFs in Hong Kong See Outflows

In contrast to the US market, spot Bitcoin ETFs in Hong Kong saw a net outflow of 535 BTC yesterday. According to K33 Research senior analyst Vetle Lunde, these outflows pushed the region’s total managed BTC below its initial AUM (Assets Under Management). This development likely reflects a different regional sentiment towards spot Bitcoin ETFs influenced by local market conditions and regulatory environments.

The recent activity in spot Bitcoin ETFs reflects the fluctuation and volatility in investor interest in cryptocurrency investment products. While the US market saw notable inflows indicating renewed interest from institutional investors or strategic investment moves, the overall downward trend in managed assets suggests a cautious market sentiment. Furthermore, the outflows seen in Hong Kong’s ETFs highlight the confusion and regional differences within the cryptocurrency market.