Cryptocurrency investors have become accustomed to losses in altcoins, but even stablecoins, which are supposed to remain at $1, have seen their stability compromised for various reasons. For example, we recently witnessed USDT falling below $1 due to FUD surrounding it.

GHO Price Below $1

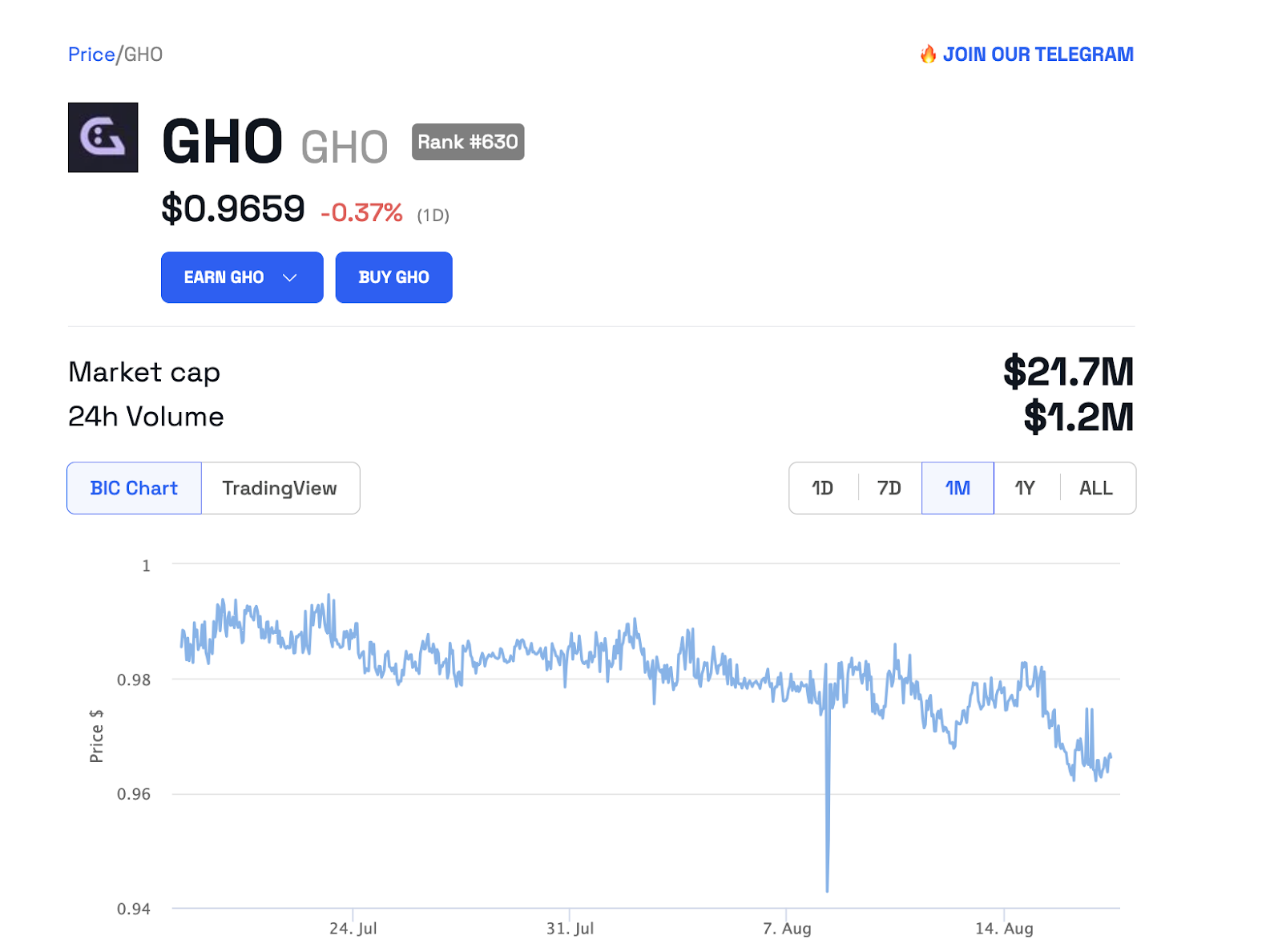

The founder of Aave, Stani Kulechov, is not concerned about the instability of the stablecoin GHO. Keeping stablecoins stable has been one of the biggest challenges for issuers. However, the founder of Aave sees it as normal for the AAVE stablecoin called GHO to remain below $1. At the time of writing, Aave’s stablecoin is trading at $0.9659. The graph below shows that the price of the GHO stablecoin is highly volatile and has failed to maintain stability.

Regarding the depeg, Stani Kulechov wrote on Twitter, “I can say that focusing on the peg should come later.” He stated that this is a strategic choice because management wants to focus on increasing the nominated debt in GHO.

“When GHO is a collateral, the balance between the peg and growth becomes challenging in the early stages.”

The community predicts that the GHO stability mechanism (GSO) cannot restore stability. A community member wrote the following:

“The only way to achieve stability is to increase the debt ratio (reduce supply) or withdraw liquidity to increase demand.”

Why Are Stablecoins Risky?

GHO is only a month old and was launched on the Ethereum mainnet on July 16. However, it has already experienced multiple depegs. Particularly, after the attack on Curve Finance, its price saw sharp declines. On the other hand, many altcoins like USDD are experiencing a similar fate as GHO. Investors who hold stablecoins to avoid losing money in the market are facing unexpected losses in what they thought was a safe asset.

The collapse of UST led to a flight from decentralized stablecoins. On the other hand, FUD and lack of transparency about Tether are causing concerns among investors about most centralized stablecoins. For example, USDC, which is considered the most regulated stablecoin, faced the risk of losing part of its collateral in the midst of bank failures in March.

US officials are making the right move by trying to regulate stablecoins. In the future, with full oversight, Fed supervision, and transparency, investors can buy stablecoins with less worry.